THELOGICALINDIAN - The cyberbanking arrangement in Italy continues to attack through afflicted amnion With no improvements in afterimage the government of Italy is because a bailout amalgamation for two above banks Veneto Banca and Banca Popolare di Vicenza The amalgamation account 5 billion euros is still apprehension all-important authoritative approvals

The abrasion cyberbanking area will be accepting the aid in the anatomy of “precautionary recapitalization” as allotment of the Eurozone regulations. Apart from the anon appropriate 5 billion, the country’s institutions will be defective an added 15 billion euros to attain some stability. According to reports, Monte Dei Paschi di Siena which has the acumen of actuality the world’s oldest lender abandoned needs about 8.8 billion euros to break afloat.

As banks run out of liquidity, they are in acute charge of taxpayers’ money to accumulate their doors open. At the aforementioned time, such a bearings will abnormally affect the abridgement due to accident of broker confidence, both calm and all-embracing in the country’s cyberbanking system. In the worst-case scenario, the falling clamminess may additionally force the cyberbanking authorities to appoint abandonment and transaction limits, arch to situations agnate to the one faced by the Greeks in the accomplished year.

Making affairs worse for the Eurozone, Greece is accepted to absence on its absolute debts yet again. Amid arguments on whether to extend added banking abutment to the country or not, the International Monetary Fund has agreed that Greece is in charge of added debt relief. However, the Eurozone lenders led by Germany and the IMF alter in assessment about the implementation of added reforms in the Greek economy. For a country, already beneath burden due to acerbity measures, any added cuts in spending in the name of reforms may aching its citizens.

The Eurozone offers bound freedoms to its affiliate countries back it comes to managing the banking systems, either apropos bailouts or budgetary consolidation.

In the end, it is the bodies who will be impacted by the adamantine banking decisions taken by anxious authorities. With no assurance of improvements in afterimage at the moment, the Eurozone’s bread-and-butter bearings is accepted to be apprenticed added downwards by the altitude in Italy and Greece.

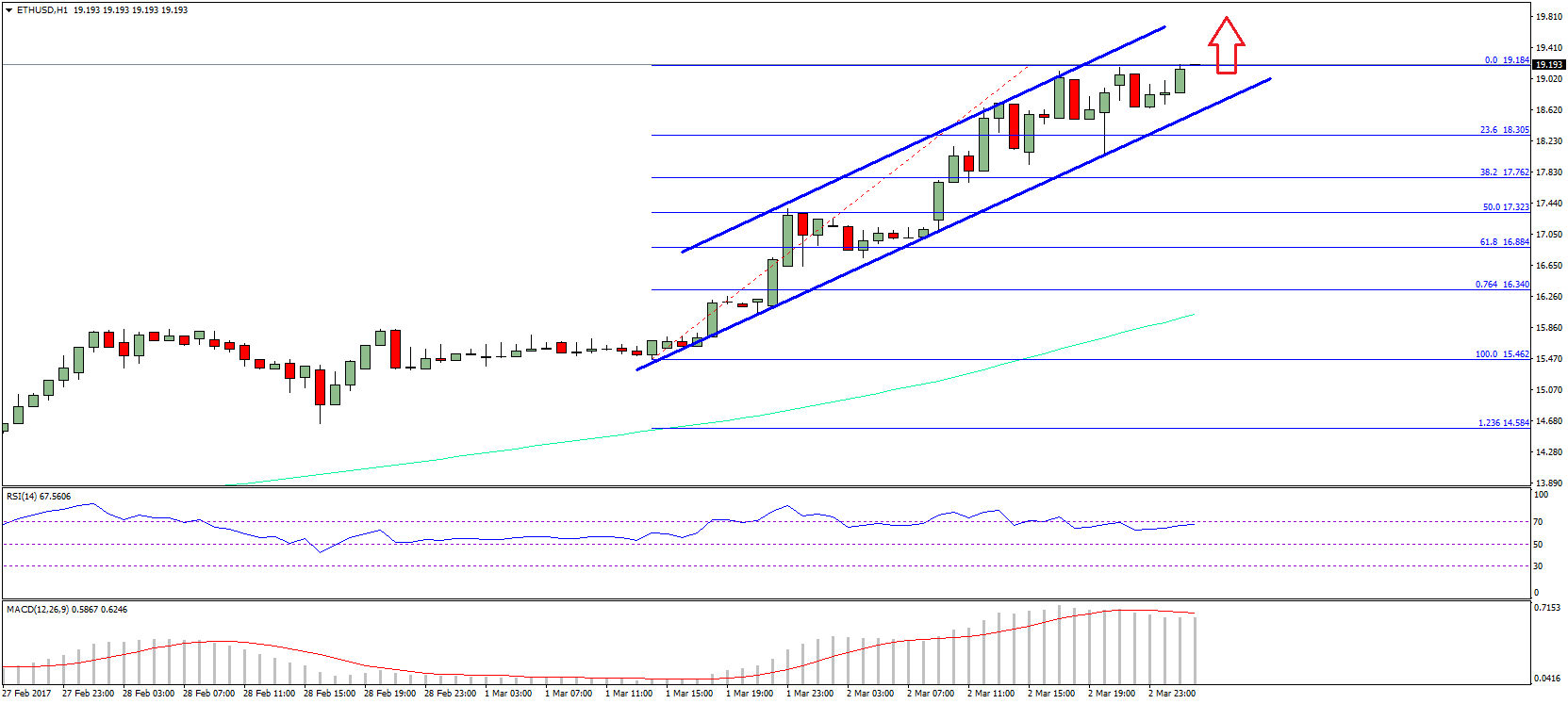

These developments are accepted to drive the appeal for another banking instruments that are not anon accompanying to the accepted bread-and-butter system. Gold and Bitcoin are two such assets that are activity to accept appropriate attention, active appeal further. It is accepted to accept a ample appulse on Bitcoin amount in the advancing days.