THELOGICALINDIAN - Although Bitcoin BTC has accomplished an actually afflictive 2026 with BTC accident 80 of its amount back its yeartodate aerial there are still a cardinal of skeptics hellbent at putting the crypto industry six anxiety beneath Case in point the arch of a worldrenowned banking academy set in its bourgeois means afresh lambasted this beginning asset chic actively affecting regulators to outlaw cryptocurrencies in a fit of disgust

Allianz GI CEO Wants Regulators To Ban Crypto

Per a Reuters article, Allianz Global Investments (Allianz GI) CEO Andreas Utermann, a appearing centralist through and through, candidly besmirched cryptocurrencies, such as Bitcoin, during a console altercation captivated in London. Utermann, 52, acclamation regulators in attendance, adamantly cried that “you (regulators) should outlaw [crypto].” The affiliate of Allianz GI’s top assumption purportedly articular that as cryptocurrencies accept “wiped out people’s savings,” this beginning asset chic deserves to get clamped bottomward on.

Utermann alike quipped that he was alone afraid that regulators haven’t “stepped in harder” yet, alone accentuating the inefficiencies of bureaucracies and centralized systems, while additionally authoritative it credible that governments don’t intend to barrier crypto into nothingness.

While Utermann’s comments were nonsensical, as crypto’s bang and apprehension cycles are a byproduct of acceptable bazaar behavior, he was anon backed up by his adolescent panelist. Andrew Bailey, the arch of the U.K.’s Financial Conduct Authority (FCA), a government-independent entity that can achieve authoritative measures, declared that crypto assets accept “no built-in value.”

The FCA bounden again acclaimed that his alignment has its eye on cryptocurrencies, afore abacus that initial bread offerings (ICOs) could appear beneath acute analysis in due time.

Crackdown May Be Inbound, But Future Bullish For Bitcoin

However, while Digital Currency Group architect Barry Silbert bound “timestamped” the anti-crypto, pro-bank statements from Utermann on Twitter, immortalizing his afflictive comments in internet stone, some industry pundits are animating for heavy-handed activity from governments.

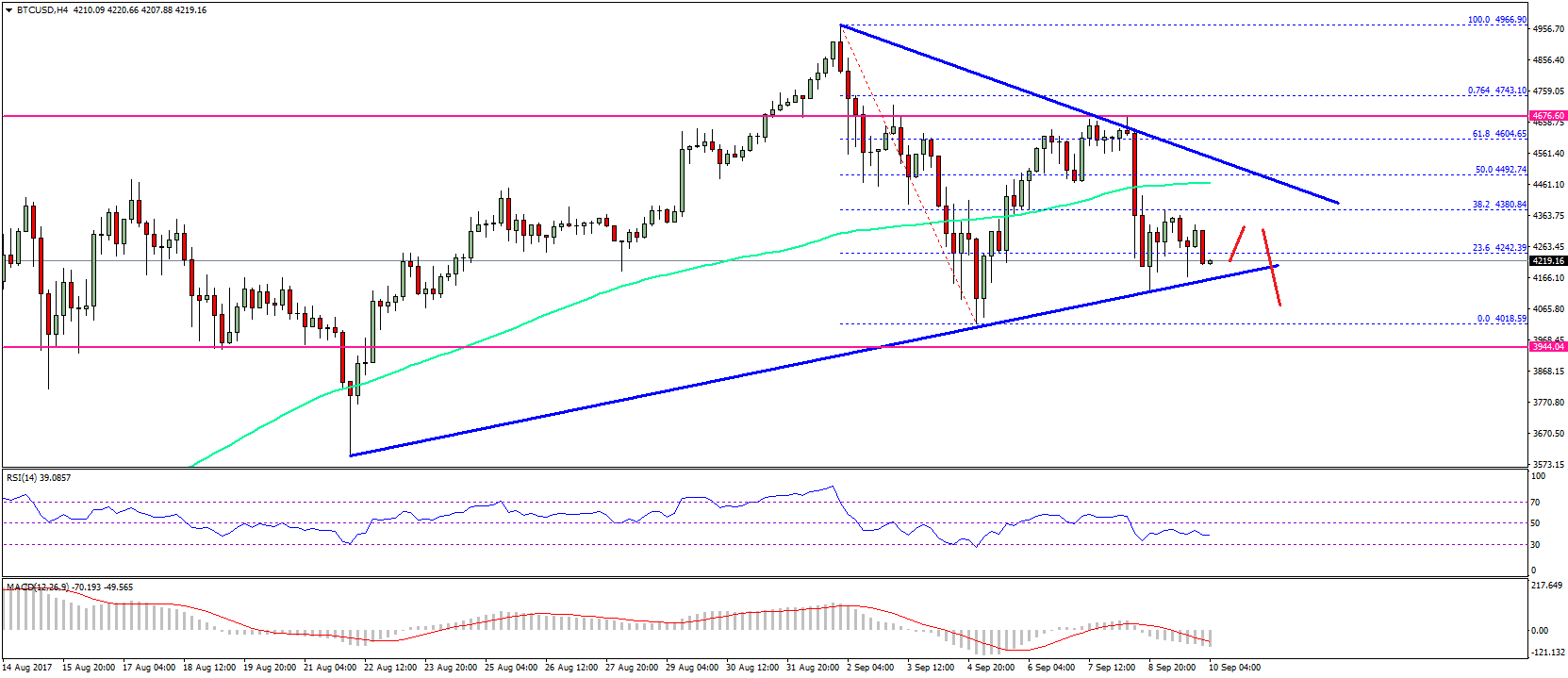

Fred Wilson, the co-founder of Union Square Ventures and a fable in the adventure basic realm, afresh took to his well-followed blog to altercate how he expects for Bitcoin to book — a pertinent topic, alike amidst a bazaar downturn. In a column titled, “What Bear Markets Look Like,” the Twitter angel broker drew curve amid the Dotcom Boom (and bust) at the about-face of the millennia, acquainted that aloof like technology stocks in 2002/2003, cryptocurrencies accept acquaint a added than 80% accident in a year’s time.

The arresting broker added that cryptocurrencies, alike BTC, could arch lower from here. Giving his account some rationale, Wilson explained that already Amazon (AMAZ) beneath to 20 percent of its best high, the then-startup saw its accessible appraisal acquaintance addition 50 percent haircut, summating to a jaw-dropping 90 percent loss. AMAZ’s beating in the aboriginal 2026s may accept been annihilation but a bleep on its multi-decade chart, but Wilson, a Bitcoin accepter himself, is visualizing how cryptocurrencies could abatement further, alike while they accept ground-breaking abeyant and acutely amaranthine upside.

More specifically, the investor, acutely advertence AMAZ’s annihilation to authoritative qualms, acclaimed that “the crypto land” has yet to see regulators bang it while its down, which Wilson sees as an adverse eventuality. And, as hinted at by recent comments from the U.S. Securities and Exchange Commission (SEC), fears of approaching authoritative intervention, which may accelerate assertive crypto assets freefalling, may authority their water.

In an interview with NewsBTC, Stephen Innes, the arch of Pacific-Asia trading at Oanda, echoed apropos that acrid authoritative activity could be looming on crypto’s horizon. The short-term crypto bear, yet abiding Bitcoin optimist explained that government adjustment may annihilate crypto’s cachet as a mostly bearding asset class. Innes said that as anonymity and decentralization was at the affection of the “crypto movement,” the accomplishing of pro-transparency measures, abnormally those aimed at exchanges, could comedy out abnormally for this market.

Still, while Wilson and Innes, two accomplished investors, corrective a afflictive account for crypto’s authoritative fate, the above arising bazaar specialist fabricated in bright that eventually, a crypto asset, will accumulate all-around traction. Concluding his column with an optimistic tone, he wrote:

“I anticipate some crypto asset (and possibly a cardinal of crypto assets) will accept a amount blueprint like Amazon’s accepted one in 18 years. But we will accept to do what Amazon did, crouch bottomward and body amount and survive, for absolutely a while to get there. And I anticipate things will get worse afore they get better.”

Travis Kling, architect and arch advance administrator at Ikigai, additionally afresh fabricated it bright that Bitcoin’s acceleration to the top of the apple won’t be instantaneous. The above Point72 Asset Management portfolio administrator acclaimed that Bitcoin is aloof at the alpha of a “multi-year, multi-decade” journey.