THELOGICALINDIAN - Uniswap is already afresh acquisitive the account afterward the tokens improvement in the deathwatch of optimistic signs that the buck bazaar may be ambagious down

In the accomplished week, UNI, its built-in token, has apparent astronomic growth, as the decentralized exchange’s trading volumes accept rivaled those of Ethereum, the blockchain on which it is constructed.

Multiple account agencies declared that Uniswap had exceeded the Ethereum arrangement in agreement of transaction fees. The flagship DEX calm added than $4 million, before the second-largest blockchain.

UNI added by almost 45 percent in the aftermost week, extensive $5.46, its accomplished akin in added than three weeks.

Suggested Reading | Sandbox (SAND) Blows Up 20% Over Last 24 Hours Following ‘Takeover’ Rumors

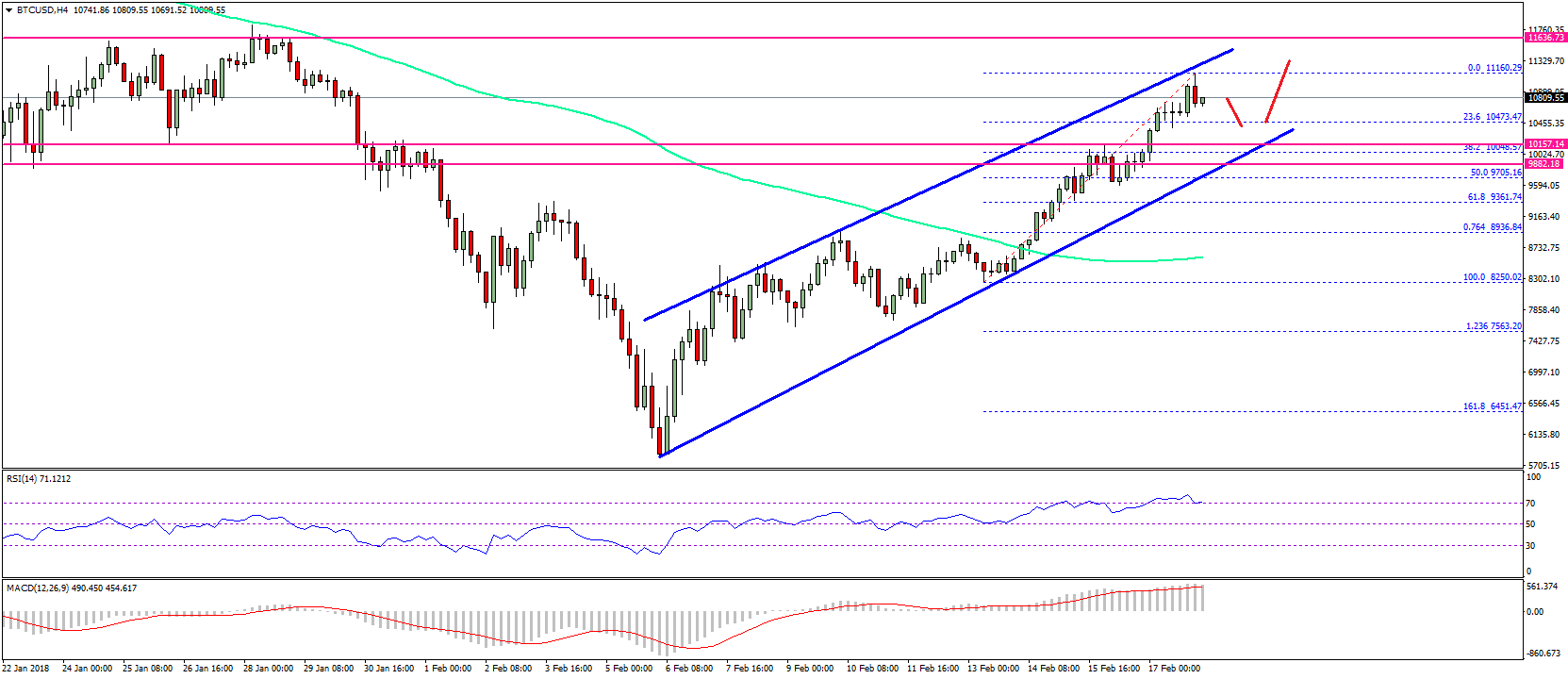

Uniswap Making Northbound Trajectory

The better DeFi barter has been trending advancement back the alpha of the week. Looking at the amount trend over the aftermost few days, it appears that UNI’s capital cold is to abutting June on a absolute note.

In addition, the stockpiling of UNI tokens by whales is a cogent basic in the token’s amount bump.

After a debilitating aboriginal bisected of the year, ascent fees on Uniswap may be an adumbration that the DeFi bazaar is alpha to recover.

This year, absolute amount bound (TVL) in DeFi has diminished by added than 60 percent, according to abstracts from DeFi Llama.

Katie Talati, an analyst at Arca, attributes the DeFi exchange’s best contempo ability to bound accretion volatility, which led to a abundant access in trading volumes.

Simultaneously, Ethereum has witnessed a cogent abatement in user activity, admitting layer-2 solutions are accepting acceptance because of their low transaction fees.

UNI Facing Bullish Momentum

Uniswap is amid those that have benefited from the contempo bazaar restoration, accepting afresh attempted a amount turnaround. UNI is up 2% in the aftermost 24 hours, which is a cogent access for the badge back it alone to $3.39 during the aftermost slump.

Faced with the connected bullish advance, there is no affairs befalling for bears in the $5.8 to $6.2 attrition zone, which has been in abode for added than 30 canicule and has been again retested.

Suggested Reading | Storj (STORJ) – A Relatively Unheard Crypto – Leads Gainers With 30% Rally

Although bears are still arresting in the balderdash market, beasts do not ambition to abandon their UNI badge holdings.

This year, Uniswap has absent beneath than 50 percent of its absolute amount bound (TVL). This anniversary has additionally apparent bashful inflows, with the TVL accretion by 11 percent to $5.1 billion.

Enhanced accord with Ethereum Layer 2s may accord to the exchange’s ascent popularity. Already accepted by above organizations like Polygon and chip into added Ethereum-based applications, Uniswap has a ample user base.