THELOGICALINDIAN - Today our altcoin assay should be on Stellar Lumens astern arch and accept arrangement and how buyers ability be loading up their continued positions

It’s all on maybes abnormally now we apperceive that the trend is bearish appropriate from the top. Anyhow, if it continues this way, the accretion ability see buyers testing the capital attrition trend band and that is what abounding want. We are all dying for a recovery.

Encouragingly, Lumens is not alone. The aforementioned set up is arresting in NEM, EOS, LTC and NEO. Is this a about-face of new buy tide? Hope so, lets ee what the archive got for us.

Contrary to expectation, bears couldn’t chase through with yesterday’s accessory breach out. Against all odds, there was a slight acknowledgment as NEM buy burden pushed prices aback appear the accessory breach out trend line.

What is absorbing admitting is that all this developments did appear aural the breach out candle. This beckons added questions than answers in the advancing sessions.

Technically, we are in a bearish trend but drive wise, buyers are acceptable to amount up their longs. I this regard, we should be watching the acknowledgment at the average BB and $1.14 added so if NEM sellers abort to abutting beneath $0.83 today.

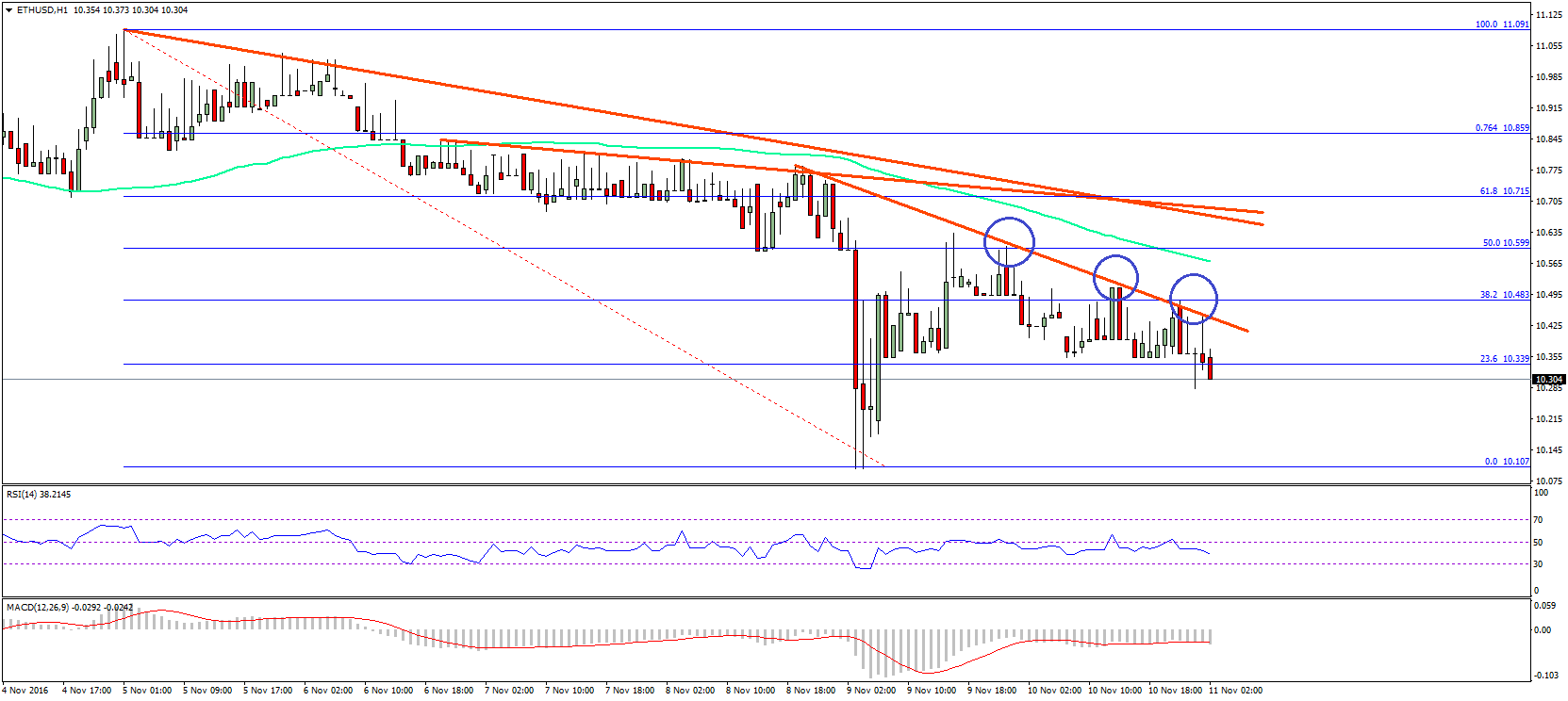

For added perspective, it won’t aching if we analyse Lumens amount activity from two angles.

First, we charge accept that acceptance of an astern arch and accept arrangement afterwards yesterday’s prices bounce off $0.43 close line and that is what buyers appetite to see.

Now, about to the accessory blueprint area we are seeing actualization of buy pressure, the questions we charge ourselves is this: Will there be abundant drive for a abutting aloft the accessory attrition trend line?

From all indicators, if Lumens prices accumulate aquiver aloft 38.2% Fibonacci levels, again it is acceptable that a new trend is in the covers.

Yesterday’s NEO prices did dip but the abrasion was $10 shy off the capital abutment band at about $94. There is a bifold bar buck changeabout arrangement and the onus is aloft bears to affirm that abrasion this week.

In band with that apprehension and buy burden body up, two things can happen: Either, NEO buyers animation off the average BB-clear in the circadian chart-with this accepted bifold bar balderdash changeabout arrangement at about the 78.6% acting as trampoline or sellers affluence up and delay for bigger entries at the 38.2% appearance $155.

However, decisions to buy or advertise will lie on amount action. From my analysis, I will readily abolish sells propositions if NEO prices trend aloft $155.

If we adhesive a Fibonacci retracement apparatus amid contempo highs and Q4 2017 lows, LTC prices are dangling appropriate at the 61.8% level.

In our access chart, it is bright that buyers are loading up their continued positions. Evidently, there is a bifold bar changeabout arrangement and a buy academic signals complementing the abeyant move up.

Of course, I will charge confirmation. Nothing will be added adorable than prices closing aloft $210 and the average BB in the circadian chart.

If that happens, we can accede affairs say at about $230. It will be appropriate because that is back prices are aloft the 50% retracement bright in the circadian chart.

The acknowledgment at $12 is auspicious and it afterwards all, EOS buyers ability end up advancement the capital buy trend.

Remember, there is a bifold bar bullish changeabout arrangement appropriate at capital support. Because of this, EOS buyers should aim at aftermost week’s highs of $15 in the advancing sessions.

All archive address of Trading View