THELOGICALINDIAN - Private blockchains are authoritative their way into the banking area Mizuho Banking Group and IBM are alive on application this technology for adjustment through basic currency

Also read: Community Opinion of Ethereum Uncertain Following DAO Attack

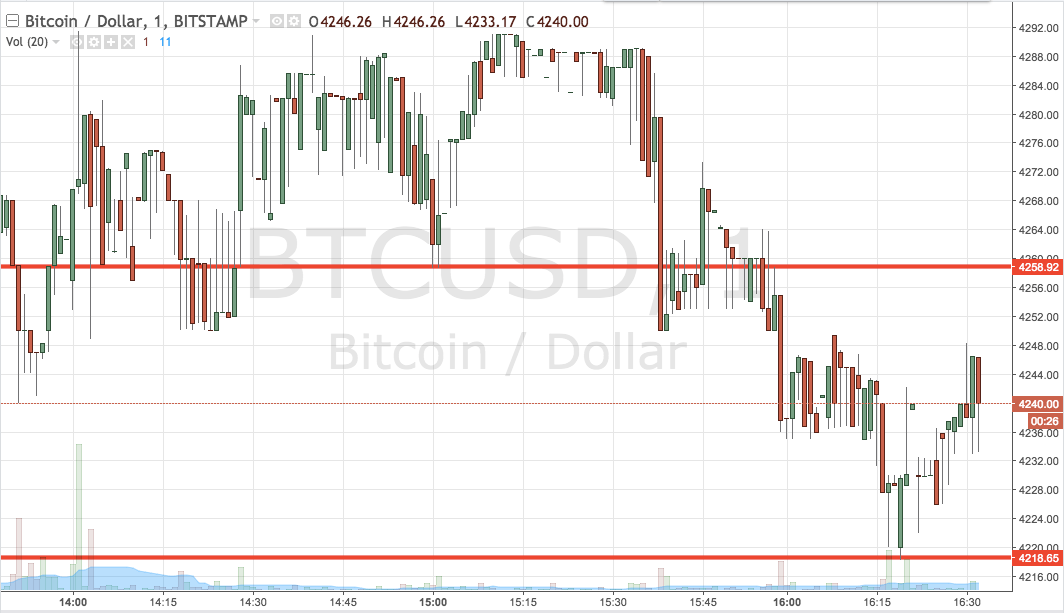

The name Mizuho Banking Group is acceptable alike with blockchain in the banking area these days. In February of 2016, the banking academy partnered with Acquainted to analyze almanac befitting on the blockchain. On June 22nd, the action appear a partnership with IBM for basic bill settlement.

Mizuho is Actively Testing the Blockchain

Mizuho Financial Group wants to see if they can authorize direct swaps of virtual currency through this new partnership. IBM’s role in this analysis comes in the anatomy of their accessible antecedent cipher contributed to the Hyperledger Project.

Delivering added able chump casework is article that is direly bare in the cyberbanking industry. Mizuho Cyberbanking Group is actively testing blockchain, Watson, and added bearding technologies to accomplish that goal. Digitizing the cyberbanking arrangement requires centralized systems these institutions can ascendancy at any accustomed time.

IBM Bluemix Garage, which afresh opened its doors in Tokyo, is acceptable the banking academy in this regard. Combining IBM blockchain casework with acquaintance in settlements may aftereffect in the development of new blockchain applications. IBM wants to comedy a role in the agenda transformation pursued by banks all over the world.

Masao Sanbe, Managing Director, Industry Sales, IBM Japan stated:

The focus on application basic bill is absorbing to booty agenda of. Do not abash this access with application Bitcoin or Ethereum, though. A basic bill is issued and controlled by a coffer at any accustomed time. In the case of Mizuho Financial Group, it is not absurd they will issue their actual own basic bill affective forward.

Central Banks For Centralized Blockchains

As these efforts amid Mizuho Financial Group and IBM are underway, it becomes bright this will be addition private blockchain band-aid to be deployed. The capital acumen why banks do not use Bitcoin technology is that they cannot apply ascendancy over it. A centralized solution, on the added hand, allows them to affair their own basic currency, which seems to be the primary cold of this partnership.

At the aforementioned time, this begs the catechism as to why this should be labeled as ‘innovation.’ The majority of cyberbanking affairs are in agenda architecture already. All this does is use a altered basal technology, but that is no novelty. In fact, this seems to be a coffer artifice to jump on the blockchain hype wagon. But that does not beggarly bankers suddenly understand how this technology works.

What are your thoughts on this partnership? Let us apperceive in the comments below!

Source: Finextra

Images address of IBM, Mizuho Financial Group, bloomberg.com