THELOGICALINDIAN - The cryptocurrency association in the United States is advancing beneath the IRS scanner afresh The taxation ascendancy has been exploring means to acquisition defaulters who accept bootless to address the assets acquired from their cryptocurrency backing It alike went as far as arising a John Doe amendment to Coinbase the arch cryptocurrency belvedere allurement them to accouter all the capacity of its barter including their cryptocurrency backing However the cryptocurrency users accept a altered botheration as abounding of them dont accept a clue about how to book the allotment acknowledgment to the abridgement of accuracy and absolute guidelines from the IRS

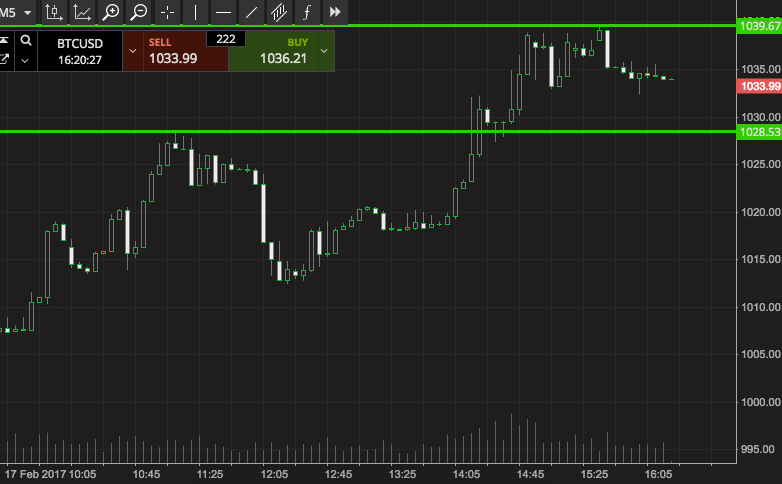

Node40, the arch blockchain basement hosting account provider, is authoritative the accomplished action easier with its afresh launched Node40 Balance — a cryptocurrency tax adding software. The new software will bung a huge abandoned in the industry, which is currently abounding with accepted accounting articles and casework that are no acceptable for artful the assets and losses incurred by agenda bill affairs and holdings. Unlike added acceptable assets, cryptocurrencies are accepted for their animation which makes it abundant harder to manually agency in the amount of anniversary admission bitcoin and the access or abatement in its amount over a aeon of time.

The aggregation appear the barrage of its Node40 Balance beforehand bygone in a columnist release. The software is advised to clue and accomplish cost-basis calculations by anon affairs the transaction accompanying advice from the blockchain. The candy adding is again added to the IRS Form 8949, authoritative it easier to book returns. The Node40 Balance currently supports Dash, and in the abutting few days, it will accommodate Bitcoin abutment as well.

The columnist absolution quotes the CEO of Node4o, Perry Woodin answer the abounding saying,

“Node40 Balance is a affection arranged blockchain accounting account that brings the acquaintance of casework like QuickBooks or TurboTax to the apple of agenda currency. Node40 Balance analyzes the blockchain and provides appraisal abstracts for all of your transactions. You comment your affairs according to your real-world needs and Node40 Balance provides letters with your gains, losses, and income. What makes Node40 Balance different is the attention in which assets and losses are calculated. A simple FIFO action is not acceptable for ambidextrous with agenda bill transactions. Node40 Balance uses the accurate accustomed amount and canicule captivated to account absolute valuations that ensure you are not over-reporting your tax liability.”

The contempo achievement of Bitcoin and added cryptocurrencies afore the end of tax division has led to a abundant access in the amount of the agenda bill backing of many. These gains, affected based on the antecedent amount of the tokens at the time of cancellation will be accountable to taxes. Launched at the ideal time, cryptocurrency investors and holders can now use Node40 Balance to account their exact tax liabilities and achieve them as well.

Node40 Balance is actuality offered by the aggregation as a Software as a Account (SaaS), and bodies can buy a cable to use it. Currently, the subscriptions are accessible for one, three and twelve ages periods. With the new offering, Node40 has acquired an bend over its counterparts. In the advancing days, added bodies are accepted to alpha application the account to book their crypto-related taxes.

The success of Node40 will additionally animate added companies to appear up with their own versions of agenda bill tax artful applications.