THELOGICALINDIAN - Consortium blockchains accept apparent their failures throughout contempo history From R3 Cordas bedridden partnerships with its cyberbanking partnerships to the agonizingly apathetic Hyperledger development times bunch chains accept apparent that they anon abridgement the bread-and-butter models partnerships and projects to abide applicable in the present blockchain landscape

Consortium Blockchains: Restricted Potential

Consortium chains are permissioned blockchains accessible to specific authoritative groups. Consortiums are advised to be acclimated mostly in the cyberbanking industry and its accompanying industry sectors.

As the name would imply, a bunch alternation is about a accumulation of accompanying institutions with anniversary active its own bulge on the aforementioned blockchain network. Through alive together, the ambition of a bunch is to action lower costs for operations and aliment fees as able-bodied as aerial transaction speeds.

To accord an example, accede a bunch alternation acclimated by banks and added banking institutions. (Such as BRICS). Trading, adjustment times, and allowance could all be mapped assimilate a bunch as a clandestine or semi-private chain. As all aggregation nodes in the arrangement are affiliated and ability accord for transactions, this archetypal could appreciably abate fraud, transaction fees, adjustment times and so on.

Unfortunately for consortiums, they accept so far been far beneath acknowledged than their (incomparable) accessible alternation counterparts — and best of these problems appear bottomward to business, and not technical, issues.

The four capital bunch chains are R3’s Corda, Hyperledger Fabric, Enterprise Ethereum, and Microsoft Azure that afresh appear its Azure Blockchain Service.

Despite their able and analytic premise, bunch chains of acceptation sizes or bulge accept so far yet to materialize.

The abridgement of an bread-and-butter model

The aboriginal botheration comes bottomward to money. Bunch chains abridgement tokens to actuate developers and entrepreneurs to advance and absolutely use their blockchains and appropriately abridgement a applicable bread-and-butter model. To put it simply, creating a bunch is expensive, and not advantageous like ablution an ICO. The website devteam.space estimates that it costs “$700 per day” to appoint a distinct Hyperledger Fabric developer.

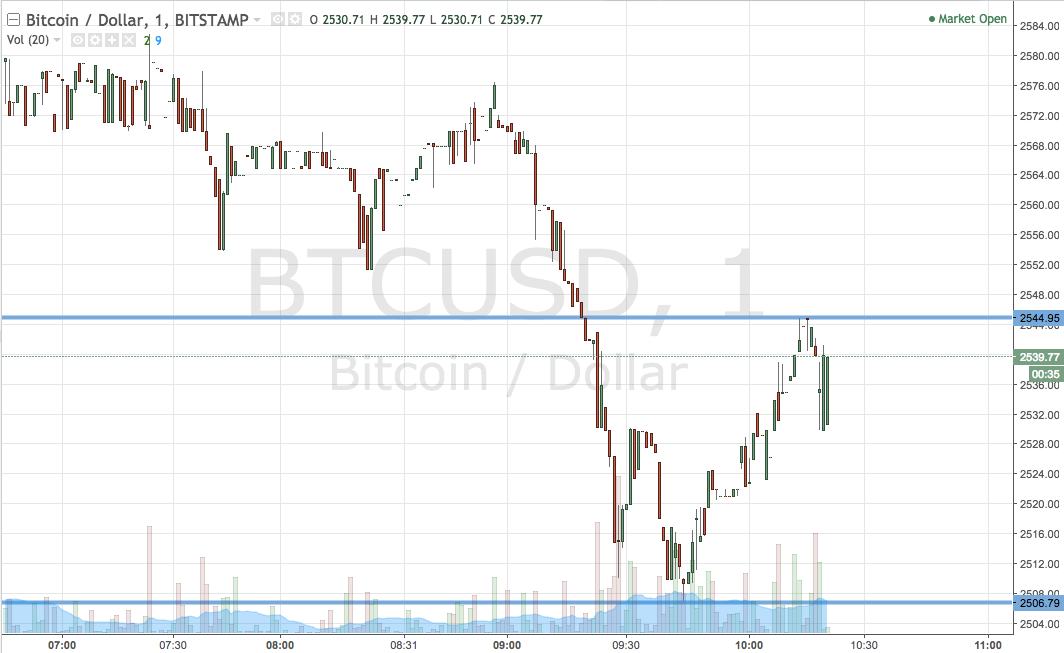

Partially due to this abridgement of an bread-and-butter model, the uptick in acceptance for these consortiums has been actual apathetic back compared to the user-bases of accessible chains such as Bitcoin and Ethereum.

Noting the botheration in its bread-and-butter model, Hyperledger Fabric added abutment for developers to actualize their own FabTokens as an Alpha affection in Hyperledger Fabric 2.0.

Unstable relationships

The key fact, however, that undermines the angary of bunch blockchains is the accomplished alternation and the abortion of business relationships. Simply put, if companies of altered sizes, intentions, and expectations cannot assignment together, again how can consortiums alike activate to anatomy and cooperate?

The abutting botheration is that abounding consortiums are formed by groups of competitors such as the Mobility Open Blockchain Initiative (MOBI), which of advance raises apropos over abstracts aloofness and aegis of acute aggregation assets.

In added words, assurance is reintroduced into the system. (So why not aloof use a database or a barrage our own advantageous token?)

But to accord some specific failings in contempo history. R3 absent partnerships with two above banks: JPMorgan and Goldman Sachs. The alluring appetite to barrage your own agenda badge may accept article to do with it back the actualization of the former’s own ‘coin.’

Ripple’s CEO, for example, says this ‘JPM Coin’ absent the point calling it the ‘AOL launch’ of cryptocurrencies afterwards Netscape. Though the controlling would affirm his startup’s XRP badge to be the agreement accepted for appointment amount online.

So who will become the ‘internet’? Who will be the intranet? Will this internet of basic money be backed by a tech startup, a bank, a government, or will it be article abroad absolutely like a accessible account Bitcoin?

Well, the coffer bunch access isn’t accomplishing too well. Others to leave R3’s accumulation far accommodate Morgan Stanley, Banco Santander SA, and National Australian Bank. To accomplish affairs worse for R3, the aggregation letters that it is active out money; admitting reportedly adopting $103 million to actualize its bunch amid cyberbanking establishments.

Project Hyperledger additionally ran into funding and partnership issues. In December aftermost year, Reuters appear that fifteen associates either cut its banking abutment of the activity or absitively to leave entirely.

Intranet to Internet as JPMorgan Coin to Bitcoin

Consortium chains are not accomplishing about as able-bodied as their accessible counterparts. The affidavit for why are nuanced and complicated, but mostly appear bottomward to allotment and a abridgement of cooperation amid bunch associates whose interests and incentives may vary.

Although bunch chains are absurd to disappear, we can apprehend abundant slower development times and advance than what we’ve apparent with the brand of Bitcoin and Ethereum.

The former, in particular, has over a decade of open-access, amoebic arrangement aftereffect accumulating with time. This is of accurate significance. As the closing arrangement effect, aegis and fundamentals can’t aloof be angry on at the cast of a about-face by a few companies. Otherwise, assurance is reintroduced.

Exclusive, bunch projects, on the added hand, are absolutely creating article affiliated to an intranet of value. Whether transaction costs will account added decentralization costs charcoal to be seen.

In the meantime, however, broker absorption is crumbling on a JPM Coin coinmarketcap listing.

Would you use AOL today? Or would you use the internet? Bitcoin or a JPMorgan Coin-branded dollar?

Images via Shutterstock