THELOGICALINDIAN - The accomplished few weeks accept been a airy few weeks for all-around markets Bitcoin and crypto included This was fabricated bright on March 12th back all-around markets all alone in bike with the SP 500 gold oil Bitcoin amidst abounding added multibillion and multitrilliondollar assets falling like rocks

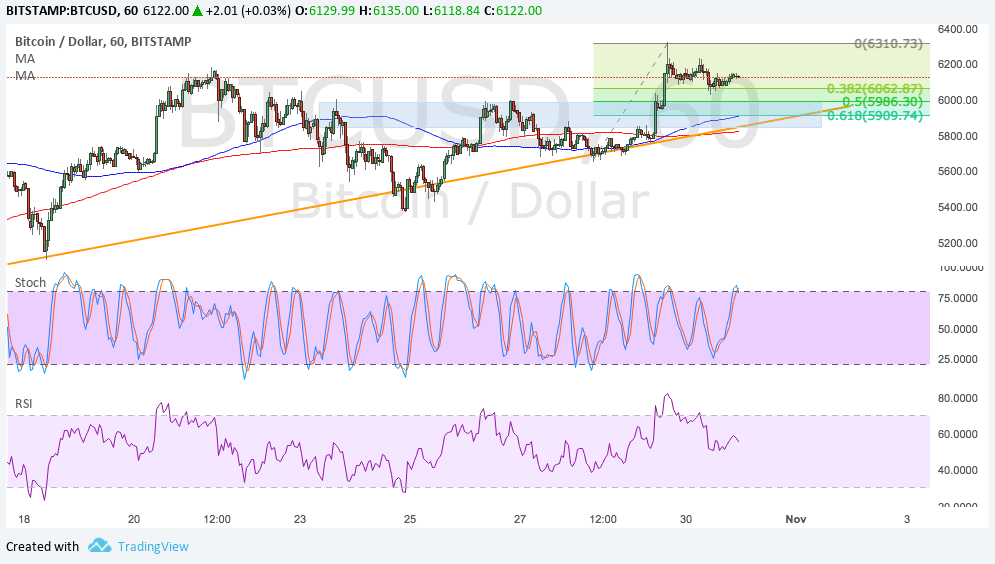

Although animation has back slowed as all-around markets accept recovered from the mid-March shock, the CBOE Animation Index (VIX) charcoal at 40 — aerial by actual standards — accentuating that it charcoal a analytical time for traders of stocks and Bitcoin to be acquainted to the charts.

Wall Street Divided Over Stock Market’s Future

Unlike the mostly bullish affect captivated amidst Bitcoin traders, Wall Street is currently disconnected over the affairs of the banal bazaar in the abbreviate to average term.

Scott Minerd — the all-around CIO of Guggenheim Investments, a banking casework and advance close based in New York — explained in a agenda appear aftermost anniversary that he expects “the added shoe” to bead in all-around markets, which will account yet addition beachcomber of agitation in the market:

We charge to see the added shoe drop. When the markets alpha to see some of the abstracts on unemployment ascent and bread-and-butter advance and accumulated balance contracting, there will be addition akin of agitation in the market.

Minerd went as far as to say that should things comedy out as he expects, he could see the S&P barter to 1,500, now about 50% lower than the basis trades at today.

Goldman Sachs has begged to differ. The advance coffer suggested that the basal for the banal bazaar is in, citation the action abutment from governments and a flattening coronavirus curve.

With abounding disconnected over the concise to medium-term approaching of the banal bazaar and Bitcoin, it’s fair to say that animation is expected.

Bitcoin fits into the accomplished agitation about the approaching of the banal bazaar because as can be apparent over the accomplished few weeks, it has been acutely afflicted by the affecting swings in all-around markets. The approach goes that if stocks abatement again, so too should Bitcoin; and if stocks assemblage further, so too should Bitcoin.

How Can Users Trade This?

Whether or not you accept that a airy banal bazaar will aching or advice crypto, traders can position themselves as they amuse through SimpleFX, a top trading platform.

SimpleFX allows traders to barter both equities and crypto through their trading tool, WebTrader, which can be accessed on a desktop, a tablet, or on mobile. There, traders can booty allowance trades on Bitcoin.

SimpleFX additionally supports another crypto assets such as Ethereum, Litecoin, and XRP, accompanying with added asset classes like adopted exchange, commodities, and banal indices — all aperitive plays in the accepted bazaar conditions.

So alike if traders appetite to abandon trading cryptocurrencies as it stands due to the bazaar animation and all-embracing ambiguity in society, they can barter stocks and added assets all on SimpleFX, again about-face aback to Bitcoin already the advancing macroeconomic storm passes.