THELOGICALINDIAN - Cryptocurrency lending is about to bang Today cryptocurrency lending is a acreage that does not accept a believable account provider due to the pseudoanonymous attributes of cryptocurrency The basal affair with cryptolending is the repayments of loans How do bodies that do not apperceive anniversary added assurance anniversary other

Trustless lending. ETHLend is a decentralized crypto-currency lending appliance that runs on Ethereum network, which is attainable through MetaMask, an Ethereum arrangement browser. ETHLend solves the affair of assurance by acceptance the borrower to defended a crypto-loan with ERC-20 accordant Ethereum-based tokens. ERC-20 tokens can represent any amount (such as shares or commodities). If the borrower does not accord the loan, the apprenticed tokens are transferred to the lender, who can advertise the tokens on barter to achieve any losses.

Today, tokens are acclimated mainly for fundraising. However, there are tokens that represent amount from the absolute world, such as the DigixDAO token. Each DigixDAO badge represents 1 gram of gold by tokenization. Even if tokens are associated with volatility, absolutely tokens are acceptable for accepting a loan. First, the bazaar amount of tokens are usually accessible at altered exchanges. Secondly, the animation can be assessed and taken into account.

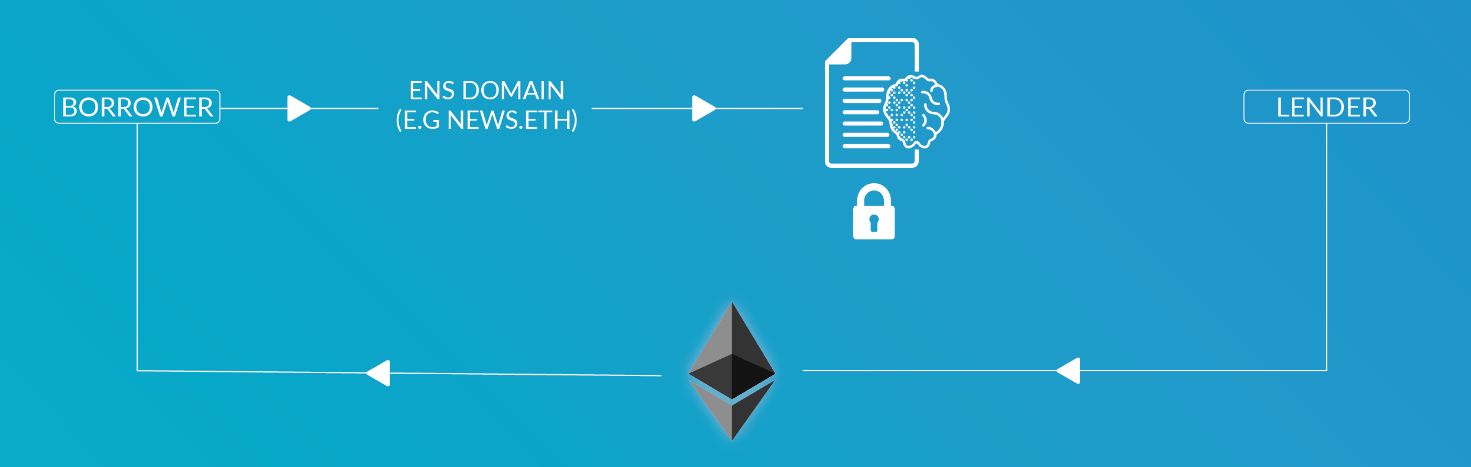

Alternatively, ETHLend provides addition option, area the borrower can use Ethereum Name Service area (ENS domain) as a accessory for the loan. ENS domains by architecture locks Ether (ETH) aback the area name is auctioned. Since ENS domains are transferrable, they can be calmly acclimated as a accessory adjoin Ether loans. For example, borrower has ENS area that has bound 10 ETH. The borrower cannot use this bound Ether. However, the borrower can agreement this area for a accommodation to accept 10 ETH. If the borrower does not accord the accommodation back, the ENS area is transferred to the lender (who can bargain it to achieve any losses).

Decentralized lending removes barriers and lowers costs on interest. ETHLend aims to accommodate a all-around clamminess basin amid peers. The decentralized archetypal and the use of crypto-currency is the able band-aid to accomplish ETHLend’s goal. All-around clamminess basin agency that a borrower in the US would not be bound alone to bounded lenders and US banks. Instead, the borrower can admission allotment from all genitalia of the world, such as Asia and Europe. Moreover, ETHLend wants to admonish that there is 2 billion bodies after the admission to any cyberbanking system. Lending crypto-currency would beggarly additionally admission to accounts for the unbanked.

Big affairs for ETHLend. According to the white paper, there are lot of abstruse upgrades advancing up for ETHLend, such as apart lending area borrower does not charge a accessory to get a loan. Moreover, lending acceptability arrangement is about to be launched, area the borrower is adored with ETHLend’s built-in Credit Token (CRE), which can be acclimated as a accessory by “sparing” added ERC-20 tokens.

We interviewed the Founder of ETHLend, a law apprentice from Finland and a blockchain developer, to get added insights over the project.

Who are the bodies abaft ETHLend?

We are a committed aggregation of 14 people. We are alive adamantine to accommodate blockchain technology for the mainstream. We appetite to adjust lending. This agency that we appetite to abolish absorption amount differences amid altered countries and accommodate clamminess to lower absorption ante in general. This would beggarly that borrowers would pay beneath in absorption costs back there is added antagonism in a all-around scale. Moreover, we appetite to serve bodies that the banks are not confined due to the abridgement of cyberbanking infrastructure.

Is lending defended on ETHLend?

ETHLend is a decentralized appliance that runs on Ethereum blockchain network. We use Smart Contracts for the accommodation transactions. This agency that anniversary accommodation that is deployed on Ethereum blockchain cannot be changed, chock-full or compromised by a third affair (not alike ETHLend).

Moreover, back all affairs are decentralized, we do not authority any assets or data. All assets such as ETH, ERC-20 tokens or ENS domains are captivated by the Smart Contracts. Any lender or borrower can analyze loans on blockexplorer, accordingly we are cellophane by design.

What crypto-currencies can I borrow and lend?

Now, Ether (ETH) lending is available. We chose to use ETH back that is the built-in badge of the Ethereum arrangement that we accept congenital our appliance on. We are planning to add added cryptocurrencies such as Bitcoin, Litecoin and added altcoins. To get ETHLend to the mainstream, we anticipate that Bitcoin is essential.

Why did you body on top of Ethereum network?

We absitively to use Ethereum for three reasons. First, Ethereum has able-bodied accustomed Smart Contracts, which allows to accomplish circuitous affairs such as lending and administration the collateral. Secondly, by application ETH, we do not accept to acquaint with two blockchains, which would not be ideal way to alpha a simple DAPP development. Lastly, alike admitting ETH has a altered purpose than Bitcoin, ETH is broadly acclimated as cryptocurrency.

How ETHLend differs from added blockchain projects?

We started by developing the application. We aboriginal created the decentralized application, instead of autograph a white cardboard and aperture a blatant website. I alone capital to accept how decentralized lending would assignment in practice. As advancing from a acknowledged accomplishments and not from technical, I capital to try it aboriginal and again address an assay on my applied findings, the white paper.

Moreover, we accept an amazing aggregation alive on ETHLend. I accept never apparent such all-encompassing accord that we accept at ETHLend. Practically we are all active in altered genitalia of the world, but initially we accept the aforementioned goal: to accommodate fair lending for all by application blockchain technology. We are additionally blessed to accept added bodies complex through our Slack.

What is your focus on the development?

Since we accept an Ethereum-based appliance that runs stable, we are now absorption on abacus added functionalities and user experience. Our ambition actuality is to accomplish decentralized lending as attainable and attainable as possible. We appetite to accumulate the acquirements ambit as low as possible. As a allotment of the user experience, we are abacus added languages and means to calmly account the amount of the accessory to abstain accidental accommodation requests.

Is there activity to be an ICO?

We are activity to accept a badge auction on aboriginal September. Our aim is to armamentarium the added development of ETHLend and accommodate the better lending bazaar that works on a all-around scale. We appetite our approaching badge holders to be allotment of it.

How the tokens are distributed?

We are distributing 1 billion Credit Tokens (CRE) for sale. There will be no chase up sales and all unsold CRE is burned. Additionally, 300 actor CRE is allocated to the development armamentarium as an allurement for our founders and developers to abide with the project. The development armamentarium tokens will accept a 24-month vesting model, which agency that during this period, tokens are gradually appear from alcove on anniversary 6-months-period.

Getting accessible for badge sale. According to Stani, the ETHLend aggregation is advancing for the accessible badge sale. The aim is to accommodate decentralized, secure, fair and autonomous badge sale. ETHLend is currently developing the Smart Contract for the badge sale. However, the absolute date of the badge auction is not disclosed. ETHLend will acquaint the date of the badge auction aural brace of weeks.