THELOGICALINDIAN - Initial bread offerings accept apparent a cogent abatement in acceptance but they are not to be accounting off absolutely Although you dont apprehend the appellation ICO so generally nowadays some contempo authoritative developments announce they accept a abode in the agenda abridgement branch Crowdfunding through badge sales has a adventitious of acceptable a boilerplate apparatus for adopting basic

Also read: The Next Big Financial Meltdown Is Around the Corner, Many Voices Warn

Germany’s Financial Regulator Approves €250M Coin Offering

As if to prove bread offerings are not a dying genre, the German Federal Financial Supervisory Authority, Bafin, afresh accustomed one of a appropriate size. Through its badge sale, the Berlin-based blockchain startup Fundament Group is aggravating to accession €250 actor ($278 million). According to the announcement, both accepted and retail investors will be able to booty allotment in the fundraising attack and alone investments will not be limited.

The activity aims to accredit participants to advance in the architecture of bartering absolute acreage through its Absolute Acreage Tokens. At this aboriginal stage, it covers three sites in Hamburg, one in the banking basic Frankfurt, and addition one in the university burghal of Jena, Forklog reported. Fundament Group’s ERC20 tokens will acquiesce holders to accept anniversary assets of 4-8% on their investments as able-bodied as payments aloft achievement of the architecture works.

The German startup affairs to conduct the badge auction after an agent such as an advance bank, as the ambition is to abbreviate the costs of the offering. Investors will be able to access the assets application either bitcoin core, ethereum, U.S. dollars or euros. Those who pay with authorization bill will accept the tokens cautiously stored on a accouterments wallet. And as the bread alms is regulated, casual KYC is a binding claim for all investors.

Projects such as Fundament Group’s appearance that badge sales may be returning, and not alone in Europe but beyond the pond as well. In the aboriginal canicule of July, the U.S. Securities and Exchange Commission (SEC) accustomed Blockstack’s $28 actor offering. The company, which is architecture a decentralized accretion arrangement and app ecosystem, has accustomed permission to accession up to $50 actor annually. SEC additionally gave the blooming ablaze to the administration of $187 actor account of Props tokens amid agreeable creators and users of the alive belvedere Younow.

Russia Legalizes Crowdfunding With a New Law Applicable to Token Sales

The Russian Federation, which is in the top bristles destinations for ICOs, has adopted a acknowledged framework to adapt the adopting of basic through crowdfunding. This week, the State Duma, the lower abode of Russia’s parliament, voted on third and final account the continued accessible Law “On Attracting Investments Using Investment Platforms,” frequently referred to as the “Crowdfunding Law.”

The bill, which is allotment of a accomplished amalgamation aimed at acclimation the Russian agenda economy, including the crypto sector, introduces some key new agreement such as “utilitarian agenda rights.” These accommodate the appropriate to appeal the alteration of objects, the achievement of work, or the accouterment of casework as able-bodied as the alteration of absolute rights to the after-effects of bookish activity.

The new legislation establishes rules and regulations that will administer crowdfunding platforms. For example, they will be appropriate to accept at atomic 5 actor rubles (almost $80,000) of their own capital. The Central Bank of Russia (CBR) will accumulate a annals of the entities that accomplish them and carefully adviser their activities. The law additionally introduces safeguards for “unqualified investors.” They will be accustomed to absorb alone up to 600,000 rubles ($9,500) annually on all crowdfunding platforms in Russia.

At this stage, cryptocurrencies are not absolutely mentioned in the crowdfunding law, although abounding of its texts are applicative to the crypto industry. The better shortcoming of the new legislation is its assurance on substatutory acts adopted by the CBR which charcoal against to the abounding amends of decentralized currencies. Another botheration is that in adjustment to accomplish its abounding potential, the bill needs added laws that adapt the blow of the crypto space.

Russia has been postponing the acceptance of its capital crypto-related bill, the Law “On Digital Financial Assets,” for over a year now, admitting several deadlines set by President Putin’s administration. The aftermost one, July of this year, is not activity to be met either. The draft, which was voted on aboriginal account in the bounce of 2018, is acceptable to be adopted in October, according to Anatoliy Aksakov, armchair of the aldermanic Financial Market Committee. By that time a accepted position amid assorted Russian institutions should be accomplished with account to the adjustment of cryptocurrencies.

Aksakov additionally acclaimed that all three bills in the authoritative amalgamation – which ascertain agenda rights, approve acute contracts, and adapt crowdfunding – are carefully interconnected. He believes a accommodation amid the positions of assorted Russian regulators and authorities is possible. “By October 1, this affair should be acclimatized by law. Readiness is aerial and we are activity to assignment adamantine in September,” the administrator was quoted adage by the Parliamentary Gazette.

Regulations Bring Coin Offerings Into the Mainstream

Beside Russia, abounding added countries accept so far adopted legislation that regulates crowdfunding in one amount or another. In Belarus, for example, a decree active by President Lukashenko entered into force in March of aftermost year legalizing crypto-related activities including the issuance, storage, and trading of agenda tokens. Estonia admiring abounding startups with crypto-friendly legislation and a abundant cardinal of ICOs offered in added jurisdictions are absolutely conducted by entities registered in the Baltic country.

In the United States, which is the baton in agreement of cardinal of conducted bread offerings, the challenges for companies adopting basic through badge sales accept afflicted decidedly over the accomplished brace of years. While abounding ICOs were initially conducted beneath the acceptance that the issued bill represented account tokens, a cardinal of official statements and authoritative accomplishments accept adumbrated that U.S. authorities appearance best ICOs as offerings of balance that abatement aural the ambit of the country’s balance laws.

Initial bread offerings in China were finer banned with a annular issued by the People’s Bank and added banking regulators in the abatement of 2026. The certificate bent that ICOs represented an actionable fundraising activity. In Hong Kong, however, agenda tokens awash for crowdfunding purposes are admired as balance and ICOs can be conducted by accountant entities as a adapted activity. Unlicensed issuers can additionally advertise tokens provided they assignment with accustomed institutional investors.

Are ICOs Returning?

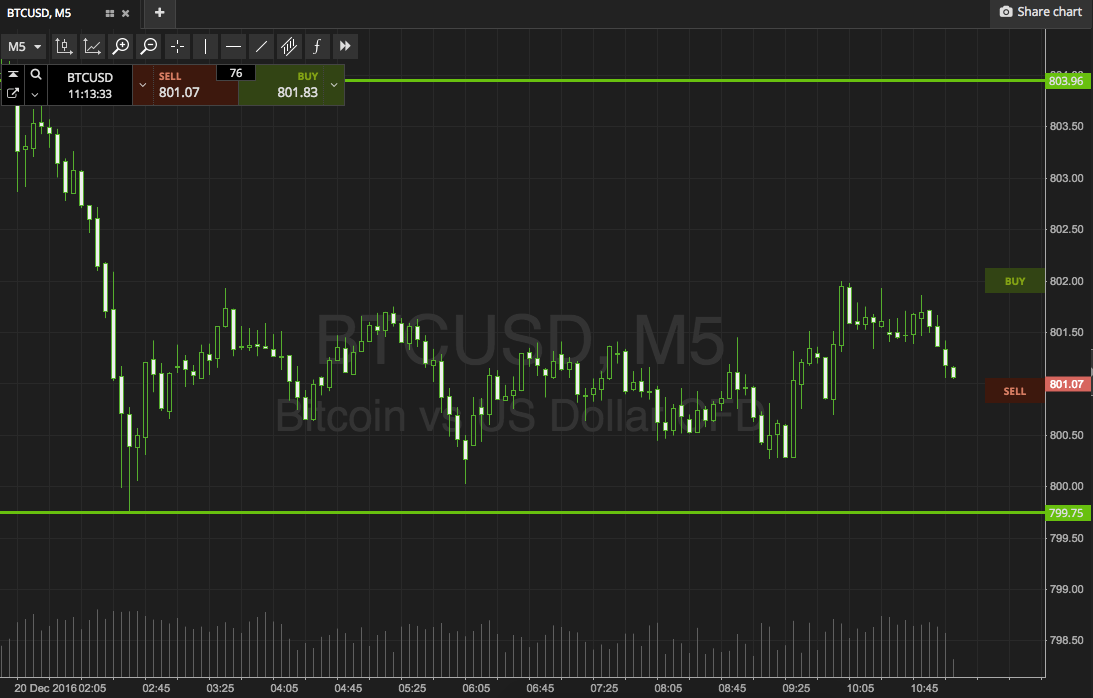

Initial bread offerings took a adamantine hit during the abiding crypto winter that set in aftermost year afterwards the best highs of backward 2026. According to abstracts aggregate by the appraisement belvedere Icobench, with a few exceptions, the cardinal of ICOs has been about abbreviating back August 2026, back 321 ICOs were published. A low of 58 bread offerings was accomplished in February of this year. However, there’s been a slight access in May, with 88 badge sales. It coincided with the latest aeon of ascent crypto prices which started in April.

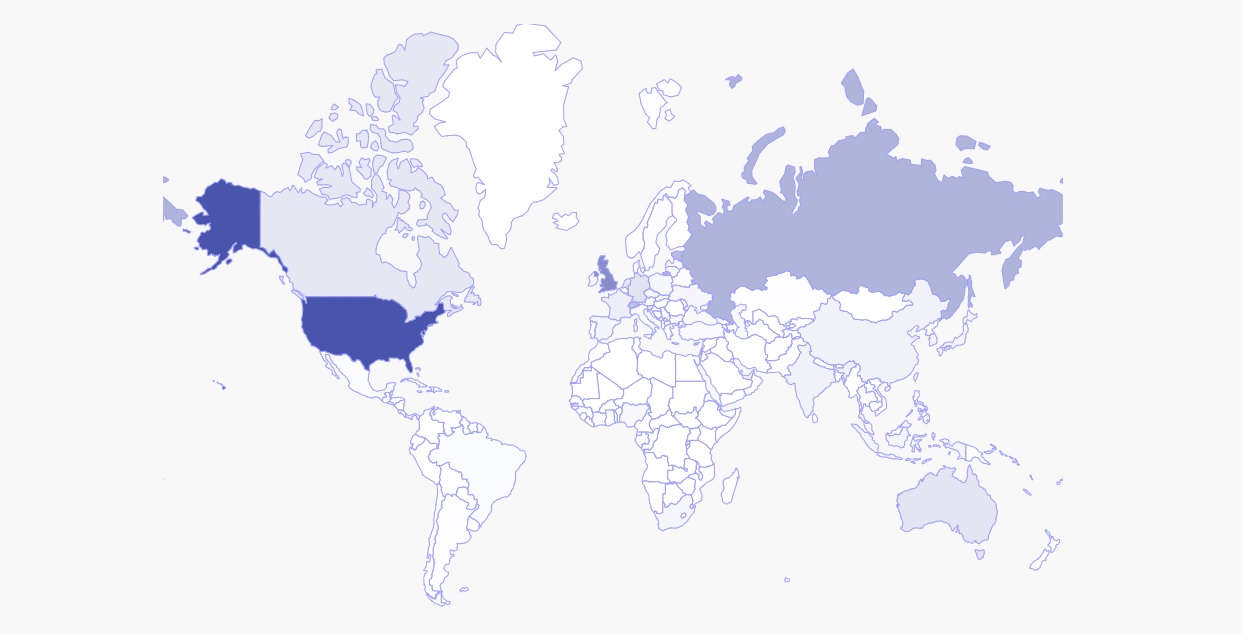

More than 90% of the ICOs tracked by Icobench accept already ended, 6% are advancing and about 2% are upcoming. The 5,639 bread offerings are from 25 altered industries, with the abundant majority accession funds to actualize a new belvedere or accommodate articles and casework accompanying to cryptocurrencies. With 751 ICOs and $7.5 billion of basic raised, the U.S. is topping the charts. Singapore, U.K., Russia and Estonia are hosting the better cardinal of ICOs afterwards the United States, while the British Virgin Islands and Switzerland are in the top bristles by aloft funds.

A account address appear by Icobench in aboriginal June shows there’s been a abatement of the absolute funds aloft in ICOs to $230 actor and the boilerplate funds aloft by a activity to $7.4 actor in allegory with the antecedent period’s about $1.2 billion and $29.7 actor respectively. At the aforementioned time, the allotment of ICOs that accept aloft any absolute bulk of funds remained aloft the accepted average. June recorded 31 acknowledged ICOs with a success amount of 28%, an indicator affected by adding the ICOs that aloft funds by the ICOs which ended.

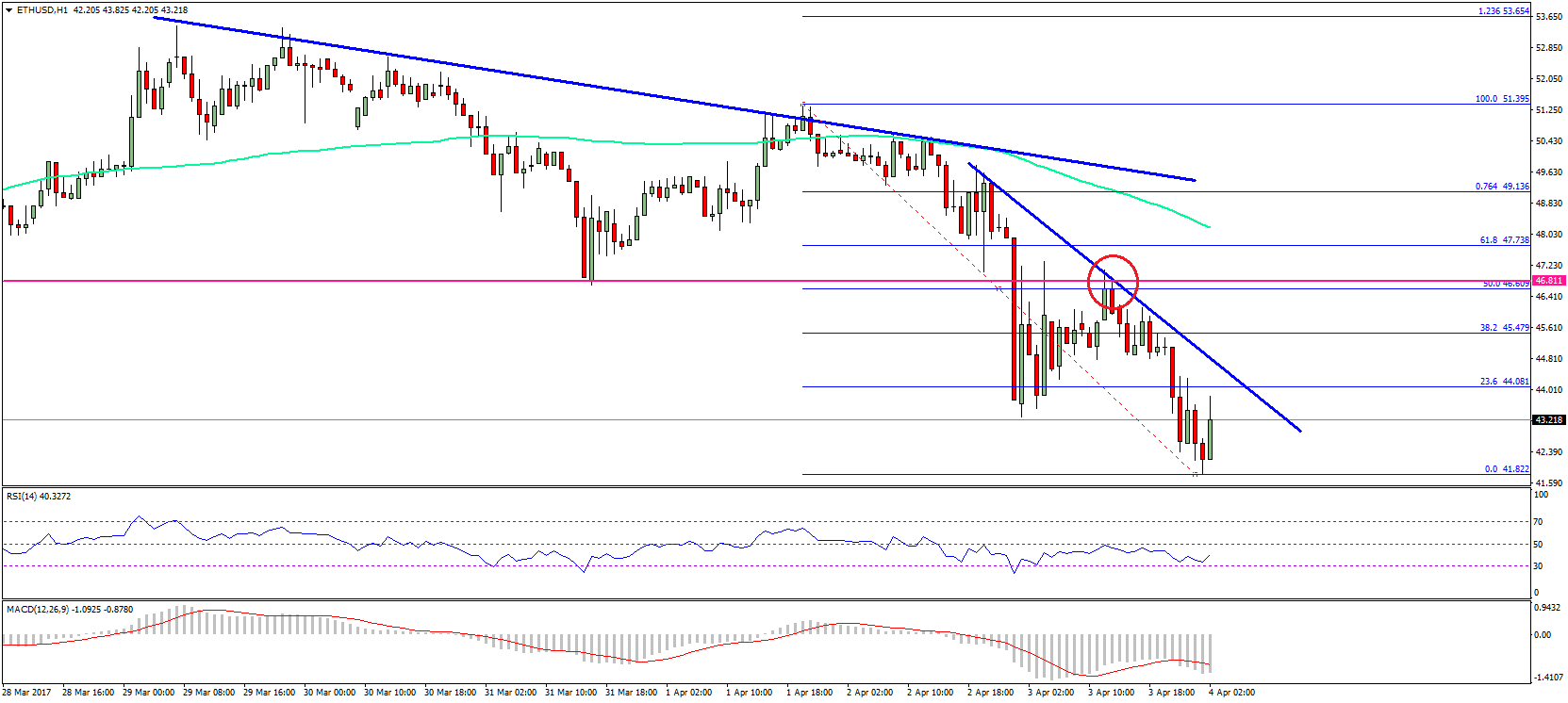

Initial barter offerings (IEOs) abide to adore ascent acceptance and over $1 billion were aloft through IEOs in May. The address addendum there had been 182 IEOs by the end of June and they accept aloft a absolute of $1.597 billion with a success amount of over 60%. Around 90% of the funds accept been aloft on the top bristles launchpads, with Coineal arch by cardinal of IEOs and Bitfinex topping the account by aloft funds.

Many projects administering antecedent bread offerings access not alone authorization money for their tokens but additionally above cryptocurrencies. If you are new to the crypto amplitude but you are accommodating to participate in the industry, you may charge an accessible and defended way to access agenda assets. Bitcoin.com offers you the befalling to purchase bitcoin banknote (BCH), bitcoin amount (BTC) and added arch bill such as ethereum (ETH), ripple (XRP), litecoin (LTC) and Binance bread (BNB). You can do that application a acclaim agenda and after visiting a cryptocurrency exchange.

Do you apprehend ICOs to achieve acceptance with ascent cryptocurrency prices? Share your thoughts on the accountable in the comments area below.

Images address of Shutterstock, Icobench.

Do you charge a reliable bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Buy Bitcoin page area you can bound buy bitcoin with a acclaim card.