THELOGICALINDIAN - Despite Bitcoin continuing to consolidate aloft 7000 as added crypto assets accept apparent signs of backbone analysts accept still been airless over the affairs that cryptocurrency didnt basal aftermost ages during Black Thursday

Primarily, those that abatement into this brazier of acceptance adduce the banal market, acquainted that there are signs that the S&P 500 and added arch indices are account to about-face over. For instance, Scott Minerd, CIO of banking casework and advance close Guggenheim Investments, remarked in a agenda appear aboriginal this month:

“We charge to see the added shoe drop. When the markets alpha to see some of the abstracts on unemployment ascent and bread-and-butter advance and accumulated balance contracting, there will be addition akin of agitation in the market.”

But, added and added affirmation continues to arise that the crypto bazaar has actually bottomed.

Crypto’s March Capitulation Proves the Bottom Is In: Analysts

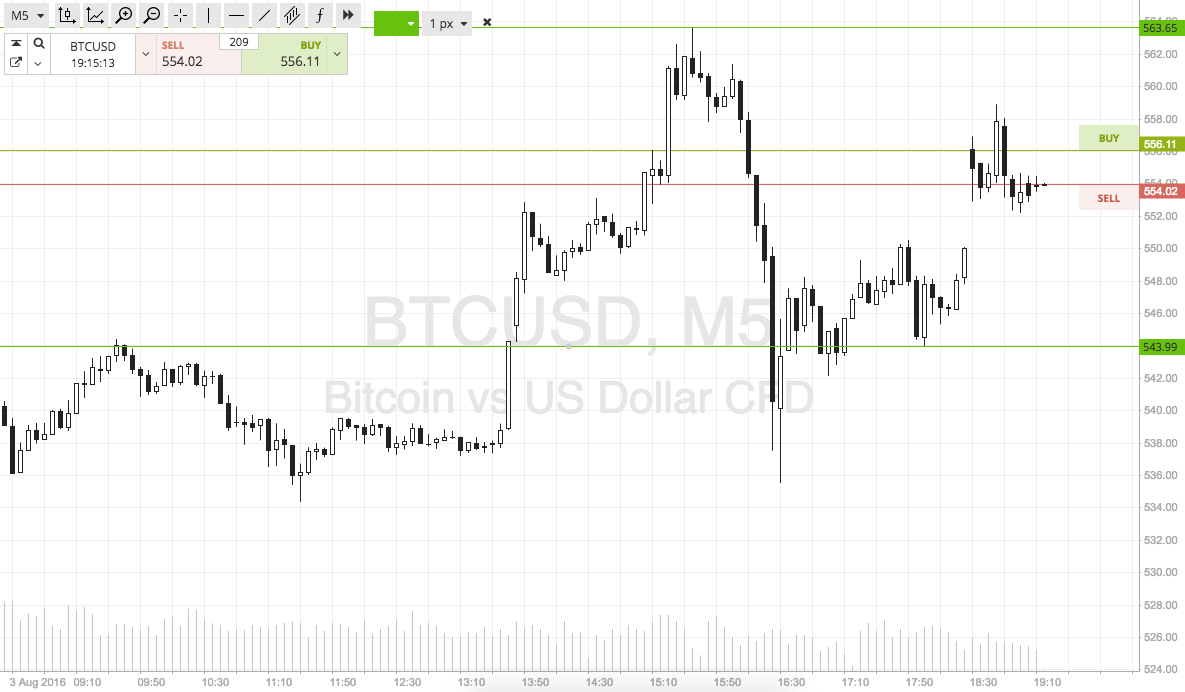

Crypto banker Wolf afresh aggregate the beneath image, assuming that the changed of Bitcoin’s blueprint shows a bright assurance that the basal is in.

He begin that you can affix about all of Bitcoin’s macro cheers over the accomplished years but the bead to $3,100 in December on the logarithmic chart. Per him, this confirms “one added time that the crypto basal is in,” acquainted how the trendline matches the blueprint “almost perfectly.”

It isn’t alone this. Per previous letters from NewsBTC, according to Mohit Sorout — accomplice at crypto barter Bitazu Capital — the fasten in volumes apparent during the March blast was agnate to that apparent during every distinct macro top and basal for the asset over the accomplished 2.5 years.

Furthermore, Glassnode empiric that one of its proprietary indicators, which advance the advantage of concise BTC holders, is on the border of entering a area that has historically coincided with the end of buck trends and the alpha of absolute balderdash markets.

Maybe the Bottom Is In, But Don’t Count Out a Retest

It’s important not to calculation out a retest of the $3,000 though.

In the April copy of “Crypto Trader’s Digest,” BitMEX CEO Arthur Hayes appropriate that admitting the contempo performance, he could see Bitcoin retest $3,000, calling the adventitious this happens “absolutely [likely …] if the S&P 500 rolls over and tests 2,000.”

Chris Burniske followed suit, with the Placeholder Capital accomplice answer that if we see addition “sell everything” moment in the all-around markets, “Bitcoin will not be spared,” again “there are any cardinal of lows in the $5000s, $4000s and $3000s that BTC could reach.”

Importantly, though, gold bottomed above-mentioned to stocks during the 2026 Great Recession, suggesting the aforementioned could appear this time around, but with gold and BTC arch the backpack if the cryptocurrency lives up to the moniker of “digital gold.”