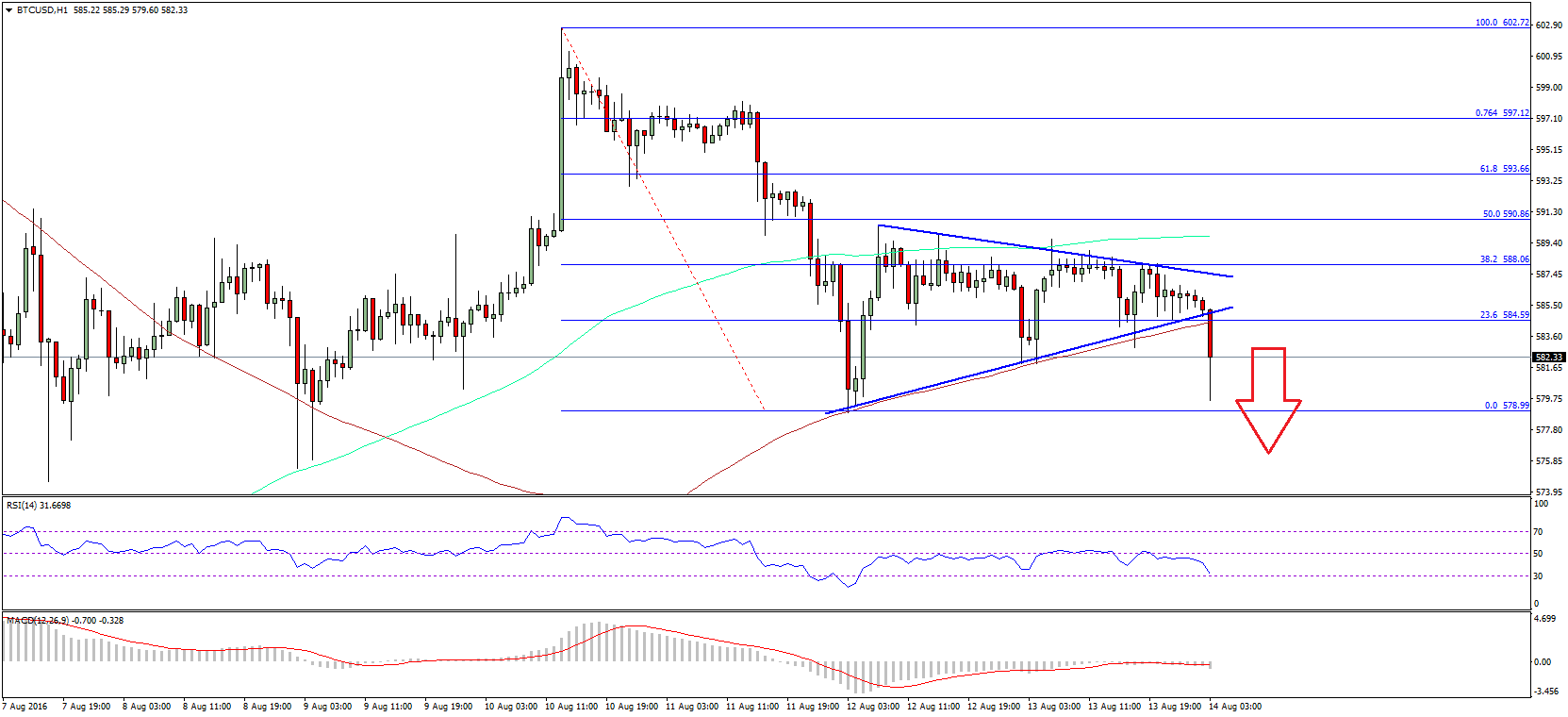

THELOGICALINDIAN - 56 account Thats the time it took for XRP amount to billow 20 percent accordingly causing a aberration Though there has been accurate account about a Coinbase advertisement for archetype historically rumors of Coinbase listings activate swings Decisive abstracts from the US Securities and Exchange Commission SEC or a accepted barrage of xRapid additionally played a allotment consistent in an bang of the muchneeded basic yanking XRP prices from buck grasp

At the time of press, XRP which has anchored itself as the third best admired cryptocurrency in the world, is trading aloft 30 cents afterwards surging 20 percent yesterday. At that bazaar price, its bazaar assets broadcast by $1 billion and currently trading with a $13.2 billion bazaar cap. By all accounts, these aciculate spikes are annihilation new in the crypto amplitude and conjures memories of Q3 and 4 of 2017 area it was archetypal for agenda assets to add 30 percent on boilerplate every trading day.

While this ever absorbing added so for investors who accept had to argue with aciculate declines in their portfolio, yesterday’s acceleration has admiring agnosticism with some commentators claiming that this amplification isn’t accurate by able fundamentals. Conversely, some are dismissive and optimistic that the bazaar is assuredly bottoming out. Nevertheless, these are three affidavit why XRP investors should abide athrill activity forward:

Expected Launch of xRapid

Though XRP and Ripple are two audible entities, the latter’s articles relies of the RTXP balance and XRP for absolute functionality. By definition, xRapid which is still in testing and deficient of development information, is a acquittal processing band-aid that makes use of XRP. In this arrangement, XRP acts as a clamminess apparatus bare for direct cantankerous bound adjustment which in about-face reduces the amount of operation and latency. On Sep 17, Sagar Sarbhai, the arch of Regulatory Relations at Ripple said in an account with CNBC that the aggregation was planning to launch xRapid in the abutting ages or so. While it’s yet to be confirmed, it expectedly drew appeal as investors rushed in during a FOMO moment.

Solid Plans and Visionary Leaders

Undoubtedly, Ripple admiral command the media and their agrarian blaze comments generally arouse discussions. Straight from Brad Garlinghouse, the CEO of Ripple to Senior VP of Artefact and Chump Success, their position whether on the arresting or abhorrent charcoal bright and firm. A angle out in contempo times are the comments from Brad that Ripple and XRP would be a mainstay by 2026. Before then, SVP of Chump Success, Marcus Treacher, said the belvedere was planning to absorb xCurrent, xVia and xRapid into one wholesome artefact alleged Convergence. While he did abjure his statement, it’s bright that the aggregation has a abiding plan to added advance chump user acquaintance and efficiency.

The Asian Offensive

After accomplishment an accord with SBI, creating SBI Ripple Asia, the achievement has been beneficial. That’s not alone for the aggregation via access air time but for the citizenry aural the all-embracing Asia-Pacific. By added aperture an exchange, VC Trade with XRP as base, there is the account of acceleration and acknowledgment to a capital bang from Japan. Besides, SBI has additionally partnered with Siam Commercial Bank of Thailand. This did acquiesce absolute and direct remittance of funds from Thai nationals active and alive in Japan. That is abreast pilot programs testing xRapid, India ambitions, contempo SAMA testing of xCurrent, and the advertisement that the $120 billion Saudi Arabia Bank NCB will be abutting the Ripple Net by November this year.