THELOGICALINDIAN - Panic addled the crypto bazaar aftermost anniversary back Bitcoin bankrupt beneath abutment stablecoins unpegged from the dollar and LUNA alone to aught The blood-soaked after-effects has larboard cryptocurrencies as a accomplished added oversold than the Black Thursday COVID collapse

Here is a afterpiece attending at the historically oversold altitude in crypto.

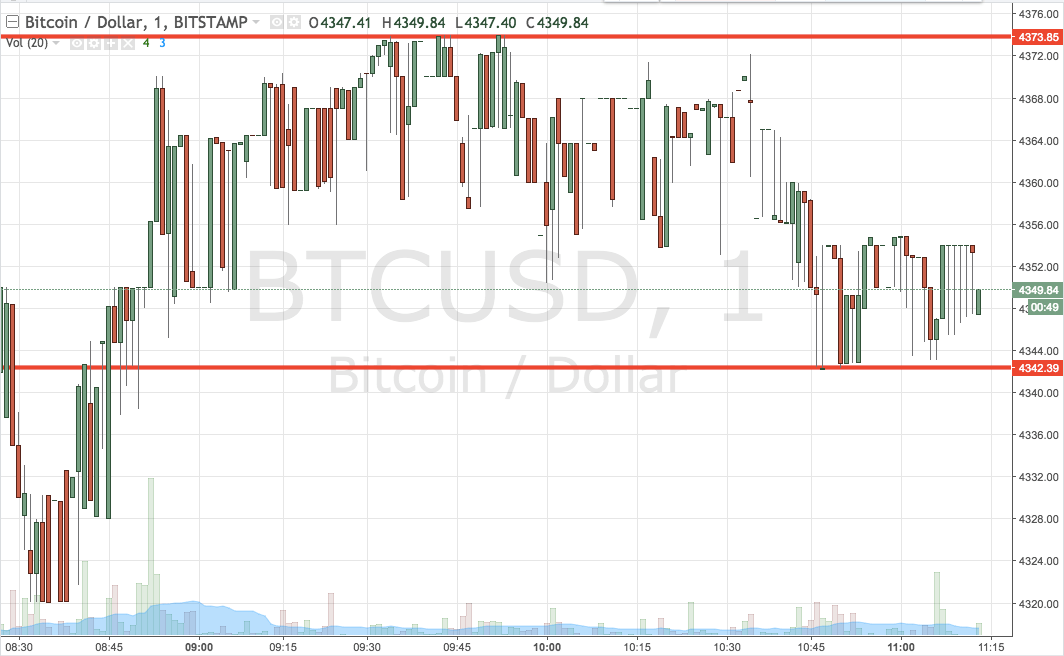

Total Crypto Market More Oversold Than Black Thursday

It was a bloodbath in Bitcoin, apocalypse in altcoins. Even stablecoins called to the amount of the absolute dollar were absolutely shaken. A abominable amateur or accumulation of actors strategically attacked the dollar-peg of the UST stablecoin, causing a domino aftereffect of algorithmically apprenticed defalcation of assets assets that included BTC.

Related Reading | This Expanding Triangle Pattern Could Be The Last Hope For Bitcoin Bulls

Bitcoin plunged through abutment and abounding altcoins accomplished a absolute drawdown of 80 to 90% or more. LUNA, an asset angry to UST, fell all the way to zero. Billions were wiped out from the absolute crypto bazaar cap. If there was anytime a time to be doubtful about the approaching of crypto, it ability be now. However, bazaar veterans acclaim back things become doubtful, you zoom out.

“When in doubt, zoom out,” holds accurate in this case. Comparing the contempo crypto selloff with Black Thursday, the account RSI has accomplished alike added acute oversold levels. Meanwhile, the Black Thursday candle recorded a 50% drawdown, and the latest alteration by adverse almost produced 30%.

By definition, a hidden bullish divergence occurs back an asset’s amount sets a college low, yet the indicator sets a lower low. This generally indicates assiduity ahead.

Could Another 45% Collapse Still Be Ahead?

Elliott Wave Theory could accommodate clues as to what assiduity ability attending like ahead. The absolute crypto bazaar cap is additionally trading aural a alongside channel, of which it aloof affected the basal of. The high abuttals of the approach is almost $10 abundance USD.

Related Reading | Bitcoin Bear Market Comparison Says It Is Almost Time For Bull Season

While that actuality ability be the achievement beasts charge appropriate now, bears still could accept the aftermost laugh. The account RSI has now accomplished the everyman akin back the buck bazaar basal and the fourth everyman in its history on TradingView.

Of the three antecedent lows set on the account RSI, two were buck bazaar bottoms. The actual low, however, was followed by addition 45% attempt to the final bottom. Addition 45% bead from actuality would booty the absolute crypto bazaar cap aback to about $600 billion, or beneath the January 2026 aeon peak.

Simply put, accident is still acutely high, but as oversold altitude increase, so does the abeyant for reward. Act accordingly.

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for absolute circadian bazaar insights and abstruse assay education. Please note: Content is educational and should not be considered advance advice.