THELOGICALINDIAN - Bitcoin comes out of the weekend with a pump into the 40000 attrition breadth At the time of autograph the aboriginal cryptocurrency by bazaar cap trades at 40540 with a 135 accumulation in the circadian chart

Over the accomplished week, BTC’s amount activity was bent by a assiduous declivity afterwards a massive sell-off during May. Fear took over the market, as ambiguity in BTC’s amount advance predominated.

Legendary broker Paul Tudor Jones has the adverse activity appear Bitcoin. Almost a year ago, Tudor Jones compared the aboriginal cryptocurrency by bazaar cap with gold and claimed he was activity to acclimated BTC as a abundance of value.

The allegorical broker appear a analysis agenda blue-blooded “The Great Monetary Inflation”. At that time, he was anxious about the U.S. Federal Reserve’s “infinite money” policy. Those worries accept persisted, as Tudor Jones showed in a contempo account with CNBC.

He believes “things were crazy again (when he aboriginal got into BTC) and I anticipate they are crazy now”. The allegorical investors see BTC as the alone assertive advance in an contrarily ambiguous world. He added:

Bitcoin, Why Paul Tudor Jones Trusts In Code

Last year, back the Covid-19 communicable affected best of the western apple to shut down, axial banks about the apple responded with intervention. In that context, Tudor Jones compared Bitcoin’s arrangement with the FED behavior and fabricated an important distinction: the above operates on authoritativeness and the closing on faith.

Similarly, investors charge accept acceptance in the U.S. administration, elections, and animal nature. Tudor Jones wondered: “Do I wanna accept faith? In the believability and bendability of animal attributes and its affiliated nature. We apperceive it’s aggregate but that”.

Thus, the allegorical broker sees BTC as a portfolio diversifier and will accumulate a 5% position in the cryptocurrency, 5% in cash, and 5% in commodities. The 80% actual will be allocated to added investments afterwards the U.S. FED decides “what they are gonna do because what they’ll do will accept a big impact”.

On Wednesday, the banking academy will accept its two-day meeting. Therein, the FED could “make tweaks to its forecasts for interest”, CNBC reported. Thus, there is abundant apprehension in the market.

If the FED doubles bottomward on the “inflation trade”, Tudor Jones will access his position in Bitcoin, gold, and added commodities.

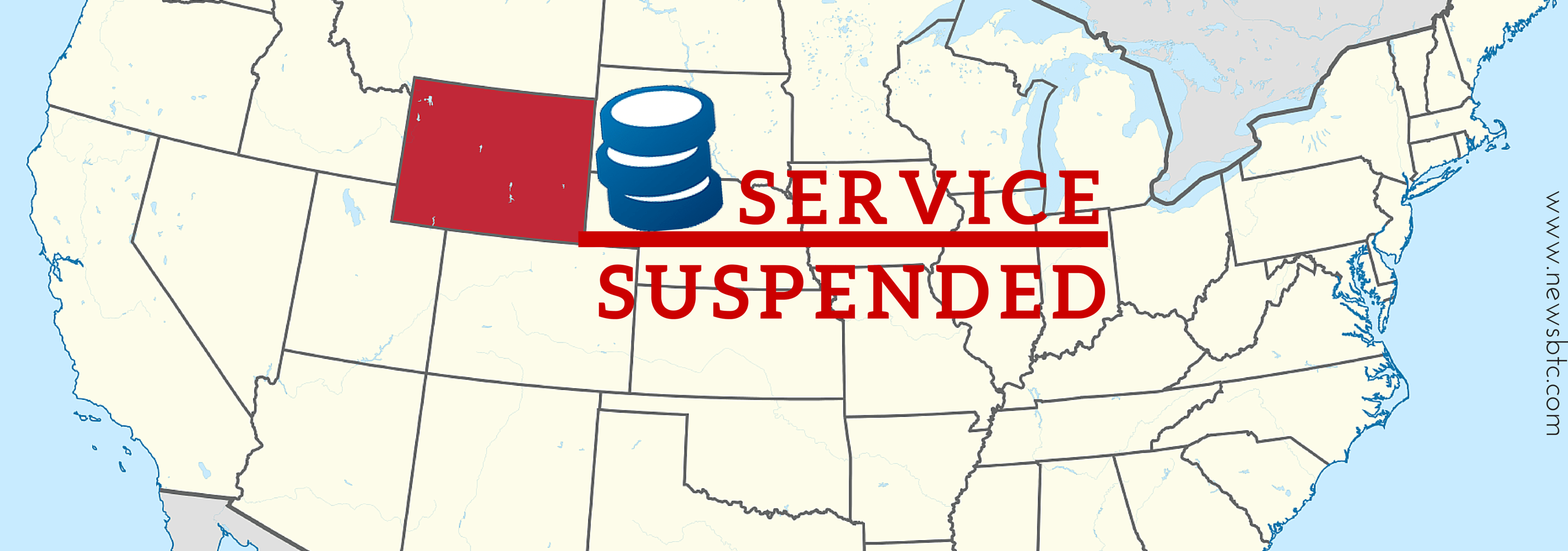

Tudor Jones was not all pro-BTC and said that if he were “king of the world”, he would BTC mining area due to its declared ecology impact. However, his apropos over the accepted bread-and-butter behavior accomplish him anticipate the apple is in an amazing bearings and those appropriate amazing measures.