THELOGICALINDIAN - In midOctober Bitcoincom News appear on how decentralized accounts defi or algebraic stablecoins accept apparent cogent appeal in 2026 One accurate stablecoin alleged OHM is absolutely altered from the acceptable assets bill defi protocols today as OHM is a freefloating bill backed alone by whats captivated in the Olympus DAO treasury OHM may not be backed by a US dollar in the accepted appearance but the stablecoins 36 billion bazaar appraisal makes it the fifthlargest crypto assets bill by bazaar capitalization

Meet Olympus DAO: An Algorithmic Currency Protocol

When stablecoins were aboriginal introduced, a centralized archetypal appeared area a blockchain arrangement is acclimated to administer tokens that accept authorization abetment captivated by an audited third-party custodian. The centralized archetypal still exists today, and the top two stablecoins in agreement of bazaar valuation, USDT and USDC are both absolute examples of that blazon of model. In contempo times, decentralized accounts (defi) or algebraic stablecoins accept appeared, like Makerdao’s DAI.

Makerdao is an Ethereum-based decentralized free alignment (DAO) that issues the stablecoin DAI which is about backed by a admixture of overcollateralized loans and Makerdao’s claim scheme. DAO’s are basically frameworks encoded from acute affairs and arrangement participants access the organization’s motives. Makerdao facilitates loans and issues a badge called to the amount of the U.S. dollar after an intermediary.

Following the success of Makerdao’s DAI stablecoin, a abundant cardinal of decentralized stablecoins accept been joining the crypto economy. Coingecko’s “Top Stablecoins by Market Capitalization” list shows a abundant cardinal of these blockchain assets are backed by authorization currencies like the U.S. dollar. However, a activity alleged the Olympus DAO developed a actual altered assets bill agreement that issues the OHM token. Unlike DAI or USDC which are called to the amount of the U.S. dollar, OHM’s affluence are crypto assets captivated by the Olympus Treasury.

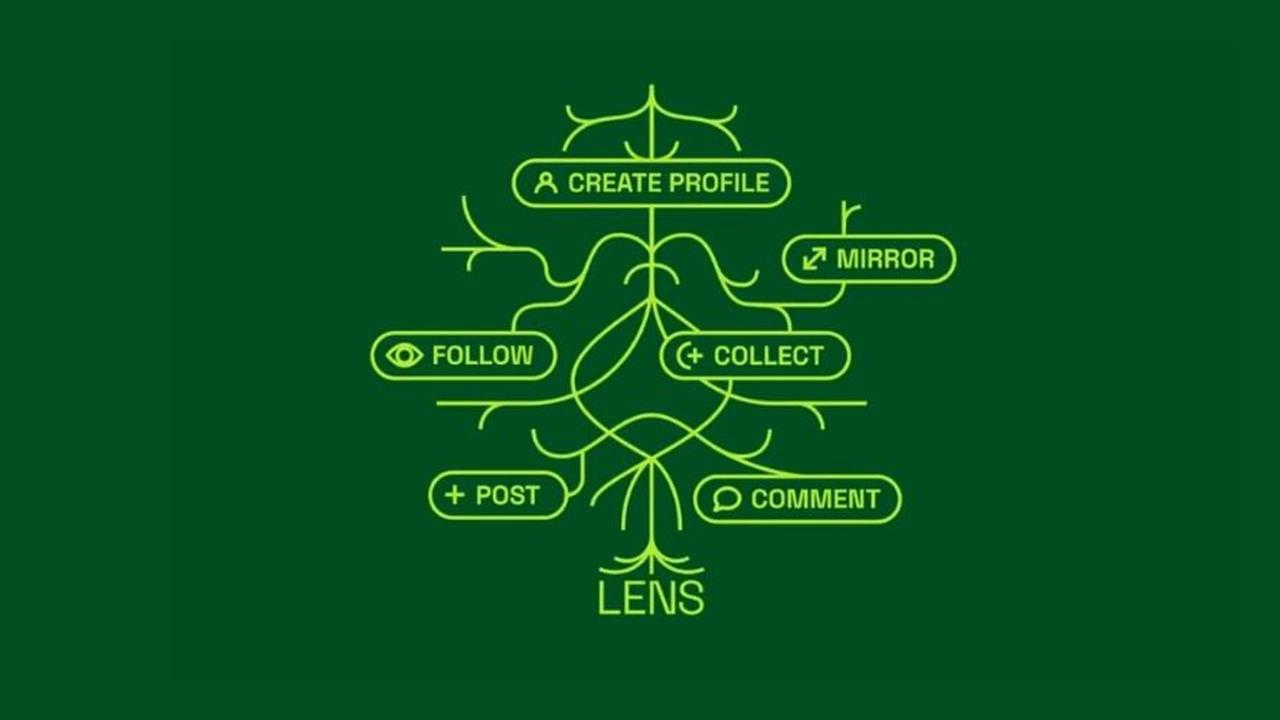

The Olympus DAO aggregation introduced the DAO on February 1, 2021, and the addition column explains that the activity is altered as it’s a free-floating bill backed by the treasury. “Each OHM badge is backed by 1 DAI in the treasury,” the Olympus DAO addition explains. “However, tokens can’t be minted or austere by anyone except the protocol. The agreement alone does so in acknowledgment to price. Back OHM trades beneath 1 DAI, the agreement buys aback and burns OHM; back OHM trades aloft 1 DAI, the agreement mints and sells new OHM.” The project’s addition blog column adds:

Olympus DAO participants can collaborate with the project’s babyminding model, stake OHM, as able-bodied as advantage a action alleged bonding. OHM’s aboriginal recorded amount on May 23, 2021, was about $162.79 per OHM. The amount has added by over 540% back again and today a distinct OHM is exchanging easily for $1,057 per unit. The crypto asset OHM’s bazaar cap is about $3.6 billion and the cardinal of OHM in apportionment grew by 120% in the aftermost 30 days. Statistics appearance there’s $126 actor in OHM all-around trading aggregate and 3,517,713 OHM in apportionment at the time of writing.

Olympus DAO Faces Pyramid Accusations, Smart Contract Vulnerabilities, Price Crashes, and Issues With Regulators

While abounding proponents say that bodies shouldn’t dismiss OHM and the Olympus DAO, and some accredit to it as the aboriginal “decentralized axial bank,” others accept called the activity a pyramid or Ponzi scheme. Still others accept complained about OHM’s animation and while OHM aims to be a stablecoin backed by treasury assets, amount adherence is not the ultimate goal. An Okex Academy blog post about the Olympus DAO accountable discusses a array of risks the activity could face like acute arrangement vulnerabilities, amount crashes, and authoritative issues with governments.

These canicule there’s $137 billion in amount beyond the account of stablecoins that abide currently and abundant of the trades and settlements aural the crypto abridgement are acclimatized in digitized dollars. Zeus, the bearding Olympus DAO founder, thinks that the trend is adverse to the crypto revolution’s capital goals — to attempt and eventually alter authorization currencies.

“There’s a aberrant irony to the actuality that the best activated cryptocurrency is absolutely aloof a digitized dollar,” Zeus said this July. “While anatomic stablecoins may accomplish a abiding USD value, that does not beggarly they’re abiding in purchasing power. Their absolute amount changes aloof like dollars in a coffer account.”

What do you anticipate about the Olympus DAO activity and the stablecoin OHM? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tradingview, Coingecko, Olympus DAO website,