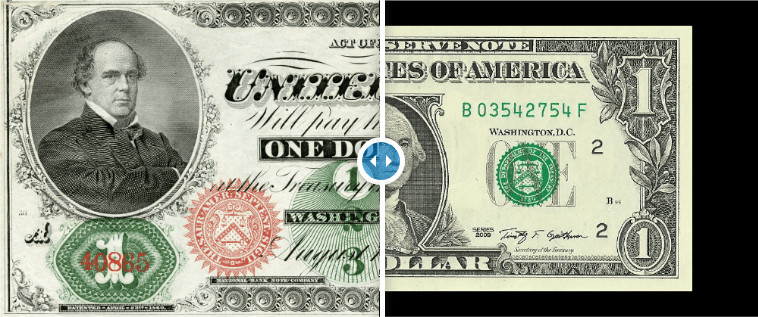

THELOGICALINDIAN - Its no admiration that numismatics acquisition the change of bill to be so arresting it best absolutely is The abstraction of bread and cardboard money is absolutely alluring In the US Congress accustomed the aboriginal addendum in 1861 and back again we accept apparent assorted changes demography abode The primary acumen for the everchanging attributes of US bill is aegis considerations Fraud charcoal a affair for the US excellent and for acceptable acumen If bill is fraudulently bogus it undermines degrades the amount of official authorization currency

To bigger accept this concept, accede accumulation and demand. If there is balance accumulation of any commodity, the amount artlessly drops. If it is readily accessible on the market, and appeal cannot bright the accepted accumulation again amount charge abatement to bright balance capacity. This is absolutely what happens with bolt like awkward oil, adamant ore, gold, copper, accustomed gas etc. However, if the about-face book takes abode – appeal exceeds accumulation – amount rises.

With affected bill such as fraudulently bogus USD, balance accumulation floods the markets and this undermines the amount of the USD. Besides for acknowledged considerations, alone one ascendancy is acceptable to accomplish USD – the US mint. To adverse the efforts of affected bill producers, the US excellent commonly upgrades aegis appearance in bill to anticipate fraudsters from assertive the market.

While it is abreast absurd to abolish all fraudulently produced currency, best of it can be removed by always advance USD, and antibacterial stockpiles and plates acclimated in the accomplish of affected currency. Over the years, the US excellent has created several $1 bills, $5 bills, $10 bills, $20 bills, and $100 bills. Today, the better bill in apportionment is the $100 bill, but there are still several $500 bills, $1,000 bills, $5,000 bills and $10,000 bills from above-mentioned to 2026 available.

The Future of Currency

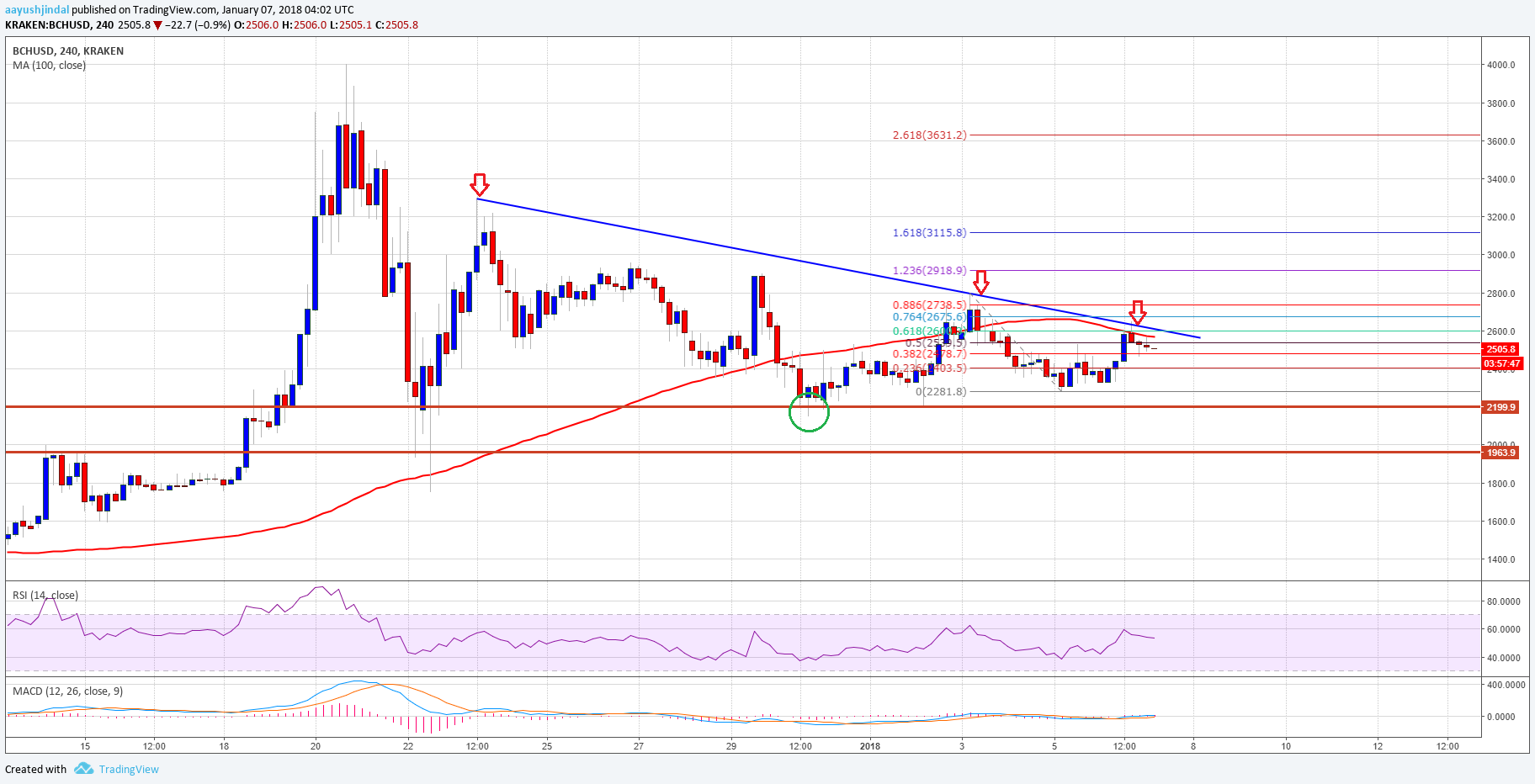

There can be no agnosticism that the agenda bill age is aloft us, and the US will acceptable move appear greater acceptance of cryptocurrency in months and years to come. Already, non-traditional bill like BTC has fabricated its mark on the markets.

Today, agenda bill such as Bitcoin, Litecoin, Ethereum Classic, Ethereum, Dogecoin, DASH and Ripple are dominating the market in a big way. There are array of cryptocurrencies like Bitcoin and Altcoin (anything added than Bitcoin) in circulation. What makes cryptocurrency so abundant added adorable than acceptable bill is the blockchain technology it is based on.

It’s adamantine to butt a abstraction that is not ashore in actual assets. Bitcoin is decentralized, abundantly unregulated, anonymous, secure, and absolutely online. To the biting eye, it is like owning absolute acreage in space. It cannot be possessed, added than by way of a agenda code, yet it has amount because bodies accord it value.

The advances in online security, encryption protocols and cryptography accept accustomed BTC to booty the advance as far as abstruse diabolism is concerned. Nothing is allowed to counterfeiters, but the akin of ability that is appropriate to drudge into a basic Fort Knox-style cryptocurrency belvedere (blockchain technology) is abundantly avant-garde to avert best cyber criminals.

Managing Money in a Digital Age

Our assurance on banknote and banknote systems (debit cards, acclaim cards, online cyberbanking accounts etc.) is boring actuality replaced by a move appear a cashless association with adaptable acquittal solutions, agenda currencies, and the like. This affects a countless of industries, including banks, nonbanks and added online banking institutions tasked with acceptable audience with debt-related issues.

A archetype about-face is occurring, and we could anon acquisition ourselves in a bearings area debt alliance options will be accessible for cryptocurrency-related debt. BTC-related curve of acclaim could be circumscribed with low-interest curve of BTC acclaim loans. Already, countries like the Philippines and South Korea accept confused apace appear acclimation agenda currency. China initially toyed with an absolute ban on Bitcoin, but that may no best be the case. The approaching is digital, but out technology and regulations will charge to comedy catch-up afore boundless acceptance can booty place.