THELOGICALINDIAN - Bitcoin futures traders in Hong Kong are axis abroad from the free territorys able cryptocurrency exchanges absorption instead to adapted US markets

December saw the barrage of Bitcoin futures on both the CBOE and CME. Since then, trading aggregate has steadily added as traders in Hong Kong about-face their backs on their beneath defended calm exchanges in favor of adapted US markets.

TD Ameritrade CEO Gary Leung claims his is one such close experiencing added absorption in Bitcoin futures advancing out of Hong Kong, explaining to the South China Morning Post:

This newfound absorption in American exchanges for Bitcoin futures stems abundantly from the actuality that the Hong Kong Monetary Authority angle the cryptocurrency as a commodity, and appropriately does not adapt it.

Benny Mau, managing administrator at China Securities International Finance Holdings, explained to the South China Morning Post:

Instead, Hong Kong investors attractive to accomplish the safest trades accessible are utilizing US exchanges, back “investors do not charge to anticipate about the counterparty accident or anguish about the platforms accepting a problem.”

According to Gary Cheung, administrator of the Hong Kong Stockbrokers Association, Bitcoin futures trading in the US isn’t bound to a specific subset of Hong Kong traders. Rather, there are two types of Hong Kong investors who barter Bitcoin futures in America:

Both types of investors accept appropriately far fabricated it abundantly bright — back it comes to advance in Bitcoin futures, adjustment is apparent as decidedly added adorable than able markets.

What are your thoughts on Bitcoin futures trading on American markets? Let us apperceive in the comments below!

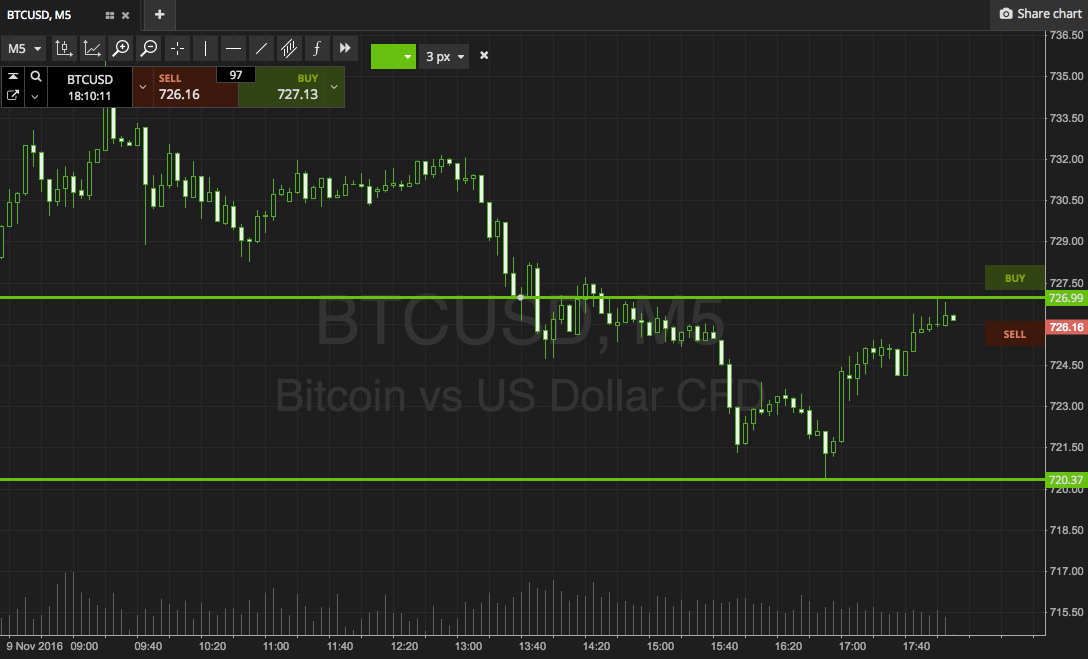

Images address of Bitcoinist archives.