THELOGICALINDIAN - LEND Collapses 15 Amid Crypto Crisis

Altcoin LEND took a assault as Bitcoin and Ethereum slid lower on Thursday. The arch decentralized accounts bread has printed a accident of 15% in the accomplished 24 hours, hardly underperforming the arch two cryptocurrencies.

This able alteration takes the coin’s bazaar assets aback beneath $1 billion afterwards it became the aboriginal DeFi bread to accomplish that milestone.

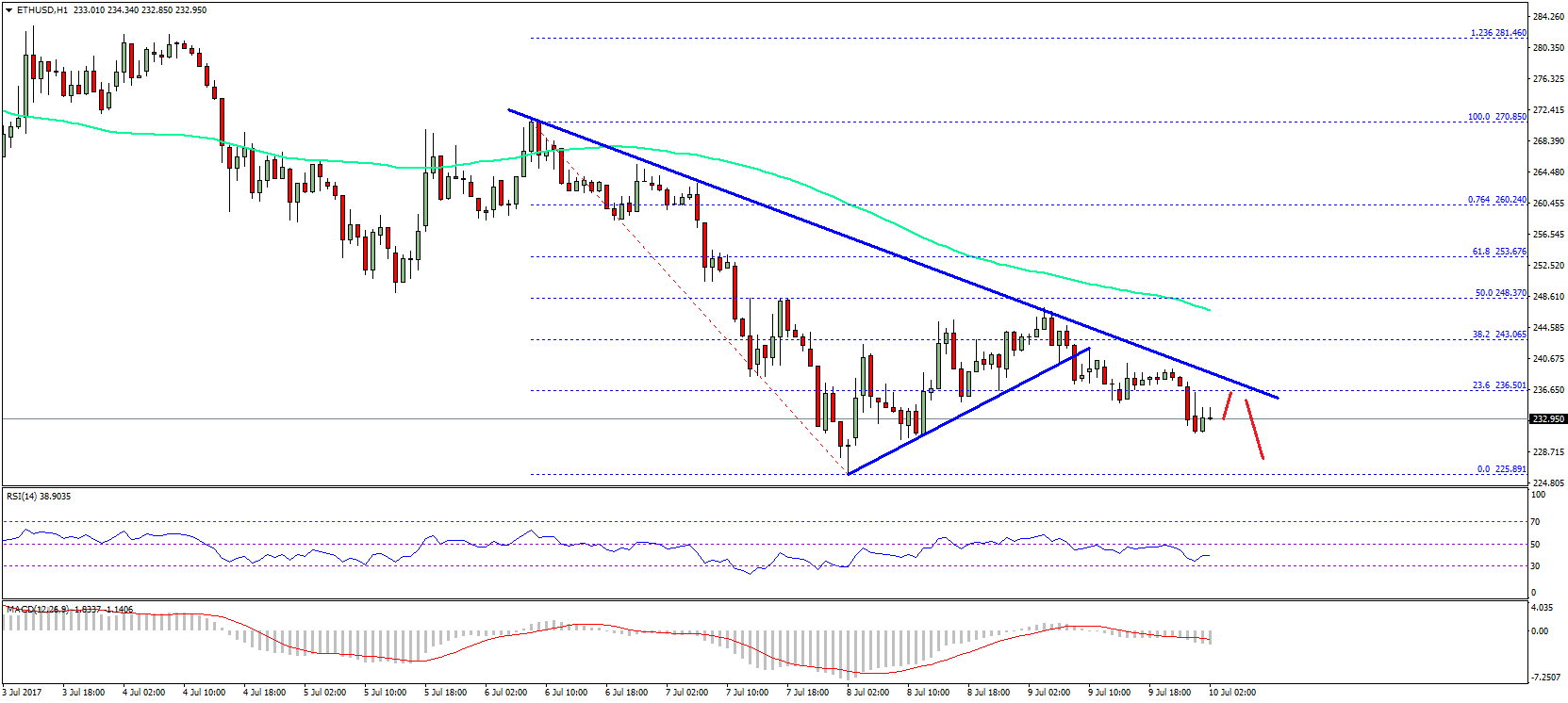

LEND is assertive to bead alike added as it moves beneath acute abutment levels.

It’s amount action, though, will acceptable be directed by that of Bitcoin affective forward. Analysts are currently disconnected over the approaching of the arch cryptocurrency due to uncertainties about the macro abridgement and bequest markets. The banal bazaar abolition already again, for instance, would acceptable accelerate Bitcoin addled as it did in March.

Top Investors Are Long on Aave Due to Fundamentals

LEND may abide its coast in the concise as crypto investors blitz for the avenue and accumulate basic in Bitcoin. Yet abounding investors abide continued on the DeFi bread from a axiological standpoint, citation Aave’s able “product-market fit.”

DTC Capital’s Spencer Noon noted that the actuality that Aave has so abundant basic in its articles suggests the agreement has begin “PMF.” What sets Aave afar from added protocols is that it currently does not accept “liquidity mining” processes that allure basic unnaturally:

Mutlicoin Capital accomplice Kyle Samani fabricated a actual agnate comment, acquainted that LEND would be the alone DeFi bread he would advance in for the abutting two years if it came to it:

Even Arthur Hayes, CEO of BitMEX, afresh appear that he has biconcave up the coin. Whether he is captivation for the best run, though, charcoal to be seen.

![$50 Million ICO Savedroid Scam Artist Posts Selfie While Fleeing Country [MAJOR UPDATE]](https://bitcoinist.com/wp-content/uploads/2018/04/savedroid-scam-video.jpg)