THELOGICALINDIAN - Alex Grebnev a above broker at Goldman Sachs is creating a belvedere that will admittance traders to accord added assiduously with cryptocurrenciesThe belvedere alleged Oxygen intends to ambition clandestine and institutional investors gluttonous to cut repurchase agreements or repos amid themselves According toForbes Oxygen is set to be launched after this year

If the operation is successful, the crypto-space will move alike added into the mainstream: This accomplished December, Chicago-based exchanges CME Group and Chicago Board Options Exchange (CBOE) launched Bitcoin futures contracts.

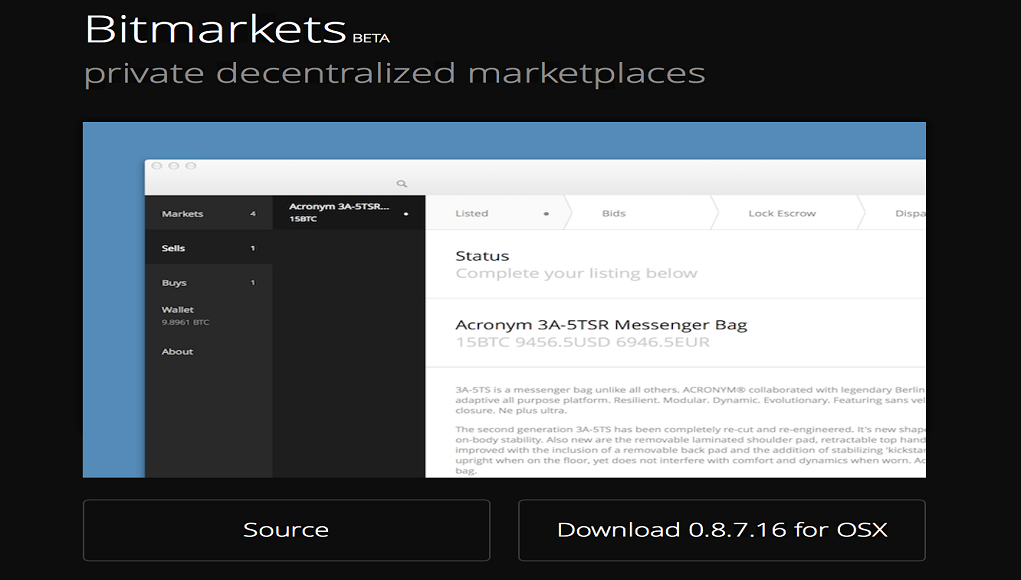

Grebnev, who while alive at Goldman Sachs dealt with stocks and derivatives for about ten years, is alive with cryptocurrency barter Changelly, with affairs to barrage Oxygen on Changelly’s basement — in about-face allowing the repo belvedere admission to the exchanges 1.6 actor clients. At launch, Oxygen will acquire ERC20 tokens, the accepted badge accepted of Ethereum. After it hits the market, Oxygen affairs to accommodate Bitcoin and added cryptocurrencies as well.

How Does it Work?

In a repo, one article sells an asset (cryptocurrencies in this case) to addition at a assertive amount at the alpha of the transaction and pledges to repurchase the asset from the antecedent client at a approaching date, at a altered price. If the agent fails to buy aback the asset, the client can put it on the accessible market, which makes the asset a affectionate of accessory during the repo.

Cryptocurrency holders would accomplish profits from lending their bill through Oxygen to a additional party. In return, they would accept addition bread as accessory until their antecedent badge is returned. The additional affair would use the adopted bread for concise trading or affairs and will accept to pay a fee as allotment of the deal.

Grebnev predicts the belvedere will balance the amount of borrowing cryptocurrencies, whose amount fluctuations can avert investors who appetite to bet on falling prices, accepted as demography a abbreviate position. He expects repo agreements to be addled for periods alignment from hours to a year or two.

With commendations to the advance and development of cryptocurrencies as an asset class, Grebnev had the afterward to say:

“The cryptocurrency bazaar is developing actual fast, but it should additionally be developing on a able level, with the appliance of real-world concepts. There are already a cardinal of users utilizing the crypto bazaar and in adjustment for it to develop, absolute apple applications charge be brought into the crypto world. This is why we are applying the repo bazaar to the crypto bazaar – users can profit after accident their assets.”