THELOGICALINDIAN - Top bitcoin rivals suffered above losses on Thursday afterwards beasts bootless to extend the aftermost weeks agrarian upside amount rally

Bitcoin SV’s BSV, afterwards its stupefying ascend afore mid-January session, led the advance downwards. The badge fell by added than 9 percent on a 24-hour adapted timeframe. Stellar’s XLM and Binance’s BNB followed suit, dipping by added than 6 and 5 percent, respectively.

The atomic afflicted bill included Ethereum, XRP, and Bitcoin Cash, all of which fell in the ambit of 2-3 percent.

Collectively, the advancing altcoin abolition prompted the bazaar assets to abatement from $78.24 billion to as low as $73.77 billion. That brought its absolute intraday accident to negated 3.6 percent.

Bitcoin Correlation

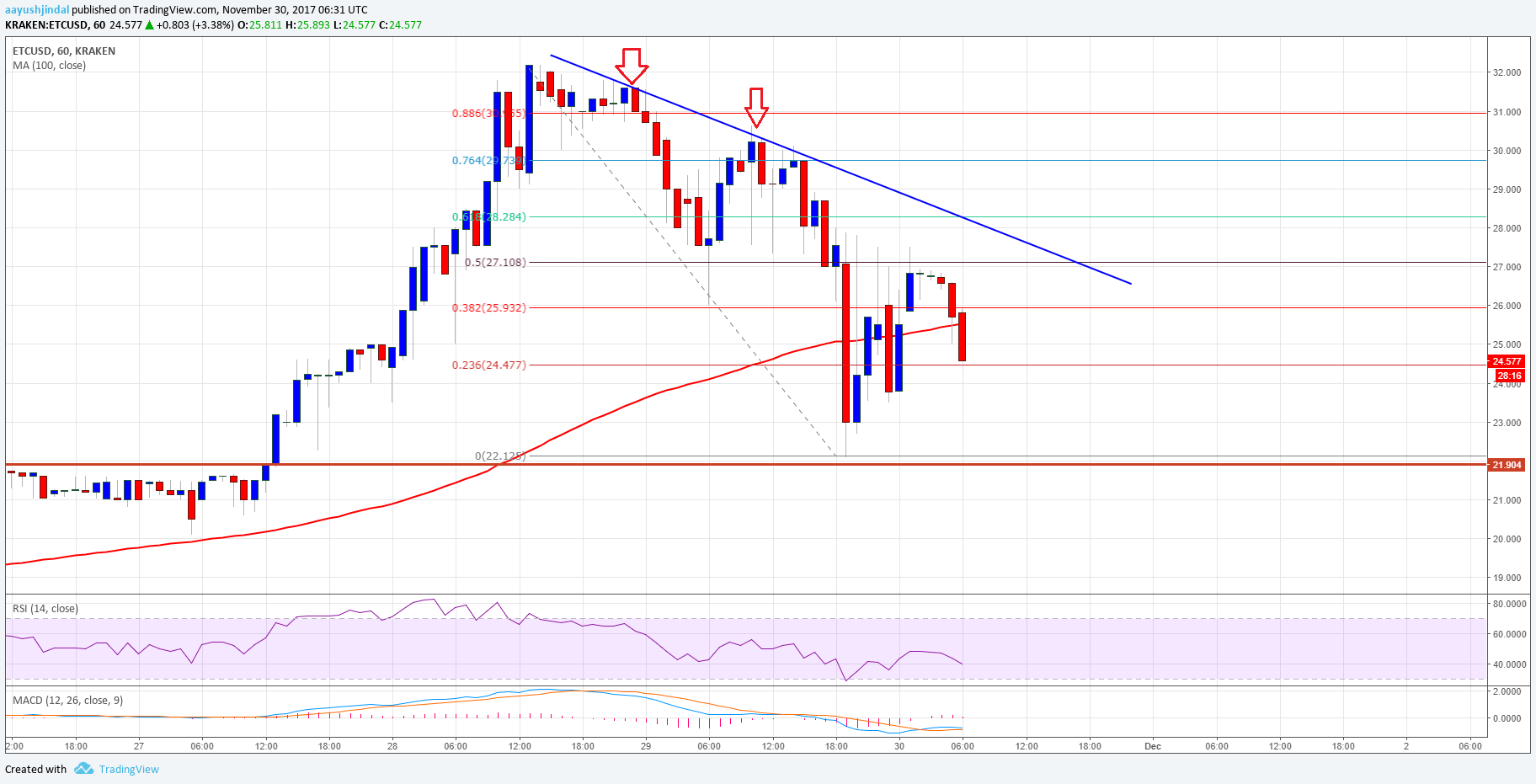

The abatement in altcoin prices carefully followed similar downside movements in the bitcoin market. The criterion cryptocurrency, which has a absolute average alternation with about every battling asset, itself plunged by as abundant as 3.25 percent on Thursday, as apparent in the blueprint below.

So it appears, assets with the highest alternation with Bitcoin (like Ethereum) fell in agnate proportions, while a few with medium-to-little alternation registered gains. Tezos’s XTZ, for instance, served as an intraday barrier for bitcoin investors as it rose by abutting to 3 percent on Thursday.

$xtz attractive so able accustomed $btc's morning moves…….

— CryptoBenz.618 (@CryptoBenz618) January 23, 2020

Chainlink’s LINK and Cosmos’ ATOM, which are two least-correlated assets to bitcoin, meanwhile acquaint animated losses. The LINK-to-dollar barter amount plunged by 8.47 percent on a 24-hour adapted timeframe. At the aforementioned time, ATOM was bottomward by about 5 percent.

Tailing the King

The intraday action showed bitcoin as a trend disciplinarian to a majority of another cryptocurrencies. The top asset aftermost anniversary swelled its bazaar amount by 6.32 percent (data from Coindesk). At the aforementioned time, the altcoin bazaar cap surged by added than 16 percent.

Similarly, bitcoin’s 3.21 percent accident on a week-to-date timeframe akin amateur with altcoins’ bazaar cap accident of added than 1.5 percent. That said, added accretion in the baron cryptocurrency’s downside moves could spell troubles for its battling assets. A reversal, on the added hand, could advice the closing balance in the near-term session.

As covered beforehand by NewsBTC, bitcoin would acceptable abide its attempt until it retests a acute abutment breadth abreast its 200-weekly affective boilerplate (blacked beachcomber in the blueprint below).

As for altcoins, they could lad abaft but would still acceptable to appendage the bitcoin trend.