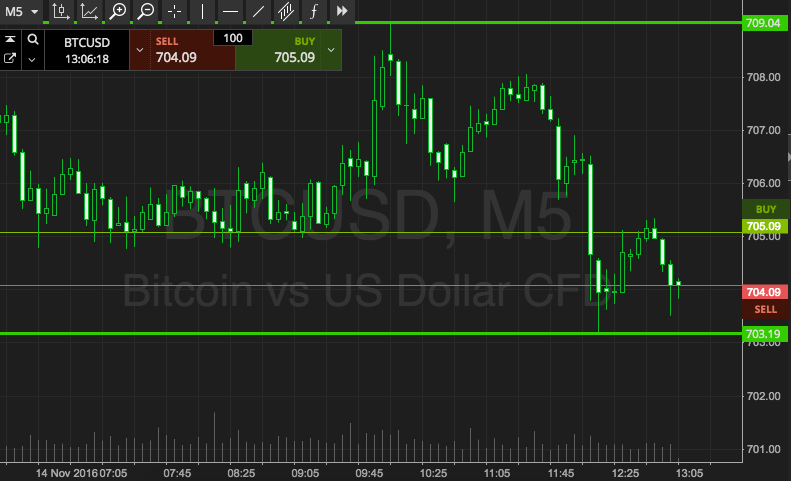

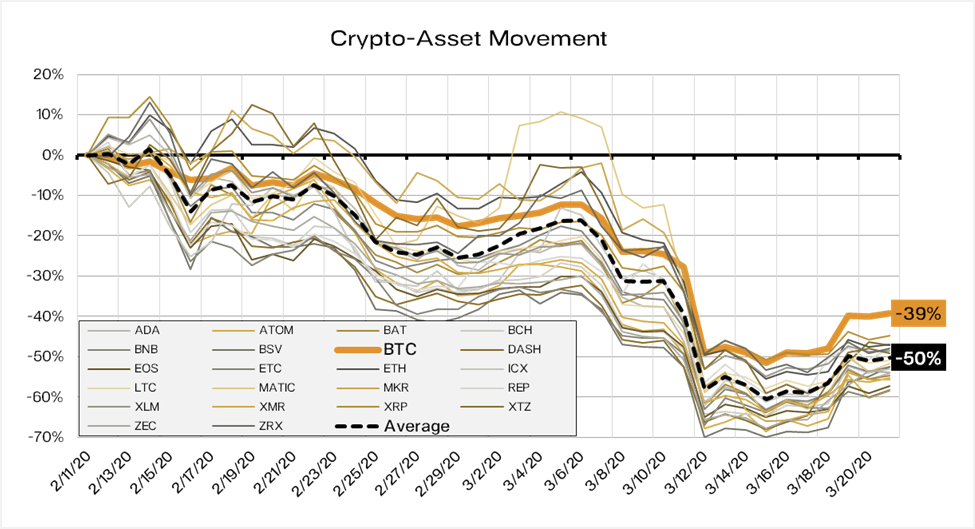

THELOGICALINDIAN - As hasty as this may assume Bitcoin has been underperforming its crypto ilk over the accomplished few weeks abstracts from CoinMarketCap shows that Bitcoin ascendancy the allotment of this bazaar fabricated up by BTC has collapsed from 66 to 649 in the accomplished three days

To added contextualize this, as of the time of this article’s writing, Bitcoin has collapsed 6% in the accomplished 24 hours while both Ethereum and XRP accept posted almost able performances of -3%.

There’s little to explain this trend; in fact, a top crypto advance armamentarium afresh bargain its acknowledgment to altcoins and added its allocation to Bitcoin. Here’s why it did that.

Crypto: Will Bitcoin Outperform In This Crisis?

In “Crypto In This Crisis: Pantera Blockchain Letter, March 2020,” Dan Morehead and Joey Krug of blockchain-centric armamentarium Pantera Capital explained that Bitcoin will “probably out-perform added tokens for a while,” answer that it is one of the crypto projects that are accepted and doesn’t await on allotment per se:

It’s a activity that’s already built, it works, it has an 11-year clue record. Many newer blockchain and acute arrangement projects are still in development and ability be fatigued to accession allotment to complete their development.

They added explained that “there’s about a flight-to-quality” or flight to assurance “where bodies appetite to put money in the mega-caps, the safest asset, “the Treasuries” of the industry.” In the case of crypto assets, Bitcoin is a Treasury bond, as it is abundant added aqueous than the rest.

Bitcoin Could Hit New Highs Within a Year: Pantera CEO

Pantera doesn’t alone anticipate the crypto bazaar will activate to recentralize about Bitcoin, the armamentarium additionally thinks the arch agenda asset will beat amidst these times of crisis.

Earlier in the letter, Morehead explained that the beatnik budgetary and budgetary acknowledgment to the crisis will be acutely bullish for Bitcoin. He wrote:

As governments access the abundance of cardboard money, it takes added pieces of cardboard money to buy things that accept anchored quantities, like stocks and absolute estate, aloft area they would achieve absent an access in the bulk of money. The aftereffect is they’ll additionally aerate the amount of added things, like gold, bitcoin, and added cryptocurrencies.

As to how absolutely it will affect Bitcoin, Morehead explains that with this backdrop, it will booty about 12 months for the BTC amount to “set a new record” aloft $20,000, which would mark at atomic a 230% assemblage from the accepted amount point of $6,200 in beneath a year’s time.