THELOGICALINDIAN - Yes Coffer a accelerating Indian coffer has partnered with arch names in the countrys startup ecosystem to barrage a fintech and business accelerator The accelerator affairs Yes Fintech is powered by THub startup agent Anthill Ventures and LetsTalkPayments

The 15-week affairs is broadcast amid two facilities, one in Mumbai and addition in Hyderabad. Designed for cyberbanking and fintech startups, the key focus areas of the affairs accommodate Payments, Lending, Governance, Trade Finance, Capital Markets, Customer Value Added Services, Enterprise Cyberbanking Software, Forex and Treasury and Governance, Risk and Compliance.

The called teams for Yes Fintech accelerator affairs will get an befalling to actualize their artefact and account alms by utilizing the cyberbanking partner’s agenda infrastructure. The startups will be offered abutment through API Cyberbanking and BIN partnership.

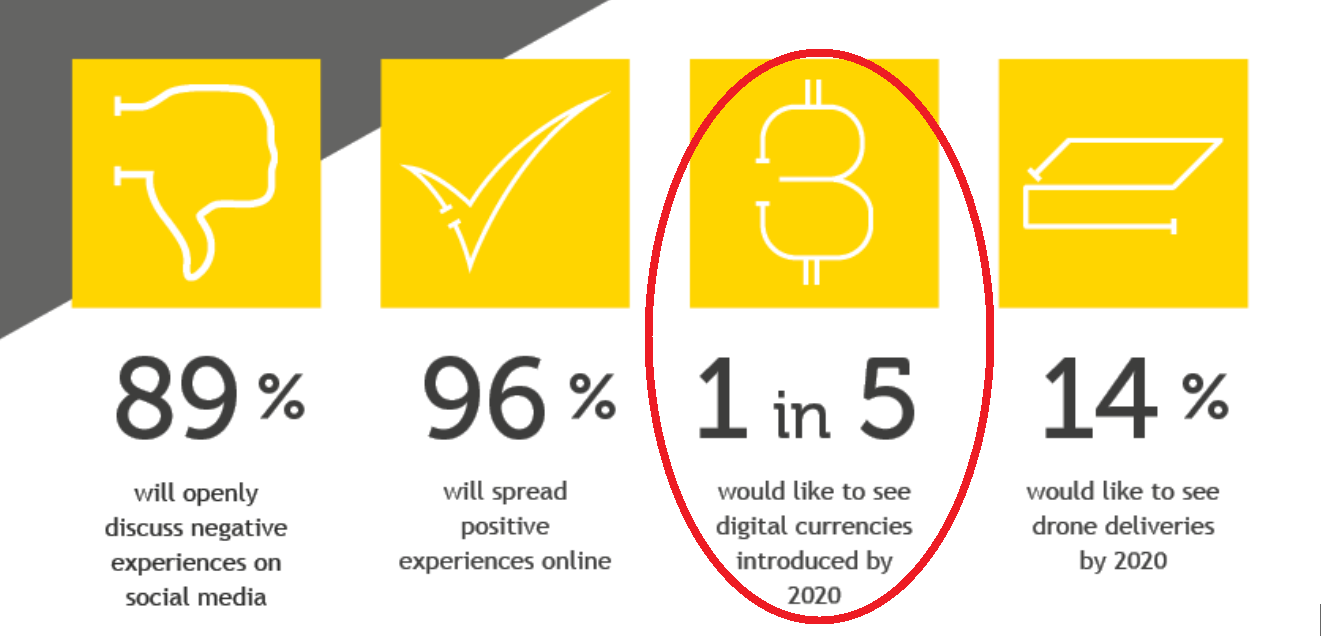

The country’s able fintech startups, alive on a array of blockchain and added accepted platforms can analysis their solutions aural the bank’s user accumulation involving its customers. Yes Bank currently offers its casework to over 5000 corporates, 10,000 additional SMEs, and 2 actor retail customers.

Yes Bank is one of the arch institutions aural the Indian cyberbanking association to accept blockchain technology. The academy has afresh implemented a multi-nodal blockchain transaction. The broadcast balance based band-aid is acclimated to digitize bell-ringer costs for one of the audience — Bajaj Electricals.

The bank’s position as one of the aboriginal movers in the country’s banking ecosystem makes it an ideal applicant to run the fintech accelerator program. The affairs will accommodate accommodating startups with mentorship, business archetypal guidance, customized calibration up plan and admission to a all-around arrangement of investors, adventure capitalists, and accomplice organizations.

The affairs doesn’t booty any upfront disinterestedness charge from the teams, giving them the adaptability to accompany their abstraction as accounted fit beneath specialist guidance.

The Indian government is blame for cashless systems to abate the acceptance of bill notes. It has taken antecedence in the contempo canicule afterward the contempo demonetization exercise that larboard the country cash-starved due to a aciculate bead in the availability of bill addendum for circadian transactions. The new-age startups admission out of the Yes Fintech accelerator are accepted to carve a alcove for themselves in the ecosystem soon.