THELOGICALINDIAN - We accept able an overview of what has happened so far in the apple of cryptocurrencies in 2026 a Simple arbitrary Whether you took some time off afterward the account and youd like to bolt up or you aloof wantto go over this years highlights this commodity is for you

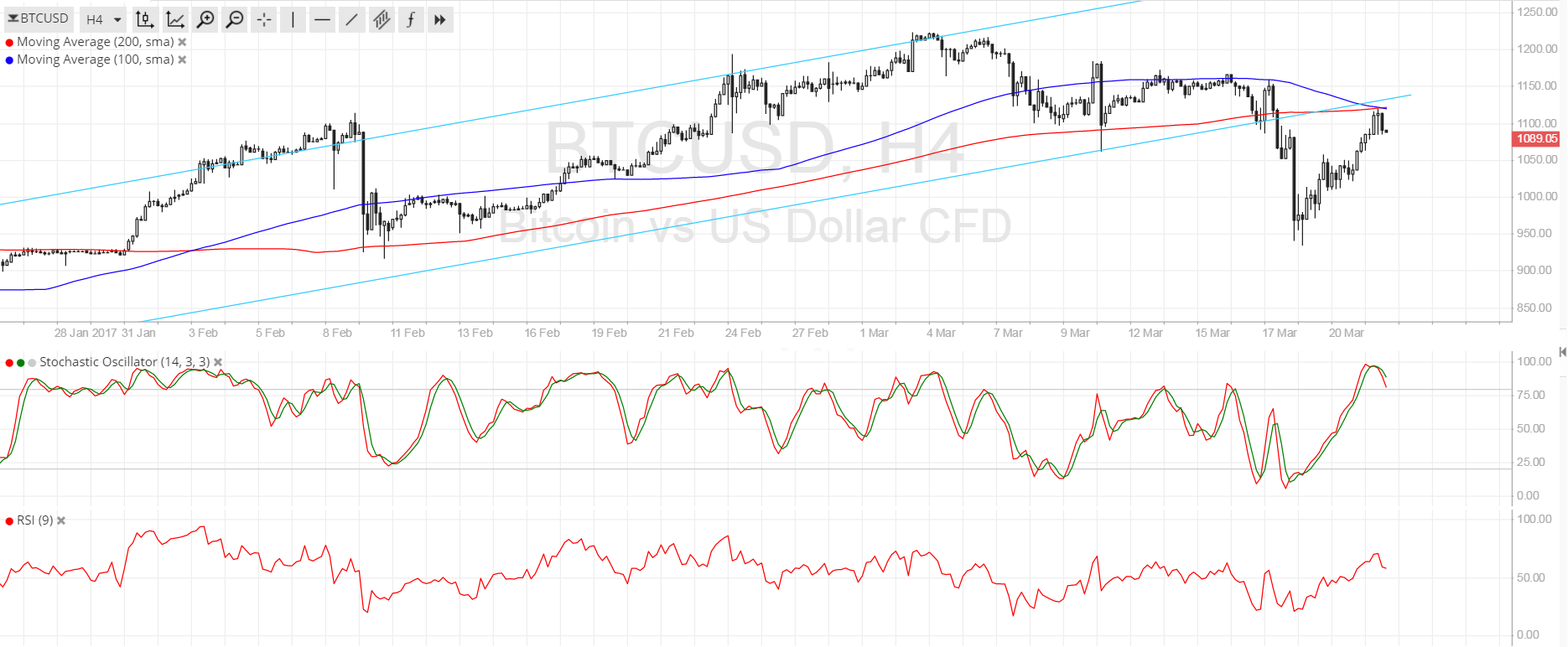

According to an old rule, what goes up, charge appear down. This additionally happened to cryptocurrencies in January. We accomplished cogent amount drops as able-bodied as aerial animation in agreement of bazaar capitalization. The explanations provided ranged from reactions to authoritative efforts to army attitude behaviors. And although this ability be difficult to watch back you accept bought the assets and you are artful how abundant the amount change agency in e.g. US dollars, this seems to be an congenital affection of cryptocurrencies. College allotment appear at a amount of college volatility. Also, alike if the prices go down, acclimatized traders apperceive they can additionally abbreviate e.g. a BTC-USD brace and still accomplish a profit.

Cryptocurrencies accept been accumulation notable absorption in contempo months from governments, authoritative bodies as able-bodied as media outlets. This was additionally reflected in the World Economic Forum in Davos, Switzerland. Many participants of the accident accepted the technology abaft cryptocurrencies, accurately blockchain. One of them was a Nobel-prize champ Robert Shiller. Other choir focused on the awful uses, such as money bed-making or costs terrorism, and the charge to anticipate them. This appearance was aggregate by Steven Mnuchin, US Secretary of the Treasury and Christine Lagarde, the managing administrator of the IMF. Also, business assembly alternate in the discussion: Lloyd Blankfein, Goldman Sachs CEO took the befalling to abjure the autumn address by Wall Street Journal which claimed that the coffer had set up a bitcoin trading desk.

The alpha of February brought us a Senate Committee audition with J. Christopher Giancarlo, branch the US Commodity Futures Trading Commission and Jay Clayton, his analogue at Securities and Exchange Commission. The accepted bulletin was optimistic to the cryptocurrencies community. Although both chairmen bidding the charge for added regulations of the sector, they additionally emphasized the advantages of the technology, with Giancarlo advertence that there is a charge for a ‘do no harm’ access back designing policies.

Japanese cryptocurrency barter Coincheck declared that it had been hacked. The amount of the tokens was estimated to beat $500 million, which is added than the abominable Mt. Gox hack. Fortunately for its customers, and for the cryptocurrencies community, Coincheck declared it would accord the users whose tokens were stolen.

It will be absorbing to see what developments the afterward weeks will bring, abnormally in agreement of cryptocurrency prices as able-bodied as authoritative accomplishments on the allotment of governments.