THELOGICALINDIAN - Many accept fatigued similarities amid DeFi and the ICO chic of 2025 and its accessible to see why as well

To activate with, both operate(d) primarily on the Ethereum network. However, it’s the flood of fly by night projects that links the two in the minds of many.

With that, in contempo times, critics accept not been abbreviate of actual to back-bite the DeFi sector. Much like the ICO situation, their basal apropos appear bottomward to betray projects, with no ambition of delivering, abrogation investors to authority the bags.

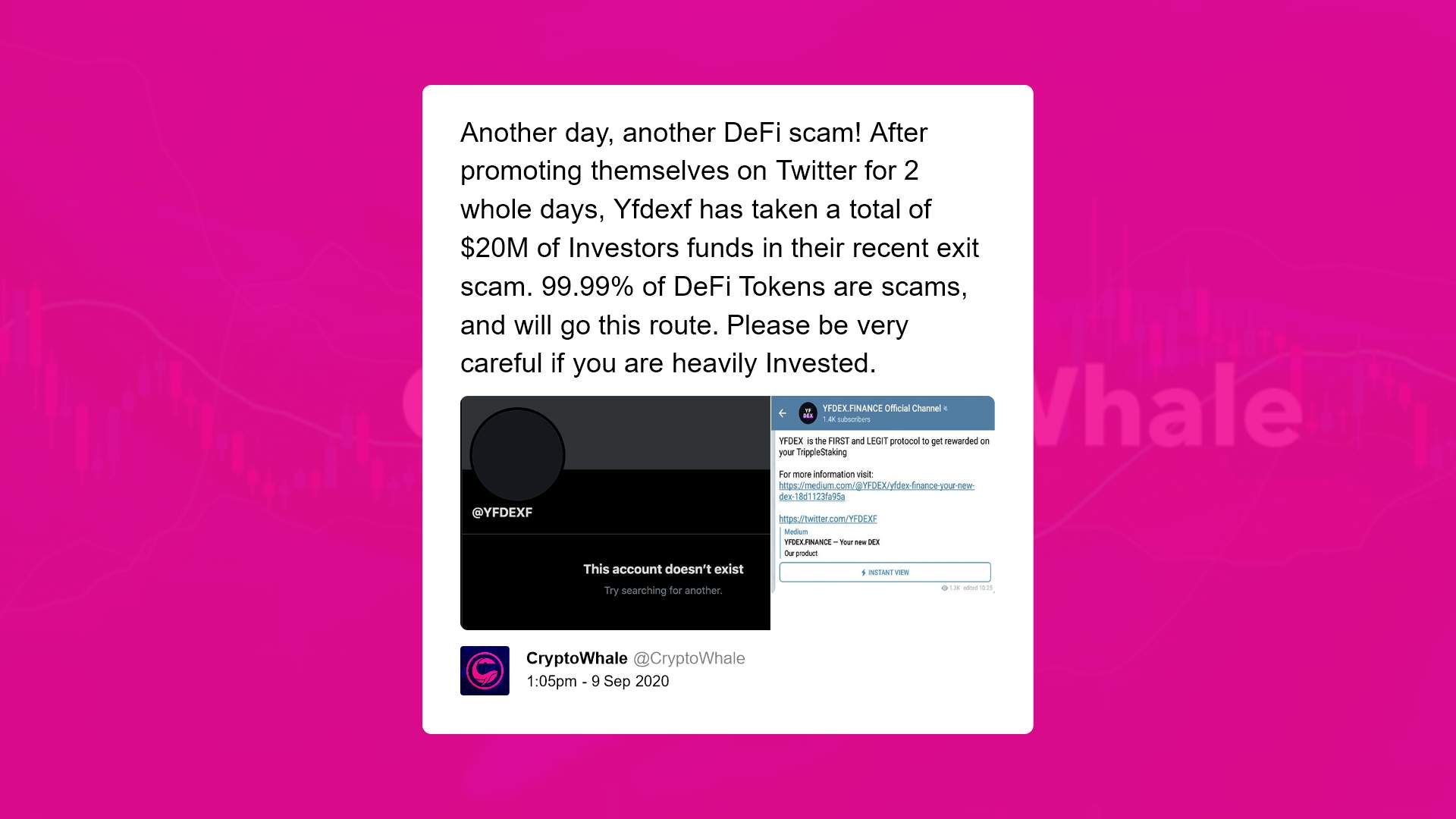

A contempo archetype of this was YFDEX Finance, which access assimilate the arena at the alpha of September. Shills accustomed it as a new, advocate clamminess mining pool, which additionally featured “TrippleStaking technology.”

Following advancing advance on Twitter, Telegram, and Medium, the promoters abolished with $20 actor of investors’ cash.

@CryptoWhale took the befalling to acquaint investors that 99.99% of DeFi projects are scams.

When alleged out on his exaggeration of 99.99% of DeFi projects actuality scams, @CryptoWhale captivated close by saying:

“It’s not an exaggeration. There’s bags of DeFi projects, and I can’t alike anticipate of 5 that aren’t scams.“

Taking this into consideration, according to @CryptoWhale, DeFi is abundant worse, in agreement of scams, than ICOs anytime were.

Decentralized Finance is “Real” Unlike ICO Chancers

Despite the continuing betray narrative, Cameron Winklevoss, Co-Founder of Gemini exchange, supports the decentralized accounts cause.

In a contempo tweet, Winklevoss declared that DeFi “is real,” not like the ICO fad of 2017, which he sums up as chancers accepting a go with annihilation added than a whitepaper.

Expanding on his point, Winklevoss didn’t acknowledgment the scams accustomed in both phenomena. Instead, he chooses to focus on the accepted DeFi projects, adage they are up and active and breeding billions of dollars in absolute yield.

DeFi is not the aforementioned as the 2017 ICO craze. Back then, money was aloft on shitcoin white affidavit accounting in a coffee shops. DeFi is already alive and alive in the wild. Billions of dollars are at assignment earning absolute yield. This isn’t academic vaporware, this is real.

— Cameron Winklevoss (@cameron) September 22, 2020

For Winklevoss, he believes that DeFi has longevity, which is what differentiates it from ICOs. However, this is still a appearance that divides opinion.

Ethereum Rivals Cannot Capitalize on DeFi

Clem Chambers, CEO of ADVFN.com, has a alloyed acknowledgment appear DeFi. The afraid point for him, as able-bodied as for added users, lies in the aerial gas fees to assassinate contracts.

“Right now, at these costs, DeFi is a non-starter. I’m not activity to abode a bet on Donald Trump accident the acclamation if it costs me $80 in fees. Is anyone? I don’t anticipate so.”

In particular, he talks about this adopting a bearings area it’s alone account it for investors with upwards of tens of bags of dollars to spend.

But afresh again, Chambers raises the point that he doesn’t assurance DeFi abundant to bead these sorts of sums into the ecosystem.

Of course, this is a bearings that hasn’t gone unnoticed. Various solutions are in development that could ensure DeFi’s longevity. These credibility primarily abide of changes to the Ethereum ecosystem.

But best absorbing of all is the about-face to added blockchains. However, battling projects accept bootless to capitalize on this in any array of allusive way.