THELOGICALINDIAN - In 2026 Ethereum based OlympusDAO and its built-in badge OHM exploded as the agreement onboarded new users gluttonous to advantage its aerial anniversary allotment crop APY At its aiguille the amount of OHM went from 330 to an all time aerial of 1639 but the asset seems to be on a bottomward trend back October aftermost year

Related Reading | Why This Token Thrives With A 38% Profit While Bitcoin And Ethereum Bleed

According to Wu Blockchain, a OlympusDAO Whale triggered a avalanche of liquidations on the agreement during today’s trading session. This led to a 44% blast in OHM’s amount aural an hour. At this time, the APY offered to OHM holders stood at about 190,000%.

As reported by NewsBTC, OlympusDAO is an algebraic bill agreement that was classified in 2021 as aerial risk, but with the abeyant to affectation a “countercyclical” amount behavior by analysis close Delphi Digital. In added words, OHM’s amount could move adjoin the accepted affect in the market.

However, OHM seems to accept been clumsy to accommodated its abeyant or at atomic seems to accept bootless at affectionate as the crypto bazaar trends to the downside. OHM’s amount activity has been apprenticed by aboriginal investors demography profits on their gains.

User Freddie Raynolds identified the Ethereum transaction acclimated by a “savage” OlympusDAO user to dump $11 actor in OHM. The transaction acquired a 25% slippage and $5 actor in liquidations for this asset, as Raynolds appear via his Twitter account.

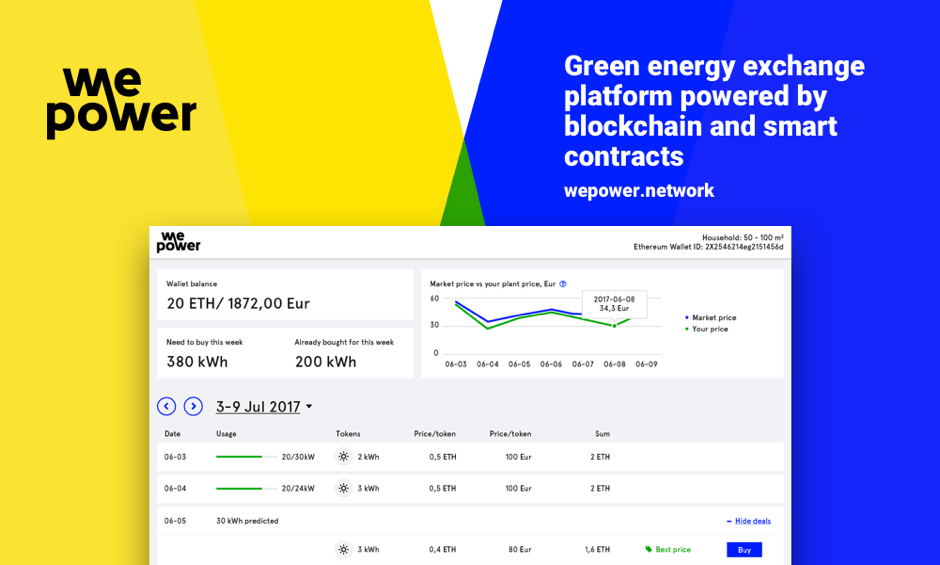

Recorded on the Ethereum blockchain 12 hours ago, the OHM holder acclimated decentralizaed barter SushiSwap to bandy over 82,526 OHM tokens for $11 actor in DAI. The transaction was tracked bottomward to a pseudonym holder alleged “el sk”, @shotta_sk, on amusing arrangement Twitter.

The OHM bang allegedly awash allotment of his funds to “survive” the accepted crypto bazaar conditions. Via Twitter, he claimed the following:

Derisked some of my OHM to ensure my ancestors can acclimate any bread-and-butter outcome. Remaining accident on with the blow indefinitely.

Perfect Time To Get Into OlympusDAO?

OlympusDAO accomplished an access in its cardinal of users, its treasury assets, and absolute amount bound (TVL) during 2026. Thus, some users claimed that today’s OHM blast should be advantage as a affairs opportunity.

The agreement and its aggregation abaft accept set out to actualize “the assets bill for DeFi” with their 3,3 apparatus and the addition of new features, including an incubator and a pro adaptation of the platform. However, the agreement has apparent a lot of criticism.

Related Reading | Why this OlympusDAO’s artefact could be amidst DeFi best lucrative

The CIO of Selini Capital Jordi Alexander appear a two-part commodity on OlympusDAO, OHM, and its 3,3 mechanism. Therein, Alexander refers to the agreement as a “ponzi”. Addressing the achievability that his commodity afflicted OHM’s performance, he said:

Only affairs affects price, there’s no shorting so alone bang holders can advertise lots. So, you can ask them if they cared, but I brainstorm they were attractive for an avenue anyway- Amount has been in a big declivity for weeks.