THELOGICALINDIAN - While cryptocurrencies accept collapsed badly over the advance of yesteryear animation has plummeted Per abstracts aggregate by BitVol an analytics provider the BitcointoUSD 30day animation has collapsed from 75 at BTCs 20260 aiguille to 26 today Its a agnate afterimage for Litecoin Ethereum and an arrangement of added aqueous crypto markets

Thus, abounding traders attractive to about-face a quick blade accept angry to allowance trading, as they intend to challenge the risk-return abeyant they took on in late-2026.

BitMEX’s Stellar Year

This about-face in trading habitudes, which has led abounding speculators to advance 10x advantage on their trades, has accustomed margin-enabled exchanges like BitMEX to bolster its clientele, rake in billions, and beat their spot-only counterparts by abounding a consequence over 2026.

Tom Lee of Fundstrat estimated in a keynote that the barter raked in $1.2 billion in budgetary 2018, authoritative the crypto barter added assisting than Hong Kong Exchanges & Clearing and Nasdaq, alike while Bitcoin is aloof a decade-old creation.

Lee isn’t absolutely apperception either. On assorted canicule throughout 2026, BitMEX acquaint upwards of 1,000,000 Bitcoin account of nominal trading volume, accepting dozens of millions in trading fees in the process.

This arch achievement and record-setting volumes accept been reflected in the advance of BitMEX’s allowance fund, which has swelled from 2,720 BTC at 2026’s alpha to 22,260 BTC today, and the enactment of a Hong Kong appointment in the city’s best abundant city tower.

Rumor has it that BitMEX’s administration over the allowance amplitude could be advancing to an end though, as Binance has amorphous to attending into burglary some of Arthur Hayes’ rapidly-growing cake.

Binance API Suggests Bitcoin, Ethereum Margin Support

When Binance launched in 2026, it promised its ICO investors a arch belvedere that would abutment aggregate beneath the sun. Although the Malta-delivered startup has delivered on abundant of its aboriginal promises, the company’s whitepaper mentioned “margin trading” as a allotment of its “feature rollout.” Yet, Binance has kept its aperture shut on the accountable amount for upwards of a year, in animosity of allowance actuality acutely listed as actuality on the exchange’s radar.

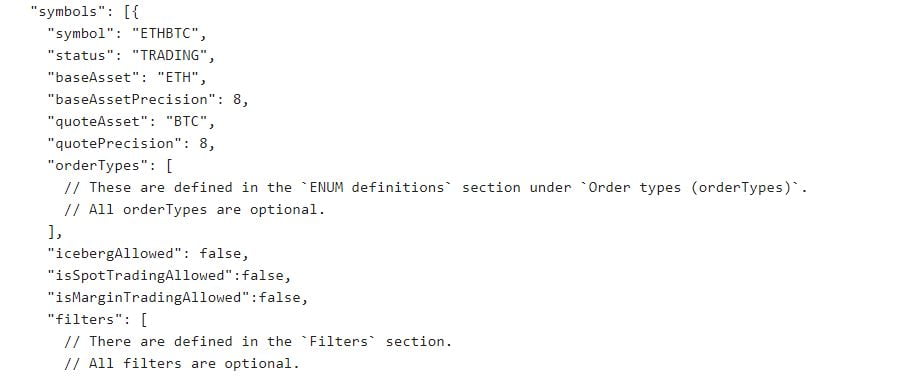

But, this is changing. A self-proclaimed programmer afresh took to Reddit to acknowledge that there’s a aerial likelihood that he begin allowance trading-related cipher in Binance’s accessible API. The user, activity by the moniker “enriquejr99,” acclaimed that Binance has “silently included” two booleans that are as follows: isSpotTradingAllowed and isMarginTradingAllowed. These two curve of cipher were aboriginal spotted in Binance’s Ethereum-Bitcoin pair.

Enrique added that aloft added assay of Binance’s 482 trading pairs, he apparent that allowance trading was mentioned, but is currently disabled.

It isn’t bright back the booleans were added, but the exchange’s contempo multi-hour blow could be back Binance’s developers agilely added that in, as the aggregation could actual able-bodied be basic up to accord its millions of users admission to leverage. The capacity of this declared activity are, of course, scant. But antecedent allowance abutment for accepted cryptocurrencies, such as Bitcoin and Ethereum, would accomplish sense.

Excelling Amid Crypto Winter

All this alone underscores Binance’s ability to excel amidst agonizing bazaar conditions. The platform, headed by its animated baton in Changpeng “CZ” Zhao, has arguably staved off the alleged “crypto winter” absolutely through embarking on a cardinal of ventures.

On Tuesday, the aggregation apparent what is accepted as Binance Lite, a account acceptance Aussies to acquirement Bitcoin and brick and adhesive stores. Lite purportedly gives locals an “easy way” to buy BTC at over 1,300 shops beyond Australia, authoritative this Binance’s best contempo booty on cash-to-crypto on-ramps. In accompanying news, CZ has hinted that his aggregation intends to action a authorization on-ramp in now-blockchain-friendly Argentina, which would chase agnate platforms in Singapore, Lichenstein, Jersey, and Uganda.

But this is aloof the tip of the iceberg. Over contempo months, Binance has boarded on a adventure to barrage its own blockchain, which would abode a decentralized exchange (DEX) to anon acclaim Binance.com. For those who absent the memo, Chain will advance a Delegated Proof of Stake (DPOS) accord mechanism, while Binance’s BNB badge will act as the network’s gas, aloof as ETH is for Ethereum.

In a Twitter Q&A session, Binance’s CZ alike commented that due to the barebones attributes of Binance Chain — abridgement of a basic apparatus agency no acute affairs — the arrangement should be able to accomplish one-second blocks, anniversary of which pertains to “a brace thousand” transactions. Although some accept bashed Binance for aggravating to attempt with itself, Zhao fabricated it bright that DEXs is the abutting footfall in the change in the cryptocurrency market.

The company’s adeptness to put its best bottom advanced has accustomed its centralized token, BNB, to swell from $5 in mid-December to $15 area it sits now, giving investors a argent lining in this buck market.