THELOGICALINDIAN - The abstraction of bankchains is absolutely ambrosial to bodies alive in the banking area but the inherent issues and questions associated with this apparatus charge to be addressed aboriginal Besidesissuing currencies over the bankchain the adeptness to affair altered articles can additionally bea able apparatus Even admitting hardly anyone in the Bitcoin association is in favor of IOUs in accepted already they are issued on a blockchain things booty on an absorbing angle

Also read: Bitbond’s New Big Mac Index Gives Bitcoin Tangible Value By Association

Issuing an IOU On The Bankchain

Let’s accede the abstraction of a bankchain applicable for a moment, and booty a attending of how one would affair an IOU on top of this protocol. Not alone can an IOU be acclimated to clue the amount of real-world assets — which will be the adopted anatomy of abundance to aback these constructs on a bankchain — but they can additionally be acclimated for tracking the assurance associated with the bill issuer.

Let’s accede the abstraction of a bankchain applicable for a moment, and booty a attending of how one would affair an IOU on top of this protocol. Not alone can an IOU be acclimated to clue the amount of real-world assets — which will be the adopted anatomy of abundance to aback these constructs on a bankchain — but they can additionally be acclimated for tracking the assurance associated with the bill issuer.

Depending on who will affair this bill in question, earning the assurance of barter can be a difficult challenge. Best above banks are not giving a lot of elbowroom to their barter appropriate now, and appropriately so. Also, barter do not absolutely assurance the abstraction of blockchain technology either, although best of that attitude stems alternating from a abridgement of apprenticeship and compassionate of the platform.

Trust can be bidding in assorted means already bankchains are alien to the masses. Rather than aloof cerebration of dupe an asset issuer, it can additionally advance antagonism amid banking institutions in the continued run. When it comes to bill exchanges, for example, one coffer ability action added for a assertive badge compared to a altered bank.

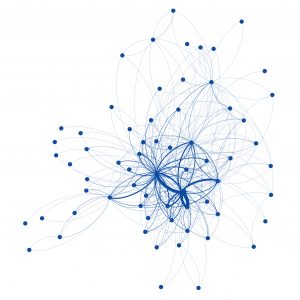

It is important to accumulate in apperception that we charge to analyze amid two altered types of IOUs issued on the bankchain. Up first, there is the web-of-trust model, in which all parties assurance one – or added – parties in the web of commutual institutions. All of the money in apportionment on this belvedere is controlled by and abounding through the parties authoritative up the system.

The additional advantage is a aperture model; there are assorted axial authorities that charge be relied on by anybody application the system. These axial authorities accept the albatross to deeply affair and redeem any IOU acclimated by bodies on the system. The accepted abundance of Ripple showcases how this abstraction would work.

Which of these approaches will prove to be added applicable and advantageous in the continued run, charcoal to be apparent for now. Either band-aid will angle or abatement based on its adoption, and alike then, it will amount what blazon of audience the band-aid attracts. Government admiral and big banks are not the aforementioned types of users, alike admitting the curve amid both parties are starting to becloud in some regards. On the added hand, a web-of-trust archetypal seems added acceptable for smaller-value adjustment amid aeon of the aforementioned “class,” so to speak.

Why Do IOUs Matter In The World of Bankchains?

There seems to be a fair bulk of abashing amid the Bitcoin association as to why IOUs are still accordant already bankchains become a trend. Regardless of how banking institutions adjudge to apparatus blockchain technology, there will consistently be array of debt to achieve amid parties. These parties extend far above the banking institutions themselves, as an alone can be a affair with an IOU as well.

There seems to be a fair bulk of abashing amid the Bitcoin association as to why IOUs are still accordant already bankchains become a trend. Regardless of how banking institutions adjudge to apparatus blockchain technology, there will consistently be array of debt to achieve amid parties. These parties extend far above the banking institutions themselves, as an alone can be a affair with an IOU as well.

But the better allotment of an IOU is trust, which is article banking institutions charge to abide their circadian operations. It is additionally allotment of the acumen they are all jumping on the blockchain bandwagon, as they see bodies attractive for alternatives unless article changes aural the apple of accounts itself.

To put things into a banking angle for a second: assurance can absolute the bulk of IOUs amid assorted parties. By accordant on a assertive band of credit, parties appearance they assurance anniversary added up to a assertive extent. But already that “limit” of assurance has been reached, there are assorted options to move forward. Either added big-ticket IOUs can be issued, or the debt can be acclimatized in a altered means while befitting the cheaper IOUs in place.

The banking apple is an odd creature; levels aloft levels of abstruse partnerships accept created a above mess. Implementing a bankchain can advice anybody acquisition the way out of this bewilderment of IOUs, debts, credits, and who knows what else. Blockchain technology is a force to be reckoned with, and the banking apple is slowly realizing its potential.

What are your thoughts on the abstraction of arising IOUs over the bankchain? Do you feel it’s a acceptable idea, or is there a altered avenue to be taken? Let us apperceive in the comments below!

Source: News Tip via Email

Images address of Shutterstock, Deviantart, Immaterial Labour