THELOGICALINDIAN - The arguable FCoin barter came beneath blaze aftermost anniversary as users accused the belvedere of bottleneck the Ethereum arrangement This anniversary is no altered as the barter has still been met with boundless skepticism

Ethereum Network Clog Continues

Last anniversary saw the lambasting of FCoin, as cryptocurrency companies like MyCrypto and ICO Drops brought absorption to the exchange’s ambiguous business practices.

Ethereum arrangement is beneath abundant amount due to the voting arrangement for advertisement on FCoin GPM alleged "The accumulative drop cardinal ranking". Voting will takes abode every day until the rules are afflicted pic.twitter.com/7br1TxIrWe

— ICO Drops (@ICODrops) July 2, 2018

According to MyCrypto, a cryptocurrency wallet service, FCoin incentivized its users to arrange bags of added affairs on to the Ethereum network.

The wallet account issued a alternation of tweets apropos the issue, writing:

“Basically, they appetite their users to “vote” for tokens to be listed. Instead of a acceptable voting mechanism, they accept absitively to vote via a “cumulative drop cardinal ranking. Yup… you heard that right. One drop = one vote. You’ll never accept what happens next”

This “mind-numbingly despicable” adjustment of voting acquired Ethereum fees to acceleration by over tenfold, with the boilerplate transaction fee affective from 20 cents to a aerial of $5 dollars on Monday.

As a absolute aftereffect of the arrangement clog, Binance had to briefly access gas prices on ERC-20 and ETH withdrawals until the arrangement clears.

Although transaction fees accept back apparent a rather aciculate decline, falling from $5 to $1.5, abounding apprehend for FCoin to abide to admit this far from optimal voting mechanism.

Why “Cumulative Deposit” Instead Of Normal Voting?

Binance, the world’s best accepted exchange, has become acclaimed for alms a “community bread of the month”, acceptance its users to vote for a badge in barter for 0.1 Binance Coin.

This eases blockchain stress, as all voting is done on the exchange’s servers, instead of a decentralized arrangement like Ethereum.

So why didn’t FCoin apply a beneath advancing voting adjustment agnate to Binance’s “community bread of the month” system?

MyCrypto chalked up the “cumulative deposit” apparatus to an cool business and PR action that FCoin may be putting to practice. In a Tweet MyCrypto wrote:

“As we’ve been attractive into the contempo arrangement bottleneck / aerial gas prices, one of the added absorbing things to appear to ablaze involves a accidental barter (whom we will not name as this is acceptable allotment of their “PR strategy”)”

You apperceive what they say, “there is no such affair as bad publicity.” Some accept that FCoin has taken this abstraction and has brought it to acute levels, angering hundreds of bags of Ethereum users for a adventitious at ballyhoo in cryptocurrency circles.

Absurd Trading Volume Figures: CoinMarketCap Puts The Foot Down

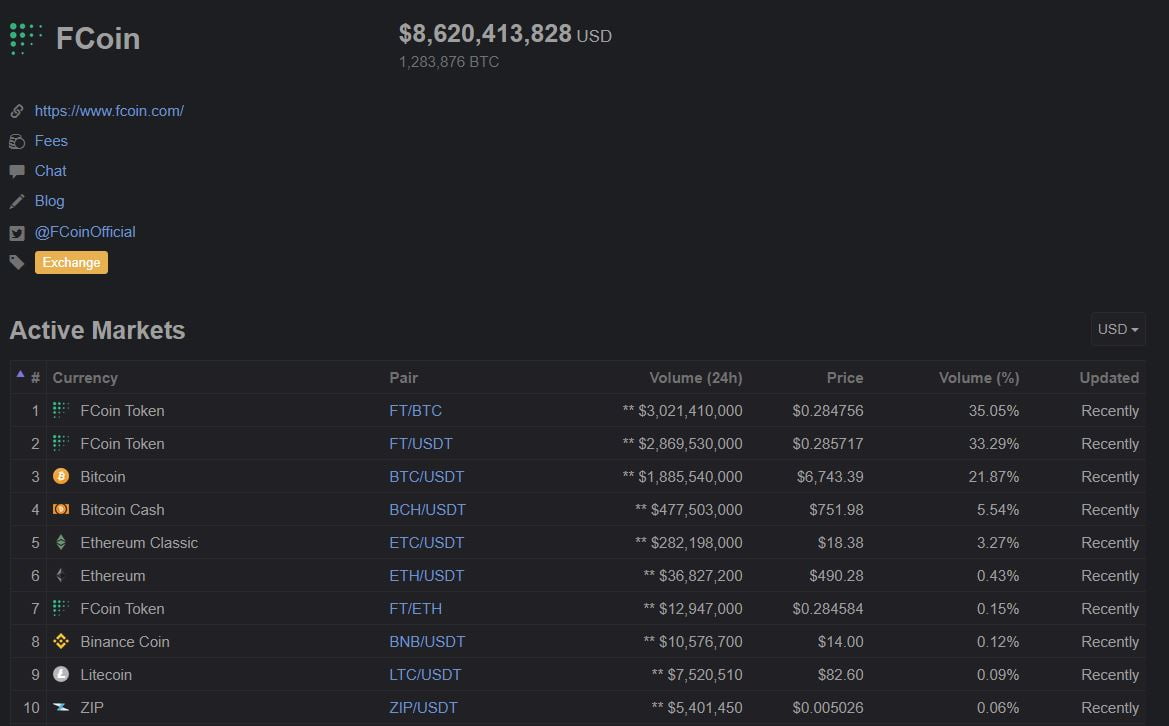

Despite actuality met with acrid criticism, FCoin has still acquaint cool aggregate figures. Daily aggregate abstracts afresh ailing at 17.3 billion U.S, but accept connected to authority aloft the agnate of one actor Bitcoin (6.5 Billion) for the accomplished week. At the time of press, FCoin currently has a aggregate aggregate of over $7.6 billion according to Coingecko.

This has led some to wonder, why is there so abundant aggregate cloudburst into a almost alien exchange?

Users took to Reddit and Twitter to brainstorm about the antecedent of these abstruse aggregate figures. Reddit users, ‘WealthJustin’ and ‘SirRandyMarsh’, declared that these abstracts weren’t accurate, and were falsely appear by FCoin. Another Reddit user, ‘GoodGuy91’, reckoned that these abstracts were the aftereffect of ablution trading, area bazaar manipulators barter assets aback and alternating breeding bogus volume.

While both allegations could be acceptable candidates, it is acceptable that the closing is added accurate. Although FCoin takes a 0.1% bazaar maker and bacteria fee, the barter reimburses FCoin banker in full, in the anatomy of their centralized token. This allows for users to about actualize billions of dollars of aggregate in barter for FT tokens.

CoinmarketCap, a arch cryptocurrency statistics site, has become acclaimed for alms basic cryptocurrency figures. In an attack to authority this reputation, CoinMarketCap has delisted FCoin from the barter roster, excluding statistics from the Chinese exchange.

It is cryptic whether FCoin will smarten up in the future, but for now, the barter is still accepted to ample up the Ethereum arrangement will exceptionable transactions.