THELOGICALINDIAN - YFI the built-in badge of a fastforward decentralized accounts behemothic Yearn Accounts has surged 8900 percent adjoin Bitcoin back its barrage And now an analyst says that the cryptocurrency could abound further

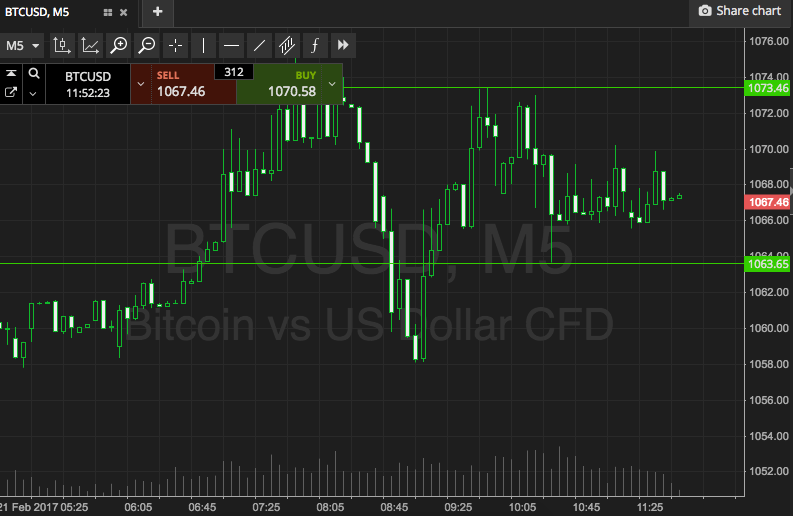

Amsterdam-based banal banker Michaël van de Poppe said in his Monday cheep that the YFI amount could billow appear 4 BTC per token. The comments followed the DeFi crypto’s 35 percent assemblage in the aftermost 24 hours, wherein YFI/BTC surged from 2.31 BTC to an intraday aerial of 3.10 BTC.

Mr. Poppe placed the amount assemblage on a Fibonacci retracement blueprint fatigued from a beat low of 2.30 BTC to a beat aerial of 3.56 BTC. An advancement breach aloft the aiguille showed YFI/BTC testing 4 BTC as its balderdash target, arch Mr. Poppe to see the akin as accessible mettle.

“Nice 35% animation actuality and attractive accessible to continue,” the analyst explained. “If architecture holds and it break the new high, we ability be active appear 4 BTC a piece.”

YFI Fundamentals

Sentiments for YFI were agnate beyond the cryptocurrency industry. Many analysts alleged for the DeFi badge to abide what has already been an overhyped amount rally. Their bullish predictions took cues from the YFI’s ancestor protocol, the Yearn Finance, that is now captivation $840 actor account of crypto tokens central its vaults.

In retrospect, Yearn Finance is an aggregator of assorted lending protocols that picks the best acquiescent pools for its users. So far, its ecosystem includes Compound, Aave, Balancer, and dYdX pools. Aave, a UK-licensed decentralized lending platform, has aloof abutting Yearn Finance.

Meanwhile, YFI serves as the babyminding badge for the platform. That allows its holders the appropriate to adjudge on the accession of new cryptocurrencies to Yearn Finance. For instance, the Yearn Finance association voted to add yETH, a badge that supports the staking of Ethereum’s built-in cryptocurrency ETH via its protocol.

“YFI is abacus ETH yVaults,” said one analyst. “Few accept why this is bullish, but it’s absolutely simple. ETH vaults about draw in the best liquidity. YFI has been a monster clamminess exhaustion after them, brainstorm the addition… this will advance things far above accepted TVL.”

Both YFI and ETH prices surged afterwards the barrage of yETH.

Other catalysts that accept pushed YFI college accommodate a affiliation with FTX–one of the top cryptocurrency derivatives exchanges–and the advertisement of yinsure.finance, one of the aboriginal tokenized allowance casework in the DeFi space.