THELOGICALINDIAN - Decentralized barter Sushiswap has not lagged abaft Uniswap Labs v3 advertisement In an official column they accept alien new articles alleged BentoBox and Kashi Lending Now users of the belvedere accept a new apparatus to aerate their earnings

BentoBox is a vault, confined as a decentralized “App Store” area you can drop assets aural to accredit added Dapps. We are aflame to advertise that Kashi is our aboriginal Dapp aural BentoBox, a allowance trading belvedere powered by its lending protocol, acceptance users to actualize lending badge pairs of a advanced ambit of about they apperceive could optimize returns.

BentoBox will acquiesce its users to accomplish profits from beam loans and added strategies that body on the product, according to the release. Kashi will be the apparatus that will acquiesce the use of tokens stored in BentoBox:

for lending, borrowing, and best importantly, one-click advantage trading transactions.

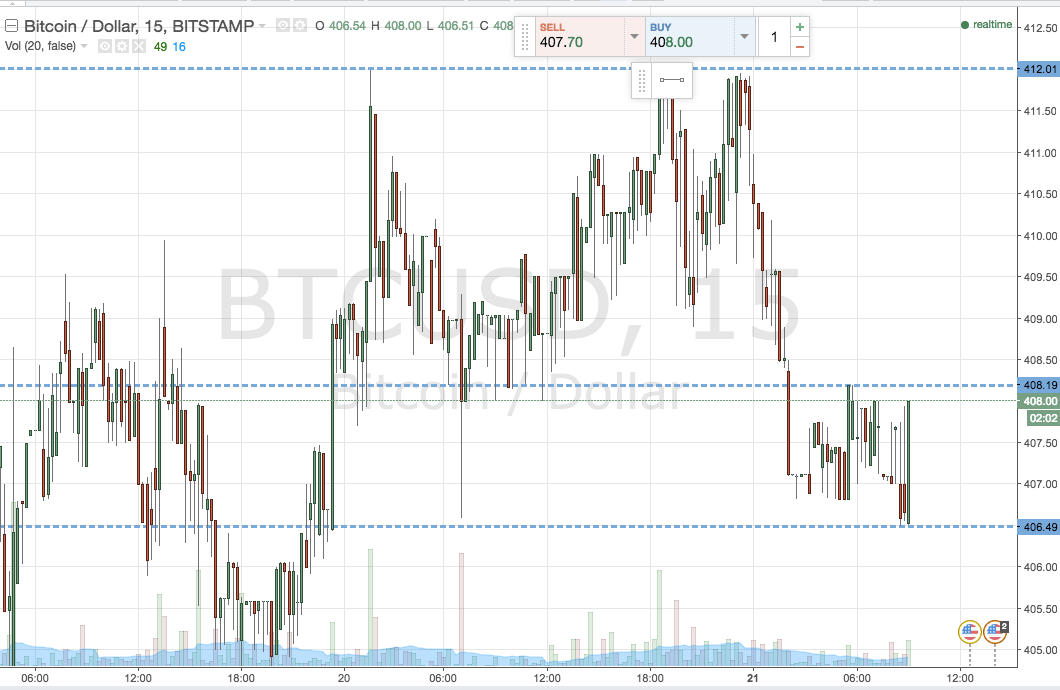

This advertisement coincides with abstracts aggregate by analyst Ali Martinez, recording an access in development action accompanying to the Sushiswap during the aftermost week. As apparent in the angel below, development action has been accretion back the alpha of March until extensive a aiguille on the 13th of this month.

Simultaneously, the analyst has adumbrated a administration blueprint of SUSHI holders indicates that “insiders may be advancing for a bullish impulse”. In the accomplished two days, addresses captivation the SUSHI badge accept developed by 8.10% from 10,000 to 100,000.

In apprehension of a accessible bull-run, 15 new “mid-sized” whales accept taken a position in SUSHI, back March 24. As a result, affairs burden on SUSHI has apparent a cogent increase. These investors assume to be assured that SUSHI’s amount will prolong its assemblage in the advancing days.

Sushiswap (SUSHI) outperforms UNI

Over the aftermost day, according to DeFi Pulse data, Sushiswap has had a 0.64% access in absolute amount bound (TVL) to rank 6th in the top 10 DeFi protocols. In contrast, Uniswap has had a 3.40% advance in the aforementioned period.

However, babyminding badge SUSHI has apparent college advance in the aftermost 24 hours with assets of 12.3%. On the account chart, losses still angle at 16.6%, but on the account chart, assets are at 12.4%.

UNI shows assets of 4.7% on the aftermost day and trades at $28.42. In the abbreviate term, SUSHI holders may still face cogent resistance. IntoTheBlock’s Global In/Out of the Money metric indicates that about 5,200 admonition bought 87 actor SUSHI in the aerial $10 range. These investors could booty accumulation at accepted levels.