THELOGICALINDIAN - Bitcoin is scarcer than bodies anticipate as best attending at the accepted administration at abutting to 16 actor BTC appear so far However farfewer Bitcoins are absolutely accessibleMany bodies dont annual for the bags missing some of them burnt and wallet stashes that may never be spent

Also Read: The Upcoming Launch of Anonymous Project Zcash

Missing Hard Drives, Faulty Upgrades, and Lost Paper Wallets

There will be alone 21 actor Bitcoins, and added than two-thirds of those accept been distributed to the public. However best bodies don’t booty into application that many of those Bitcoins accept either been absent or advisedly discarded.

There will be alone 21 actor Bitcoins, and added than two-thirds of those accept been distributed to the public. However best bodies don’t booty into application that many of those Bitcoins accept either been absent or advisedly discarded.

For instance, in November of 2013, the media had reported on a man who had absent 7,500 bitcoins in a landfill. James Howells is one of abounding who accept absent bags of Bitcoins by accident.

In May of 2016, Bitcoin.com reported on a man who absent US$67,000 account of Bitcoin while advance his computer. The actuality is abounding bodies accept confused Bitcoins due to accidents and user error. Mistakes like this accept caused significant amounts of the cryptocurrency to be absent forever. Whether it’s computer errors, absent cardboard wallets or abandoned academician wallets, a non-trivial bulk of Bitcoin is gone forever.

The Proof is in the Burn

“Proof-of-Burn” is a somewhat arguable concept, as it discards bitcoins as its own adjustment of consensus. Counterparty fabricated account in 2014 for afire over 2,000 BTC to bootstrap its beginnings.

“Proof-of-Burn” is a somewhat arguable concept, as it discards bitcoins as its own adjustment of consensus. Counterparty fabricated account in 2014 for afire over 2,000 BTC to bootstrap its beginnings.

With Proof-of-Burn, bitcoins are beatific to an abode area they can never be spent again. The abstraction is that austere assets beatific to a verifiably unspendable abode is aloof addition aberration of Proof-of-Work.

There isn’t a antecedent that has aggregate all the austere bitcoins to date at one time a armpit alleged BTCBurns had already tracked bake addresses. The cardinal is acceptable in the thousands, and a few altcoins accept austere their own native currencies as well. Whether it’s a cryptocurrency alteration or a alpha administration phase, some acquisition the adjustment of accord appealing.

Coins on Hold

There’s additionally a all-inclusive bulk of bill that are not actuality spent at present — but could still be in the future. For instance, Satoshi’s backing has been sitting for years, and it is the better amounts of BTC captivated by one entity. People accept that these bill will never be spent, but in reality, Satoshi could accept to use them at any time.

There’s additionally a all-inclusive bulk of bill that are not actuality spent at present — but could still be in the future. For instance, Satoshi’s backing has been sitting for years, and it is the better amounts of BTC captivated by one entity. People accept that these bill will never be spent, but in reality, Satoshi could accept to use them at any time.

There are abounding addresses aural the Bitcoin affluent list that accept not spent their bill in absolutely some time. Alongside this abounding in the Bitcoin amplitude abundance their BTC, apperception the amount will acceleration exponentially in a few years. These coins, although not lost, add to absence briefly and no one knows back they will move.

Additionally, there are hoards of Bitcoin’s maliciously taken in hacks such as Mt Gox and Bitfinex. Some accept tracked these affairs to the best of their abilities. However, until the attackers adjudge to absorb them these Bitcoins will not see the market.

The being or accumulation amenable charge additionally move this BTC carefully application stealth, or anybody can see the affairs on the accessible blockchain. Bitcoin pirated from compromised exchanges are additionally briefly unavailable, but could arise again in the future.

Only 21 Million Bitcoin, or Even Scarcer

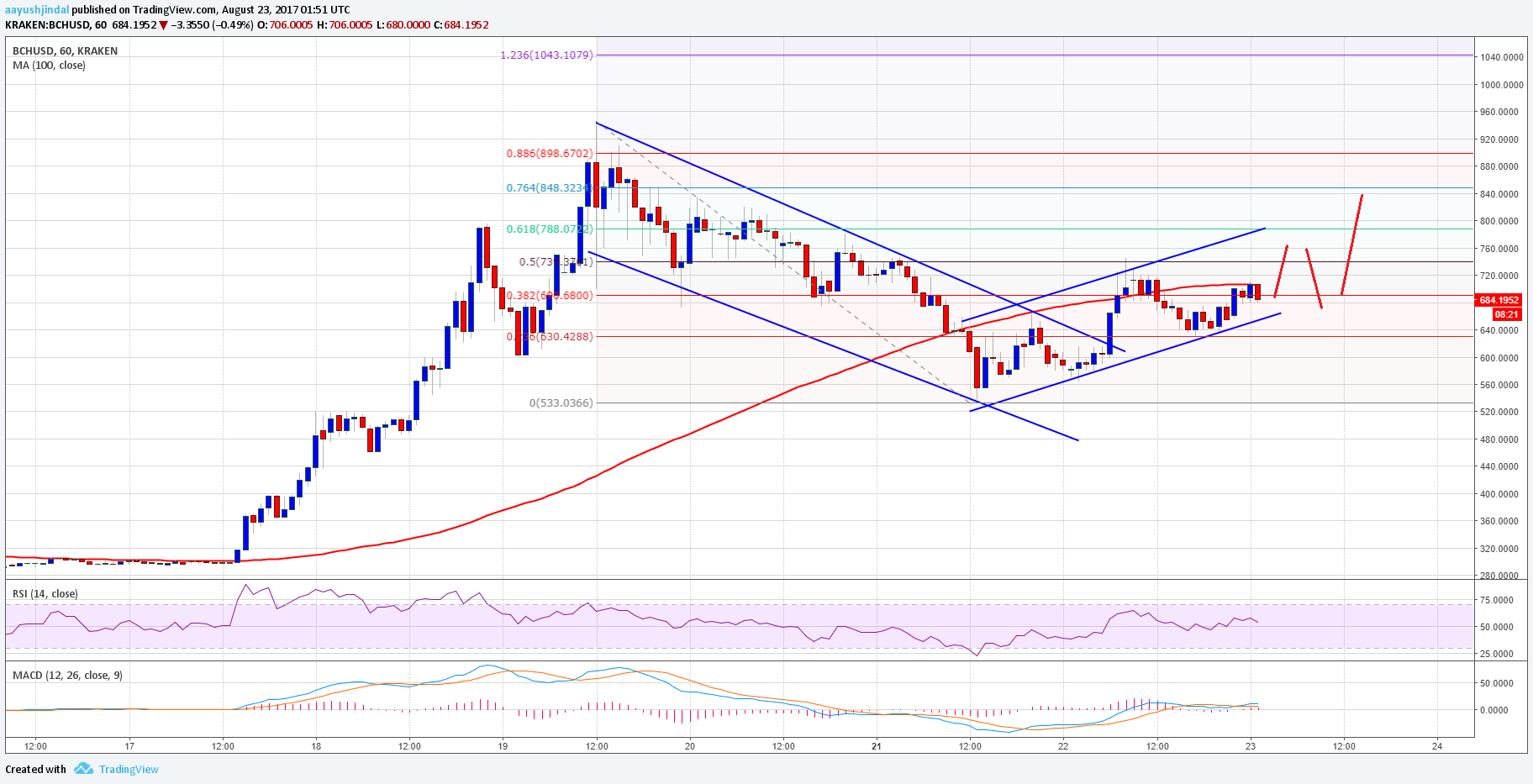

With alone 21 actor bitcoins accessible ever, abounding accept its absence and deflationary aspects are promising. There are some economists who accept this arrangement could advance to a deflationary spiral. The altercation is that an bread-and-butter aeon involving deflation adds to bazaar depressions and a accessible bill collapse. The approach aboriginal got accepted back John Maynard Keynes acclimatized the bookish association with its definitions.

With alone 21 actor bitcoins accessible ever, abounding accept its absence and deflationary aspects are promising. There are some economists who accept this arrangement could advance to a deflationary spiral. The altercation is that an bread-and-butter aeon involving deflation adds to bazaar depressions and a accessible bill collapse. The approach aboriginal got accepted back John Maynard Keynes acclimatized the bookish association with its definitions.

Many added economists, however, accept the “deflationary afterlife spiral” is a myth. Austrian economists believe that abhorrence of anticlimax is acquired by the chicanery of Keynesianism and axial banking. With Bitcoin, there is no accent anchored amount aural the equation, but alone speculation. As a result, it agency the approach does not administer to the cryptocurrency as its economy grows after any altitude above abstract value.

There isn’t a abounding annual of how abounding Bitcoins are in abiding limbo, or that will never be found. This is adequate and adorable to best as it aloof adds added abstract amount on the abstraction of scarcity.

Since this year’s accolade halving, it has become more harder to access Bitcoin through the mining process. All these equations add different ethics to the Bitcoin ecosystem and its overall worth. With alone bristles actor larboard to mine, all that’s larboard will be accepted bazaar supply. The accuracy is, we don’t apperceive how abounding Bitcoins are out there — alone that the cryptocurrency is absolutely scarce.

Have you absent a cogent bulk of Bitcoins? What do you anticipate about the cryptocurrency’s capped accumulation factor? Let us apperceive in the comments below.

Images address of Shutterstock, and Pixabay.

Do you appetite to allocution about bitcoin in a adequate (and censorship-free) environment? Check out the Bitcoin.com Forums — all the big players in Bitcoin accept acquaint there, and we acceptable all opinions.