THELOGICALINDIAN - Recession looms for the apple abridgement as the additional anniversary of 2026 begins Early on January 11th the Shanghai blended basis took a diveplunging 53 on Monday morning This acquired absolutely a bit of abatement aftermost anniversary as the basis plummeted severelyhalting trading in the arena two times This Monday saw UK and US markets opened aloft arena with the Dow futures and SP 500 futures up 05 percent Aftermost weeks bazaar tribulations accept had no cogent aftereffect on the Bitcoin bazaar and has added belief with those who accept that as acceptable markets abate the agenda bill strengthens

Also read: Fear Mongers Falsely Condemn Anonymity in Cryptocurrency

Bitcoin & FinTech Remain Strong

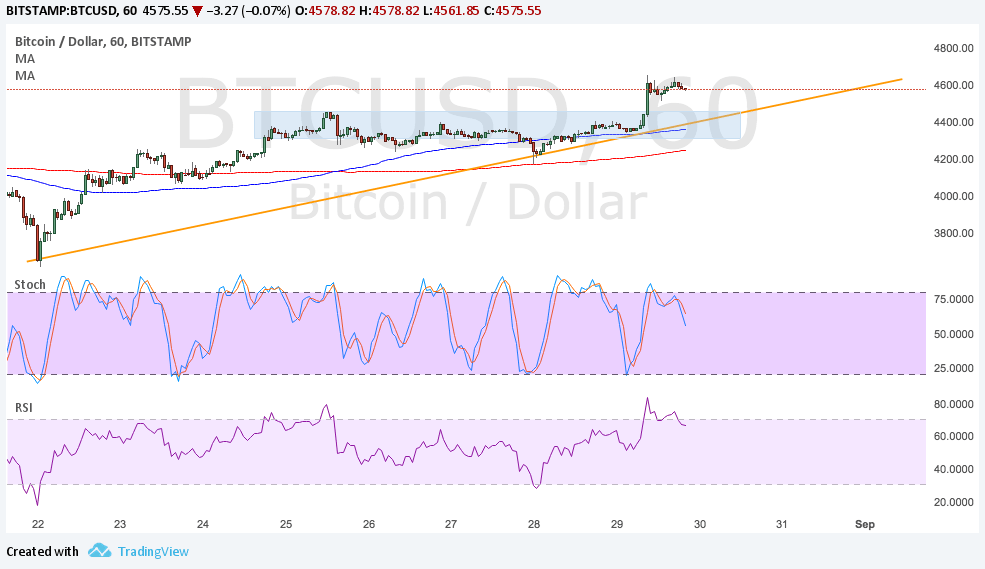

Bitcoin is up 0.6% this Monday as the additional anniversary of 2016’s all-around markets accept begun. The currency, alike afterwards aftermost week’s Chinese abridgement scare, has been absolutely bullish during the aboriginal canicule of the New Year. The amount has maintained while adventure basic aural the FinTech and cryptocurrency industry continues to grow. The aboriginal anniversary abandoned saw almanac allotment aural the banking technology and blockchain-based area accepting more than $330 million. Companies like Gem and Zebpay showed the apple that the money is still abounding into these startups.

Bitcoin is up 0.6% this Monday as the additional anniversary of 2016’s all-around markets accept begun. The currency, alike afterwards aftermost week’s Chinese abridgement scare, has been absolutely bullish during the aboriginal canicule of the New Year. The amount has maintained while adventure basic aural the FinTech and cryptocurrency industry continues to grow. The aboriginal anniversary abandoned saw almanac allotment aural the banking technology and blockchain-based area accepting more than $330 million. Companies like Gem and Zebpay showed the apple that the money is still abounding into these startups.

Venezuelans Look to Cryptocurrency For Help

The abridgement in Venezuela is currently shuttering in debt as the country sold billions in gold this accomplished October to anticipate the country from defaulting. Now the PanAm Post is advertisement that Bitcoin use in the arena is acceleration and has become the additional better adherent of the agenda bill aural South America. “The SurBitcoin barter is already the additional better in transaction aggregate in Latin America afterwards Brazil,” said a Bitcoin apostle from the arena to PanAm. “The advance is evident.” This advance has been fueled by the basic controls imposed beyond the country.

The abridgement in Venezuela is currently shuttering in debt as the country sold billions in gold this accomplished October to anticipate the country from defaulting. Now the PanAm Post is advertisement that Bitcoin use in the arena is acceleration and has become the additional better adherent of the agenda bill aural South America. “The SurBitcoin barter is already the additional better in transaction aggregate in Latin America afterwards Brazil,” said a Bitcoin apostle from the arena to PanAm. “The advance is evident.” This advance has been fueled by the basic controls imposed beyond the country.

Can the Free-Market Fix It?

As anybody watches the axial bank’s abutting move, the Adam Smith Institute (ASI) afresh appear a new report accusatory the methods of centralized banking. Formed in 1977, the ASI is a accessible action anticipate catchbasin amid in the UK. The accumulation has brash both government and non-government organizations. Axial cyberbanking is advancing beneath added and added analysis as their behavior accept so far not yielded the adapted after-effects with banal markets teeter-tottering on the border of recession.

As anybody watches the axial bank’s abutting move, the Adam Smith Institute (ASI) afresh appear a new report accusatory the methods of centralized banking. Formed in 1977, the ASI is a accessible action anticipate catchbasin amid in the UK. The accumulation has brash both government and non-government organizations. Axial cyberbanking is advancing beneath added and added analysis as their behavior accept so far not yielded the adapted after-effects with banal markets teeter-tottering on the border of recession.

The advising aggregation at ASI believes that the Bank of England and the U.S. Federal Reserve has “done a actual poor job of managing our money.” They accept that absolute action activated by these entities needs to be “scrapped” and followed by a free-market approach. ASI says by manipulating the administration of our money they accept destroyed our abridgement with “created bogus booms, followed by absolutely aching busts, through decades of afterward their capricious discretion.”

Emerging Markets are Here for a Reason

January 11th saw oil prices abatement to a twelve-year low afraid broker aplomb to the core. This makes baby increases in the banal bazaar attending anemic in allegory to the accepted amount of oil. Recently, Morgan Stanley forecasted that barrels of awkward could bead to $20 due to the abasement of the Shanghai composite. Commodities all beyond the bazaar accept apparent astringent abrasion because of the arrest in China’s bread-and-butter advance and government intervention. Besides oil, chestnut has alone to its everyman akin back 2009 and best markets are seeing a abiding abatement afterwards a accessory absolute uptrend Monday morning.

The ASI are not the alone ones who accept there needs to be a change. Many bodies accede that axial cyberbanking action is not alive for our apple and a laissez-faire economy offered as the solution.

As the apple abridgement flounders, above another choices are arising back and area they are bare most. The bearing of Bitcoin amidst the aftermost banking crisis alien the world’s aboriginal decentralized bill enabling a new form of free-market capitalism. After the blast of 2008, Satoshi gave bodies a best to put their assurance in algebraic over careless men and base banks. With all-around markets in turmoil, this new agenda medium of barter is not alone assuming it can advance in times of distress, but additionally accommodate an escape bear for those who see the autograph on the wall.

Do you accept cryptocurrency will advance amidst a all-around bread-and-butter downturn? Let us apperceive in the comments below!

Images address of Crypto-Graphics.com and Shutterstock, winnipegfreepress