THELOGICALINDIAN - Even afterwards the contempo alteration the ample crypto bazaar charcoal far aloft it did at the complete lows of March Data from CoinMarketCap in actuality suggests that the accumulated of all cryptocurrencies is up to 196 billion as of the time of this accessories autograph 50 college than the 129 billion low

This has been abundantly unexpected; aloof weeks ago, investors were fearing that Bitcoin “was dead” and branch “under $1,000.” And alike now, analysts accept been abundantly agnostic of the rally, asserting that it could aloof be an “impulse higher” above-mentioned to a antique lower.

However, assay suggests that the contempo and advancing advance of Tether USDT’s bazaar assets shows that added upside is approaching for the crypto market.

Tether’s Market Cap is Exploding Higher, Boding Well for Crypto Bulls

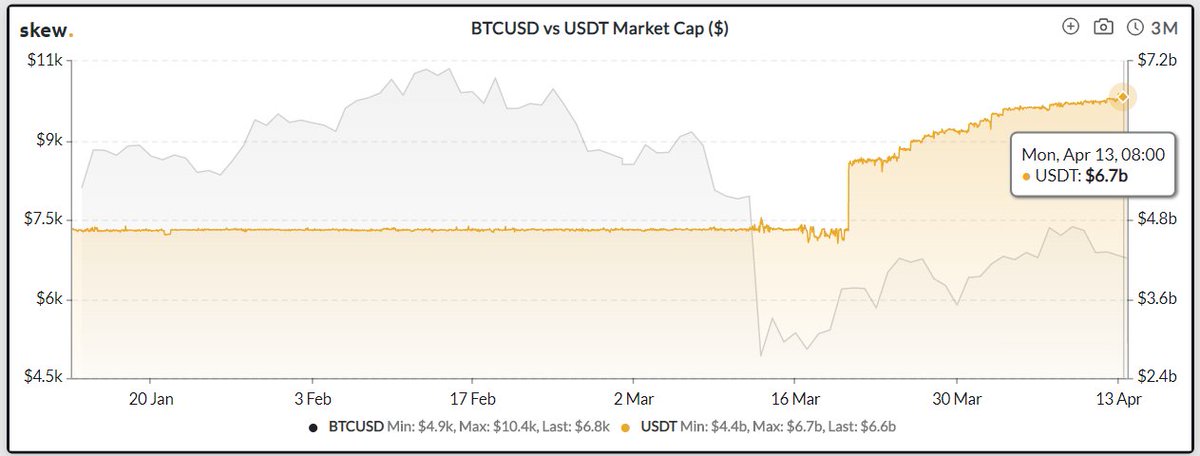

According to abstracts from Skew.com, afterwards yet addition alternation of prints, the amount of all circulating USDT accumulation has risen to $6.7 billion, $2.2 billion college than the about $4.5 billion bazaar cap apparent at the alpha of March.

Analysts accept this trend to be absolute for the cryptocurrency market, and may absolutely explain abundant of Bitcoin’s accretion from the $3,700 March lows to the accepted price.

Charles Edwards, a agenda asset manager, remarked in January that “major changes in Tether’s market capitalization have led Bitcoin’s bulk over the aftermost 1.5 years.”

Prior to the about 50 percent blast in November 2025 that saw BTC attempt from $6,000 to $3,150, the bulk of USDT circulating fell by hundreds of millions; also, above-mentioned to the majority of 2025’s crypto assemblage was the press of hundreds of millions account of USDT.

Major changes in Tether's Market Cap accept led Bitcoin's amount over the aftermost 1.5 years.

5 January 2020 was no different.

A advantageous signal.

Keep it press ?️ pic.twitter.com/dfe0dBJzwh

— Charles Edwards (@caprioleio) January 13, 2020

The actual accurateness of this indicator suggests it will comedy out again.

It’s Not All Buying Pressure

Notably, some advance that the able advance in the appeal for USDT and added stablecoins isn’t one alone based on investors attractive to admeasure their authorization basic into the crypto market, namely Bitcoin.

Sam Bankman-Fried, a above institutional broker angry CEO of both crypto acquired barter FTX and Bitcoin assistant armamentarium Alameda Research, explained that there are three absurd factors that are abaft USDT’s bazaar cap growth:

1) Alright, time for some answers!

My abrupt account is roughly:

There's huge buy-side appeal for USDT. It's advancing from:

a) OTC flow, primarily from Asia

b) People affairs BTC –> USDT to barrier positions

c) People affairs BTC –> USDT to abate accident https://t.co/cFWSQhhAVl— SBF (@SBF_Alameda) March 31, 2020

All this, he wrote, is “drives up [the amount of USDT] and in about-face supply, so bodies create.”

It isn’t bright if the actuality of this ancillary of USDT appeal invalidates Edwards’ analysis, which was fabricated beneath the acceptance that USDT was actuality printed by investors attractive to flood the bazaar with Bitcoin, askew adjustment books to the buy-side.