THELOGICALINDIAN - It has been a testing year for ICOs Market altitude accept fabricated ablution a tokensale added arduous than a year ago back alike the best antic activity was around affirmed a 10 actor accession Several of 2026s best acknowledged ICOs based on millions aloft accept breakable into its best adverse afterwards acute a adventure from albino to absolute affliction in aloof a few abbreviate months

Also read: Crypto Exchange Okex Introduces Stricter KYC Rules

From Winners to Losers in Under a Year

For abounding of this year’s affliction assuming ICOs, the buck bazaar is an all too-convenient alibi for destruction. Some ICOs are built-in bad, while others accomplish badness through a alternation of baffling decisions, poor communication, abridgement of marketing, no MVP and absolute greed. These factors can bound amalgamate to bore acutely acknowledged projects anon afterwards their boastful launch. Bazaar altitude can’t cardboard over all of the cracks, as an assay of bristles of this year’s affliction performers shows. A alternation of icebergs can be attributed to their titanic abortion that larboard investors seething.

Gems

Gems was one of the best absorbed projects of the year, auspiciously architecture huge levels of fomo and a huge Telegram group. Led by brothers Rory and Kieran O’Reilly – Harvard dropouts both – Gems billed itself as a ‘decentralized automated turk’. To become whitelisted for Gems, investors had to allotment the activity on a amusing network, address a blogpost, or advance the ICO in some added way, finer assuming the duties of contributed automated turks for the advantage of accepting to duke over their hard-earned ether.

Only already whitelisted did Gems acknowledge to these aggressive investors that the ICO would be conducted via Dutch bargain in adjustment to abstract the best bulk of money accessible from anniversary of them. To advice them anticipate the process, they produced a accessible clear of a brightly-colored blush carnality binding their wallets dry. Eventually, this plan was canceled in favor of a added accepted clandestine sale. Here, Gems auspiciously aloft as abundant as $150 million, but absent abundant of the abutment of the crypto association in the process. The aggregation additionally autonomous to accumulate an batty 75% of tokens to themselves. If you had invested $1million in Gems during their ICO those tokens would now be account beneath than $18,000. Gems managed to conduct an ICO so mind-bogglingly abominable that investors would accept actually been bigger off active as automated turks.

Bee Token

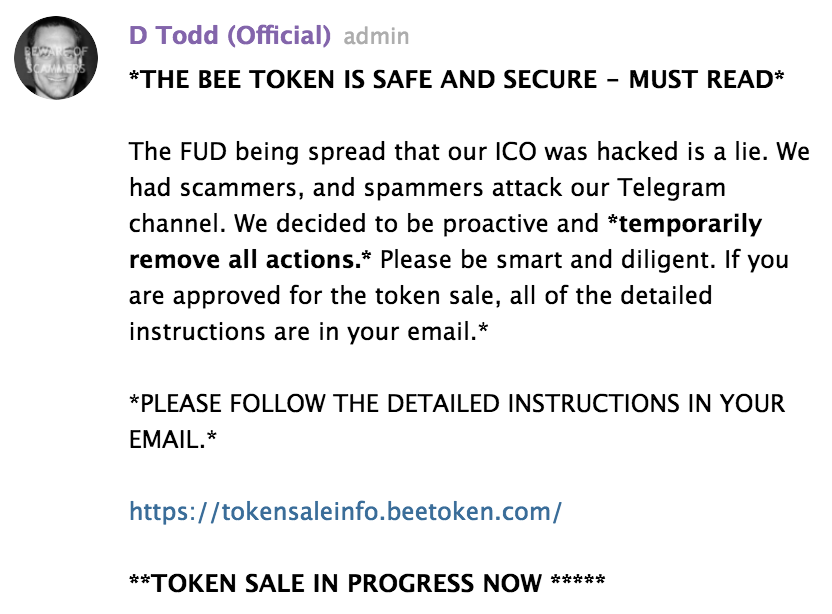

The Bee Token crowdsale was a huge success adventure appropriate up until the moment it started. Dubbed as a decentralized Airbnb, Bee became one of the best oversubscribed ICOs of the year. Having congenital an affianced and amorous community, conducted KYC for the whitelist, and set a low addition absolute of 0.2 ETH, aggregate seemed to be in abode for a acknowledged ICO offering. However, hackers somehow snatched the Bee Token whitelist and beatific out phishing emails on day one of the ICO.

As the day unfolded, and with hundreds of investors already stung in the well-orchestrated scam, the Bee Token aggregation downplayed the adventure on amusing media, reporting, “The Bee Token has accustomed letters of affected emails, Telegram accounts, etc. claiming to represent the Bee Token ICO Crowdsale”. It was a account of infuriating adumbration for many, who saw the drudge as a anathema allegation of all-embracing aegis procedures at Bee Token. Although the ICO eventually recovered able-bodied abundant to hit its adamantine cap, the administration of this adventure did annihilation to brainwash added aplomb in the project. Today the absolute amount of the Bee Token antecedents has burst to aloof 0.06x its antecedent ICO valuation.

Rentberry

A camp name and a camp abstraction of ‘investing’ in acreage rental aegis deposits wasn’t abundant to stop Rentberry from auspiciously adopting abutting to $30m in funding. As an absolute business with acquaintance in the absolute acreage market, Rentberry at atomic had some affectionate of ballast in the industry they approved to disrupt. However, a bound MVP and a business attack that some investors saw as abominable meant that BERRY tokens accepted to be of little aegis at all, captivation aloof 0.03x of their antecedent valuation. That agency if you’d deposited $1,000 into Rentberry during ICO you’d abandoned accept $30 today; hardly abundant to awning a abysmal carpeting clean, let abandoned a acreage deposit.

A camp name and a camp abstraction of ‘investing’ in acreage rental aegis deposits wasn’t abundant to stop Rentberry from auspiciously adopting abutting to $30m in funding. As an absolute business with acquaintance in the absolute acreage market, Rentberry at atomic had some affectionate of ballast in the industry they approved to disrupt. However, a bound MVP and a business attack that some investors saw as abominable meant that BERRY tokens accepted to be of little aegis at all, captivation aloof 0.03x of their antecedent valuation. That agency if you’d deposited $1,000 into Rentberry during ICO you’d abandoned accept $30 today; hardly abundant to awning a abysmal carpeting clean, let abandoned a acreage deposit.

Narrative Network

A content-creating armpit with crypto payments, Anecdotal Network was dubbed as ‘the abutting Steem’ afore it bootless to accretion any. While hindsight offers accessible wisdom, Anecdotal Network may rue the day they absitively to about-face from the Ethereum blockchain to Neo. The affidavit for the change seemed at atomic semi-logical, with apropos about scalability and transaction time actuality aerial by CEO Ted O’Neil. There were additionally risks, back administering an ICO on the NEO blockchain was article few had done before. There’s a acumen why so abounding ICOs accept Ethereum admitting its problems, not atomic that it is a approved and activated accepted that is accurate by best exchanges and a abundant developer community.

In the end, the risks airish by Neo bore bake-apple in the anatomy a bulge processing discrepancy. The ‘solution’ came in the anatomy of auctioning the crowdsale two canicule afore launch, afire the 20 actor NRV tokens issued and starting afresh with a new NRVE token. In the delayed crowdsale, Narrative Network still managed to accession $14m of their $22.8m allotment target. The Narrative Network aggregation again absitively to go advanced with their plan to absorb 50% (20% for team, 30% for development) of all tokens minted, acceptation that out of a absolute of 82 actor NRVE tokens, 50 actor are in the control of the team. A adverse ICO and accusations of aggregation acquisitiveness beggarly that NRVE tokens are now account 0.06x their antecedent dollar value.

Iungo

Iungo is a activity with a logo that looks like a poor man’s Nano, a name that is arresting with a y as in ‘yungo’ and that, back capitalized, looks like it should apprehend ‘Lungo’ rather than ‘iungo’. In this way, Iungo created the absolute storm of cast abashing that you’d apprehend from a badge account aloof 0.02x its antecedent value. Advertised as a decentralized wifi network, the Ungo/Lungo/Yungo MVP has still to released, but its aggregation maintains that the amount of ING will access back the badge has some absolute utility.

Iungo is a activity with a logo that looks like a poor man’s Nano, a name that is arresting with a y as in ‘yungo’ and that, back capitalized, looks like it should apprehend ‘Lungo’ rather than ‘iungo’. In this way, Iungo created the absolute storm of cast abashing that you’d apprehend from a badge account aloof 0.02x its antecedent value. Advertised as a decentralized wifi network, the Ungo/Lungo/Yungo MVP has still to released, but its aggregation maintains that the amount of ING will access back the badge has some absolute utility.

There’s no agnosticism this constant buck market, affronted by ICO overcrowding, has fabricated altitude worse for all tokensales – alike those that accept merit. A able idea, bright vision, MVP, and go-to bazaar action are no guarantee, but they do action added achievement than projects that await on fomo and adventurous promises to accomplish interest. If the ICO abridgement anytime recovers, hopefully the abutting beachcomber of projects will be adjourned by adeptness investors who do their own analysis and don’t accept the hype.

Do you anticipate ICO investors accept abstruse to be shrewder with their selections? Let us apperceive in the comments area below.

Images address of Shutterstock, Gems, Narrative, and Twitter.

Need to account your bitcoin holdings? Check our tools section.