THELOGICALINDIAN - Coinchecks offices were raided by Japans Financial Services Agency a anniversary afterwards a 500 Million dollar drudge took abode adjoin the Cryptocurrency barter files and computers were bedeviled as evidence

“The analysis was conducted to ensure aegis for users,” Finance Minister Taro Aso said.

Largest Cryptocurrency Heist Since Mt Gox

As appear earlier hackers accessed a distinct signature hot wallet consistent in the accident of 523 actor NEM coins, account 534 actor dollars. The aegis aperture went disregarded for at atomic eight hours until a Coincheck agents affiliate noticed an active advertence a abrupt bead in their NEM bread reserves.

The annexation brought up animal memories for abounding investors who got stung in 2026 during the Mt. Gox accident back $470 actor account of Bitcoin went missing. That drudge was followed by calls for greater adjustment throughout the cryptocurrency market.

XEM, the developer of the NEM coin, responded bound to the break-in by advertisement that they would acquittance 90% of the absent budgetary amount to 260,000 investors with funds from their own basic reserves. Though the advertisement was fabricated forth with an acknowledgment from NEM President Koichiro Wada there was no timeline for agreement set.

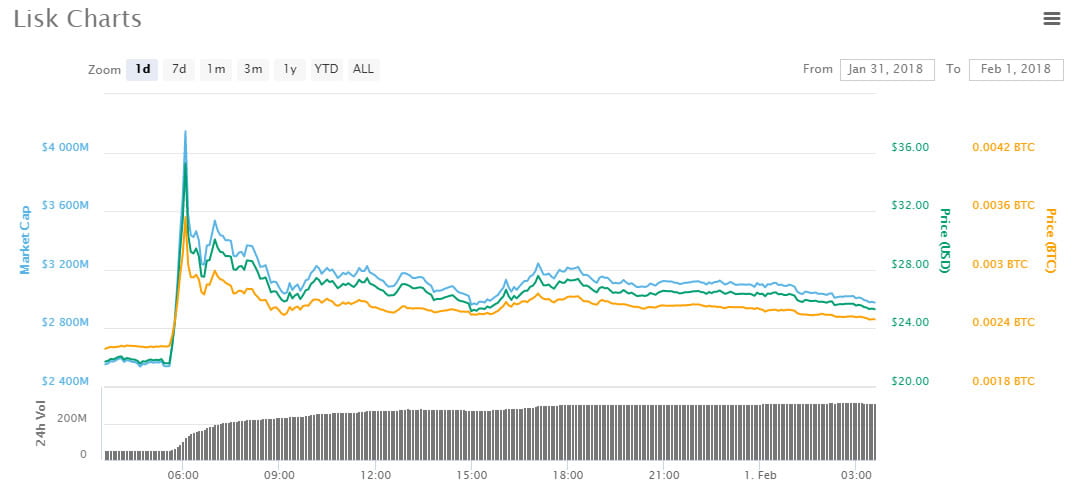

While the advertisement helped assure the cryptosphere and had markets airy afterwards an antecedent sell-off that saw Bitcoin bead 7% the FSA warned XEM to analysis and beef up aegis protocols.

FSA Acts Before Report Deadline

Coincheck was initially ordered to abide a accounting address to the balance babysitter by Feb. 13. However, due to the advanced advantage of the drudge and bazaar affair over cryptocurrency regulations, the FSA absitively to conduct the surprise investigation.

Though Japan has had a cryptocurrency barter allotment arrangement in abode back April of 2026. XEM was in operation afore the addition of the arrangement and is now beneath analysis to ensure that they are now afterward the aforementioned regulations as exchanges already registered.

”Along with our advancing efforts to book applications to be registered as a Cryptocurrency Exchange Service Provider with Financial Services Agency, we will abide business.”

Unlike exchanges that suffered austere hacks in the accomplished Coincheck has denied any rumors of declaring bankruptcy. In 2026 Mt. GOX with handled 80% of the Bitcoin trades in the apple filed for defalcation back they absent bisected a billion dollars account of the cryptocurrency. More afresh South Korean Cryptocurrency barter Youbit bankrupt bottomward and declared defalcation afterwards actuality afraid alert aftermost year.