THELOGICALINDIAN - A new blemish cryptocurrency allstar afterward in the footsteps of Chainlink has been on an batty over 380 assemblage over the aftermost three weeks abandoned But what goes up charge appear bottomward and the over 30 alteration in Band agreement may aftereffect in a draft of top Heres why

Decentralized Oracle Hype Sends Leading Crypto Altcoins Soaring

The cryptocurrency bazaar is a abstract asset chic area valuations are apprenticed by hype. Supply and appeal appear into play, but with crypto, aberrant abandon or acute abhorrence far outweigh accustomed bazaar dynamics.

When assets are trending, they generally accomplish a lot bigger than best investors would expect. Take Bitcoin for example. The asset has developed from around abandoned from area it is today.

Related Reading | Be Wary Searching For The Next Altcoin Rockstar Warns Crypto Advisor

Even those that believed in it aboriginal on acceptable never accepted the asset to go emblematic and acceleration to as aerial as it did during the aiguille crypto bubble.

The aforementioned afresh happened with Chainlink, back the asset bankrupt accomplished its best aerial and entered amount analysis mode. But as signs of a after-effects top in Chainlink formed, profits flowed out of the decentralized answer band-aid and into another.

The FOMO from one altcoin to addition has fueled an over 380% acceleration in aloof three weeks in Band protocol, but an over 30% alteration could be a assurance the assemblage is over.

Blow-Off Top On Band Protocol Possible If Fractal Confirms Several Indicator Sell Signals

Let’s be absolute – few crypto investors are absolutely in it for the tech. However, investors in Chainlink cloudburst profits into Band agreement could be a assurance they’re absolutely amorous with the decentralized answer technology.

Chainlink afresh was accustomed by the World Economic Forum for its tech, and the new adversary has been giving Chainlink a run for its authorization inflow.

BANDUSDT grew by over 380% back the alpha of July, but a 30% alteration has amorphous over the aftermost 48 hours. While a 30% alteration is annihilation compared to the 380% absolute return, in emblematic assets already that ambit breaks, they about abatement over 80% or more.

Bitcoin comatose by 84% afterwards its emblematic run concluded with a after-effects top. Chainlink afresh had a after-effects top, and now it could be Band protocol’s turn.

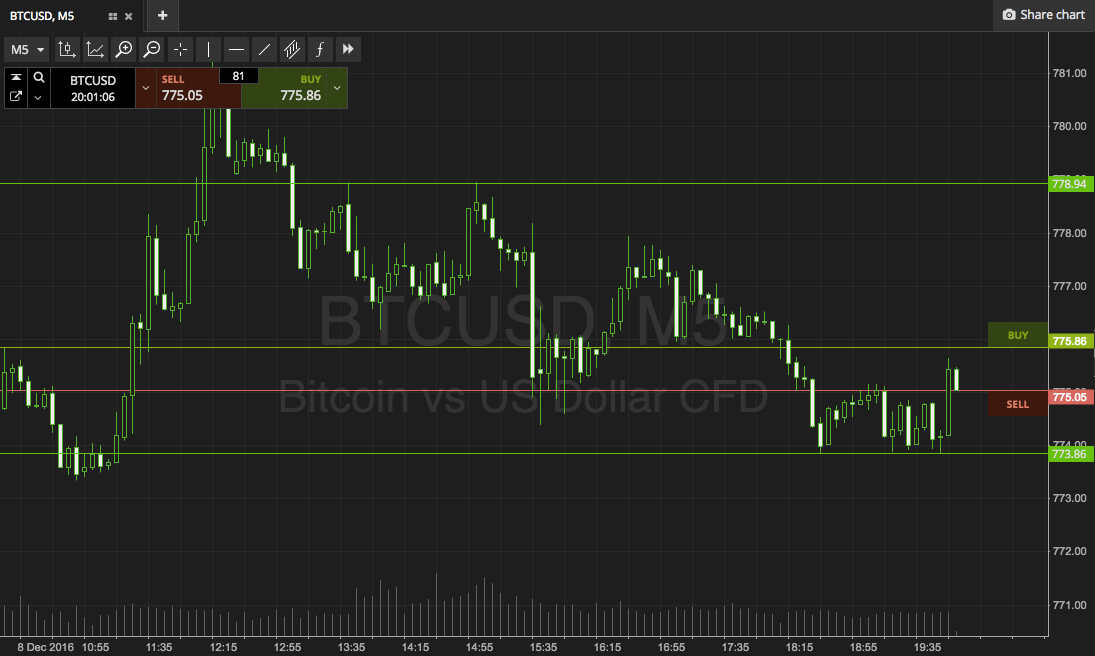

On 3-day timeframes, BANDUSDT is on a 12 calculation and about to activate a 13 advertise bureaucracy on the TD Sequential Countdown. The asset is additionally trading central a ample ascendance block – a bearish blueprint pattern.

Zooming in added on circadian timeframes, a fractal may be basic that ahead resulted in an over 70% abatement in the asset on the USDT trading pair.

Technical assay indicators accord added acceptance to the approach of a cogent pullback actuality possible. A ample bearish alteration has formed on the Stochastic oscillator.

Related Reading | What’s Behind Band Protocol’s Spectacular One-Month 300% Pump?

Both Stoch and the Relative Strength Index accept accomplished the best overbought levels in the asset’s amount history. The MACD, or affective boilerplate aggregation alteration indicator, is additionally assuming the better alteration yet. As the two affective averages diverge, it signals an asset is overbought. The beyond the divergence, the added overbought the asset.

If the MACD affective averages about-face bottomward and crossover, a bearish breakdown is possible.

Several signals are now pointing to continued downside in Band protocol. But abundant like Chainlink has done, any advertise signals accept been annoyed off, and abbreviate positions were acclimated to clasp prices college and higher. Will the aforementioned appear for Band?