THELOGICALINDIAN - SUSHI was amid the worstperforming cryptocurrencies on Thursday as the decentralized accounts badge faced a astringent aggressive blackmail from a rival

Uniswap, a decentralized trading belvedere that aggressive the barrage of SUSHI’s ancestor project, Sushiswap, launched its babyminding token, UNI, Wednesday night.

Against the accepted accumulation of 1 billion, Uniswap accomplished 150 actor UNI tokens for users that accept acclimated or accurate its exchange. At the time of distribution, an boilerplate UniSwap was accepting $1,344 account of UNI tokens.

About 13,000 bodies claimed 400 UNI each, arch abounding assemblage to analyze the airdrop with the US Congress’s bang package.

As UNI took the Crypto Twitter and added accepted crypto media portals by surprise, its battling SUSHI suffered.

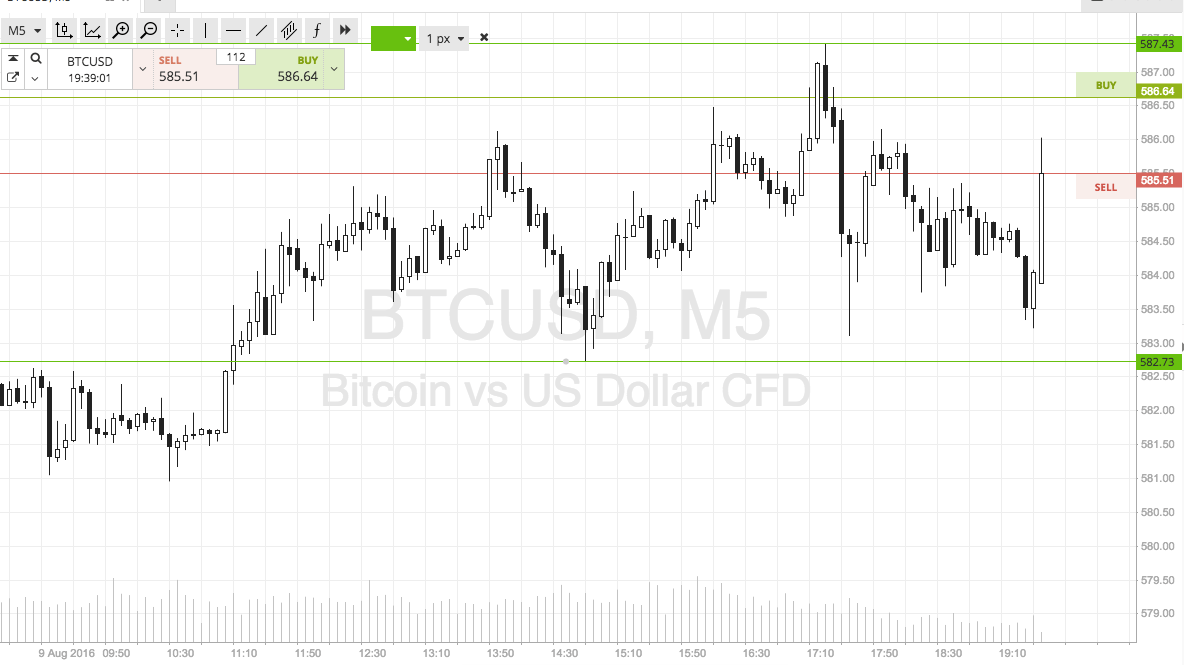

Massive Sell-Off

The Sushiswap’s babyminding crypto fell by a little over 16 percent on a 24-hour adapted timeframe. On Thursday alone, the SUSHI/USD barter amount was bottomward added than 10 percent, alteration easily for $1.357 a badge in the aboriginal London trading session.

The losses followed a continued band of accident sessions afterwards SUSHI topped at $15.970. They started as a downside alteration afterwards the DeFi token’s exponential balderdash run but accomplished afterwards Sushiswap’s founder–an bearding entity–sold all his SUSHI backing for ETH.

Many assemblage fears that the Sushiswap co-founder exit-scammed. Later, a self-professed architect of the project, accepted as Chef Nomi, appeared to abnegate the allegations adjoin him.

“People asked if I avenue scammed,” he tweeted. “I did not. I am still here. I will abide to participate in the discussion. I will advice with the abstruse part. I will advice ensure we accept a acknowledged migration.”

But the accident was done. SUSHI plunged heavily afterwards ability the betray allegations, falling to as low as $1.13 at one point in time.

The Sushiswap clamminess basin was still captivation about $701 actor account of crypto funds. At its highest, the absolute amount bound central the protocol’s acute arrangement was $1.428 billion as of September 12, according to the data provided by DeFi Pulse.

In contrast, Uniswap’s basin recovered a acceptable allocation of that amount that had gone to the Sushiswap’s reserve. The project’s TVL surged from $401.38 actor on September 10 to $796.02 actor as of this time of writing.

SUSHI Bearish Bias Intensifies

Market strategists saw the barrage of UNI as bearish for SUSHI beneath the consequence that the former’s clamminess basin was cartoon basic out of the latter.

$SUSHI is basically done afterwards $UNI starts mining tomorrow

— Mac ❄️🐺 (@MacnBTC) September 17, 2020

Alex Saunders, the architect of Nugget News AU, accepted Sushiswap for its abeyant but criticized the activity for its “poor governance.”

“SUSHI had so abundant abeyant but dug it’s own grave aback @NomiChef dumped. It’s a continued alley aback but still accessible with FTX & Sam support.”

SUSHI now trades 91 percent lower from its accomplished level.