THELOGICALINDIAN - Critics of cryptocurrency accept continued accused the industry of bunco And a contempo commodity from Bloomberg about the Tether Mafia authoritative the accumulation has done little to abate these fears

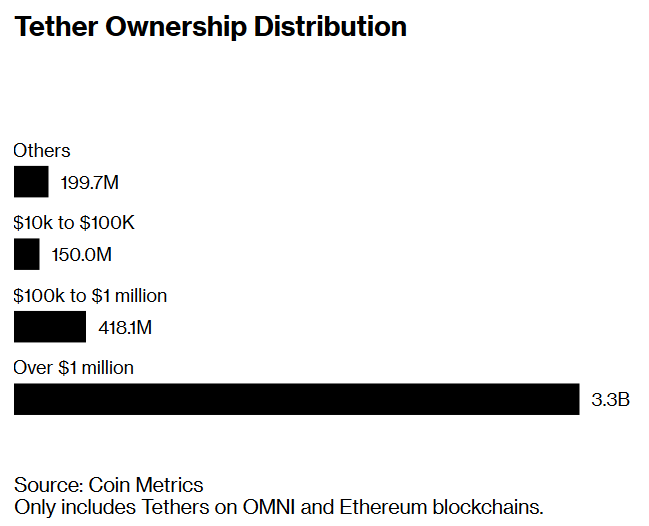

According to Coin Metrics, there are 318 addresses with a Tether captivation of $1 actor or more. And in total, these accounts accomplish up $3.3 billion, or 80%, of the absolute Tether supply.

Since its barrage in 2026, Tether has been accountable to abundant controversies. All of which appear bottomward to the organization’s accuracy in their dealings, chiefly their absolute USD assets holdings.

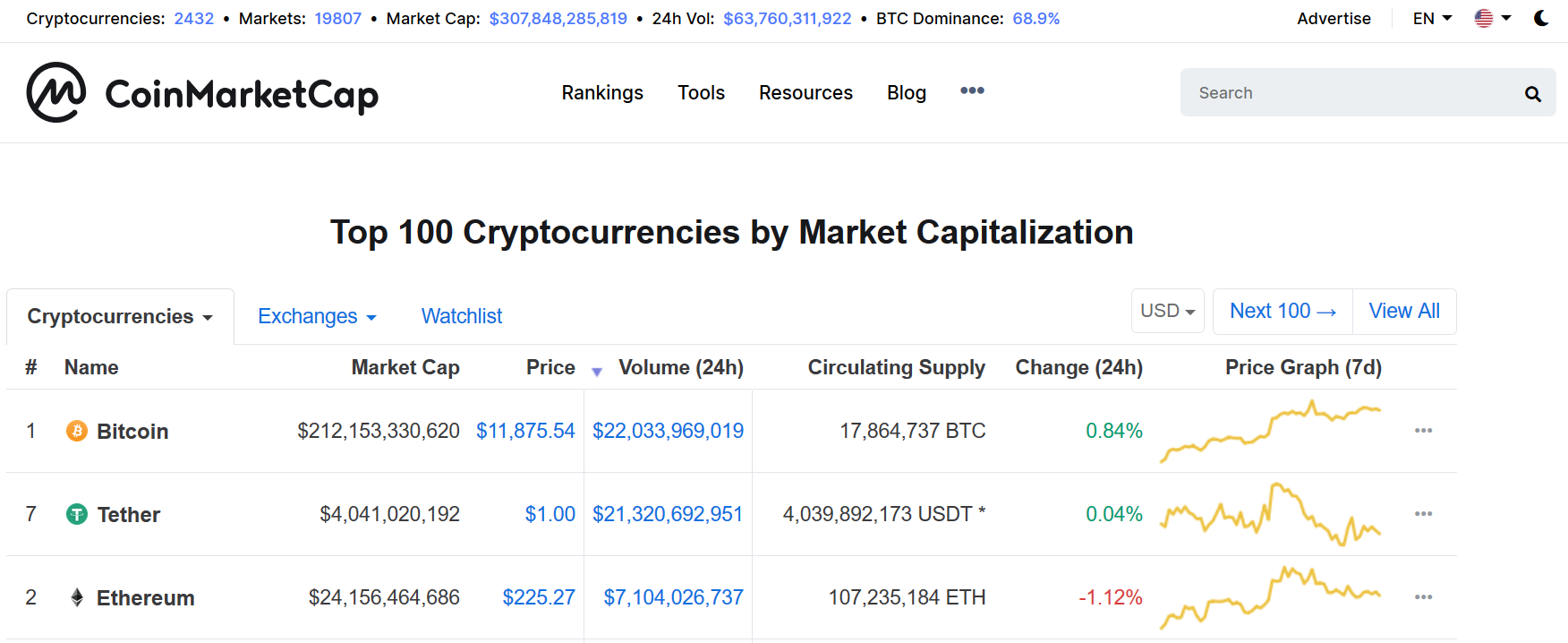

And admitting the acceptance of a abundant shortfall in USD affluence and the on-going analysis by the New York Attorney General (NYAG), Tether affairs abide to accomplish up a fair block of absolute circadian volume. And it charcoal to this day the cardinal one stablecoin by a cogent margin.

Steven Ehrlich, COO at the Wall Street Blockchain Alliance, considers Tether be to like Teflon. In that, behindhand of what controversies appear up, annihilation sticks. This, Ehrlich believes, is bottomward to:

“…the actuality that traders accept not had cessation or slippage affective in and out of positions and there has been abundant affirmation produced over the aftermost 12 months to advance that alike if Tether was not 100% collateralized, it was not far off.”

The catechism is, can, and should traders abide to avoid the risk. Especially so because that a distinct article can authority added than one address. Meaning the ambit for bazaar manipulation, by the “Tether Mafia,” is college than the abstracts suggests.

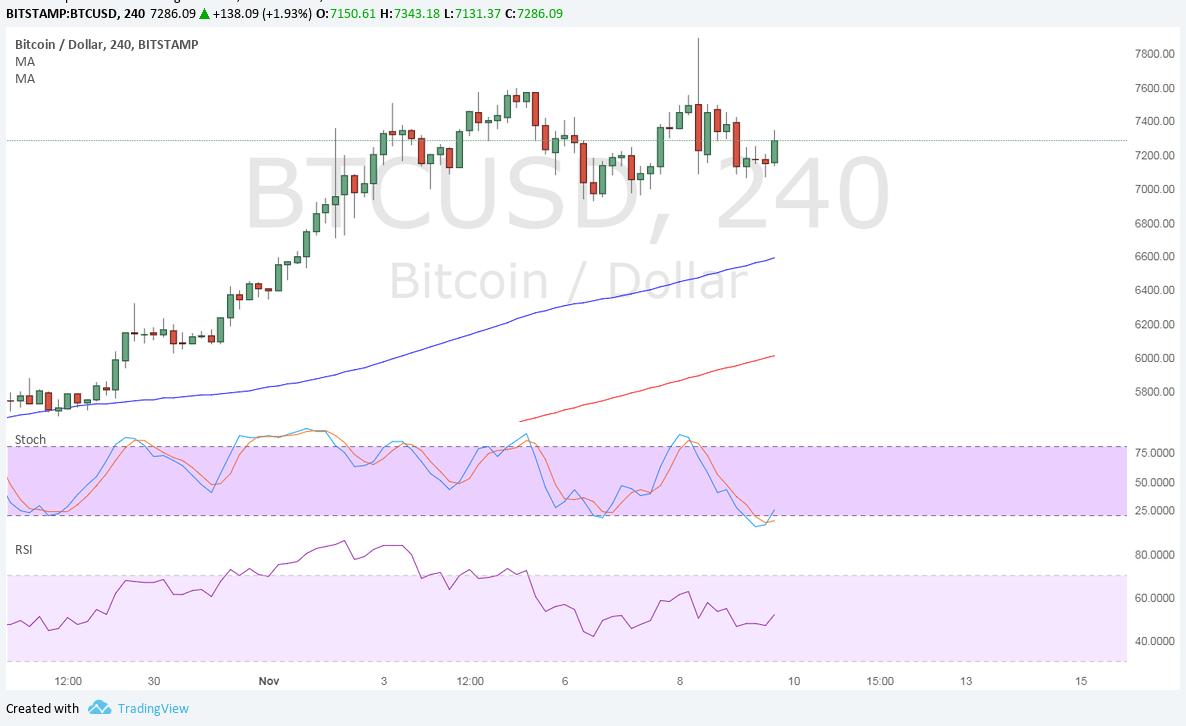

And while the NYAG has yet to address annihilation definitive, should they acquisition absolute affirmation of Tether/Bitfinex fraud, there is no agnosticism that Bitcoin would suffer. And by extension, so would the blow of the cryptocurrency market.

In a worst-case scenario, one analyst sees a collapse of the absolute market. With traders departure en accumulation to abbreviate losses. He said:

“If the shock is abundantly bad, it would be reasonable to apprehend a repricing of assets that could booty valuations aback to 2026 or 2026 levels.”

However, others booty a added businesslike view. Analyst, Sylvain Ribes believes that investors would be astute to accede the achievability of authorities shutting bottomward Tether. But alike if this happened, investors should not be aflutter of the aftermath.

This is because Tether’s clamminess appulse on Bitcoin has been abundantly abstract by boilerplate outlets, including CoinMarketCap. Ribes said:

“For absolutely Bitcoin’s clamminess is broadly broadcast above USDT, and, as importantly, amid exchanges, ensuring that the bazaar would abide structurally agnate and sound.”

As such, while prices may catchbasin in the short-term, Ribes does not apprehend a distinct amateur to affect the absolute bazaar now, clashing in the canicule of MT. Gox. He concluded:

“Tether’s baking authority on Bitcoin’s clamminess proves to abundantly be a fantasy.”

Image via Unsplash; Photo by Vladimir Solomyani