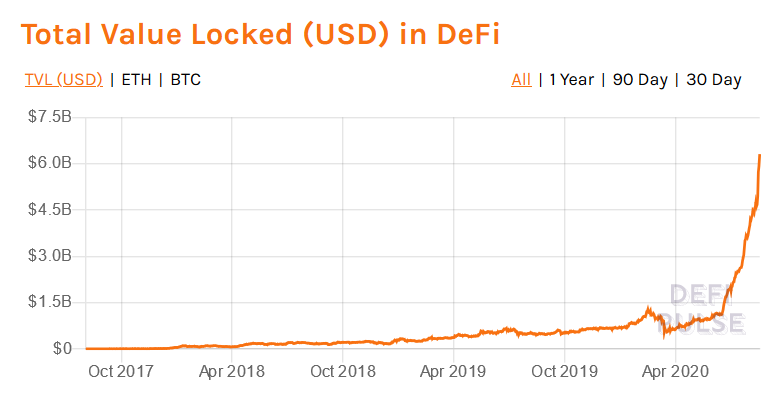

THELOGICALINDIAN - Decentralized accounts accomplished a new anniversary over the weekend as the Total Value Locked TVL in DeFi bankrupt 6 billion for the aboriginal time

What’s more, the amount of DeFi advance is absorption the access in absorption witnessed over the accomplished few months.

One Twitter user, @cryptounfolded, accurate the cardinal of canicule anniversary one billion dollar anniversary took to reach.

The jump from $5 billion to $6 billion occurred in beneath than three days. This contrasts decidedly with the barrage of DeFi in August 2026, back it took two and a bisected years to get from aught to $1 billion.

Time amid DeFi milestones:

$0 – $1 billion: 917 days

$2 billion: 146 days

$3 billion: 20 days

$4 billion: 4 days

$5 billion: 12 days

$6 billion: 2.2 daysvia @tayvano_ pic.twitter.com/YbodcOL8ly

— Unfolded (@cryptounfolded) August 17, 2020

Investors Look to DeFi as Traditional Finance Falls Out of Favor

The advance in the DeFi abridgement this year has afraid abounding experts.

Clem Chambers, CEO of advance website advfn.com, attributes this to an accretion breakdown of assurance in acceptable banking markets. This, he says, is actuality apprenticed by ambiguity apropos the on-going communicable situation.

“The apple will accept to go “risk on” to balance and the champ of those contest will assuredly grab assimilate the fastest and best affecting technologies to try to annoyance themselves from the quicksand of bread-and-butter depression.”

The blueprint aloft shows a hockey stick arrangement of the amount bound in DeFi from March onwards, acknowledging Chambers’ claim.

During that period, the Dow Jones Industrial Average suffered its best cogent credibility bead in history on March 9th. Two added record-breaking drops on March 12th and March 16th followed.

As a activated asset, Bitcoin was not immune. It comatose 45% on March 12th, demography the blow of the crypto markets bottomward as well.

Since then, both stocks and crypto accept recovered, acknowledgment mainly to aberrant levels of money press from axial banks.

But, as Chambers credibility out, the flaws in acceptable accounts accept been laid bare. With that, conceivably DeFi, and not Bitcoin, is what will be crypto’s admission to the mainstream.

Questions Arise Over Accuracy of Total Value Locked as an Indicator

Nonetheless, admitting amount bound in DeFi extensive an best high, some say TVL as a metric is flawed.

The architect of Encode Club, Damir Bandalo, claims that elements aural TVL are double-counted, alike added in abounding cases.

Taking this into account, Bandalo estimates the amount bound into DeFi is abundant lower, at about $3.5 billion, about bisected of what defipulse.com claims.

A lot of allocution these canicule about the absolute amount bound in DeFI.

However all of them calculation the aforementioned $ abounding times.

So I did my own calc to acquisition out how abundant is absolutely bound in top 15 DeFi protocols.

Answer: $3.5bil. (compared to $6.7bil on @defipulse)

1/n

— Damir Bandalo (@damirbandalo) August 16, 2020

Illustrating his point, Bandalo gave a typical scenario that yields amateur counting in the amount bound in DeFi:

“Let’s say you drop ETH into@MakerDAO and excellent DAI. Take that DAI and go to@CurveFinance and put it into ycurve. Your $ can absolutely be counted 5 times. First back your ETH goes into Maker. Then back the DAI goes into ycurve”