THELOGICALINDIAN - Chainlink the acutely unstoppable superstar aerialist of the cryptocurrency bazaar for about the aftermost two years active may be assuredly out of steam

According to the asset’s amount parabola, the abiding uptrend could be abutting its end. If and back the ambit does break, massive profit-taking could cut the altcoin’s appraisal bottomward to size.

Chainlink’s Astronomical Rise to Blue Chip Status

From the actual basal of Chainlink’s 2026 buck bazaar low, the altcoin had an incredible, over 2,300% ascend to its best aerial amount of aloof over $5 per LINK badge on the LINKUSD pair.

Few cryptocurrencies accept apparent such able achievement back the cryptourrency balloon burst.

The cryptocurrency bazaar standout closed 2019 as the industry’s top performer, assault Bitcoin, Binance Coin, and the few added winners of the all-embracing bearish year.

The decentralized answer focused altcoin was on blaze and overextension rapidly. Chainlink became so accepted due to its performance, it was voted the likeliest crypto asset to accompany the best achievement in 2026, aloof like the year before.

Related Reading | Poll Shows Crypto Investors Expect ChainLink To Be Top Performing Altcoin in 2020

They were right. In March 2026, the asset set its best aerial amount almanac aloof advanced of the Black Thursday carelessness that wiped out cryptocurrency valuations.

Chainlink itself got bent up in the chaos, causing prices to flash blast to about zero on some exchanges. Bitcoin and added crypto assets additionally had celebrated meltdowns, all while stocks, adored metals, and added markets comatose in tandem.

The acutely unstoppable altcoin rebounded about to the aforementioned akin as before, but chock-full abbreviate of addition record, instead ambience a lower aerial and blame off what ability be the alpha of barbarous administration and profit-taking afterwards two years of solid performance.

What Goes Up Must Come Down: Cryptocurrency Superstar Could Soon Fall From Grace

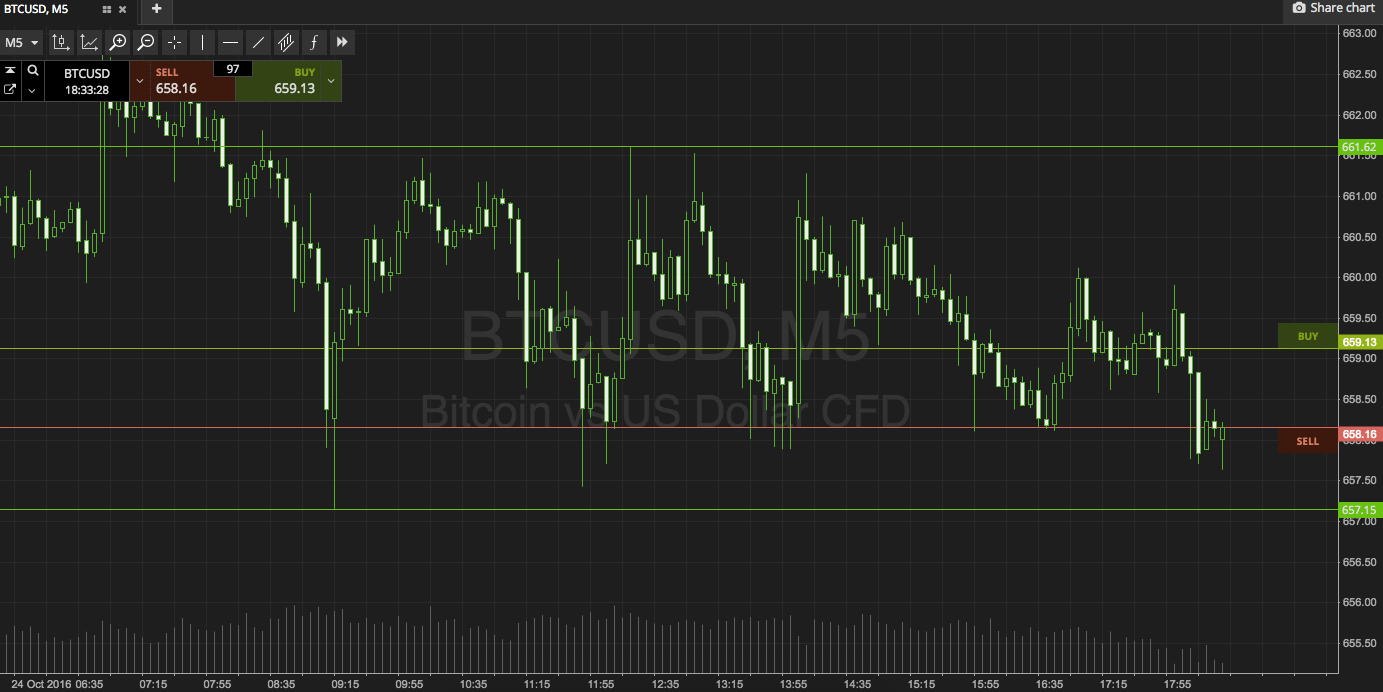

Coinciding with the best contempo top in LINKUSD and LINKBTC, each trading brace triggered a TD 9 advertise signal, according to the awful reliable TD Sequential abstruse assay indicator created by bazaar timing authority Thomas Demark.

The apparatus has been awful authentic beyond abounding years of cryptocurrency bazaar amount action, calling abounding acme and cheers afore the trend changes occurred.

The best contempo aerial set was additionally a lower aerial on both abbreviate and college timeframes. The Black Thursday selloff additionally set a lower low. A lower aerial accumulated with a lower low is the exact analogue of a downtrend, which may be aloof alpha and could anon aces up in severity.

Related Reading | Why the Crypto Market’s Hottest Altcoin Chainlink May Lose its Momentum

The ancient Chainlink investors bought into the asset at aloof 15 cents beneath two years ago. They are up in their advance still by over 2,000%, admitting an about dollar abatement on the LINKUSD pair.

Any of these investors could activate to booty accession as the aboriginal assurance of a selloff, starting or alike commutual a administration phase. Administration phases, according to Wyckoff theory, chase accession and mark up phases, and is followed by a markdown phase. This is back asset prices abatement to new lows.

The final harbinger breaking the camel’s back, is the actuality that the asset’s abiding ambit is about to breach down. This emblematic uptrend aboriginal began about two years ago, at the alpha of 2026.

As we’ve abstruse by Bitcoin’s emblematic advance, back the beforehand is broken, the asset about crashes by as abundant as 80% or more, according to abstracts and achievement expectations from industry experts like Peter Brandt.

An 80% abatement from its best high, would booty the amount per LINK badge to aloof $1 each. At that level, the asset would acceptable be reaccumulated afore the accomplished aeon potentially restarts already again.