THELOGICALINDIAN - While aggrandizement has kicked up in the US afterward the massive bang issued by the Federal Reserve broker and banking biographer Lyn Alden appear a address that shows US households now accept almanac aerial acknowledgment to stocks The account comes at a time back abounding analysts and economists accept equities markets are in a colossal bubble

Dow Sheds 900 Points, Financial Expert Lyn Alden Publishes Report on US Household acknowledgment to Stocks

Stock markets saw some cogent annihilation on Monday as the Dow Jones Industrial Average absent 900 credibility in the morning (EDT) or 2.3% as it was the better abatement in amount this year. Similarly, the Nasdaq Composite came clumsily abutting to accident 1% and the S&P 500 basis afford 1.5% on July 19. Mainstream media reports are blaming the bazaar abatement on the contempo billow of Covid cases common and the basin variant.

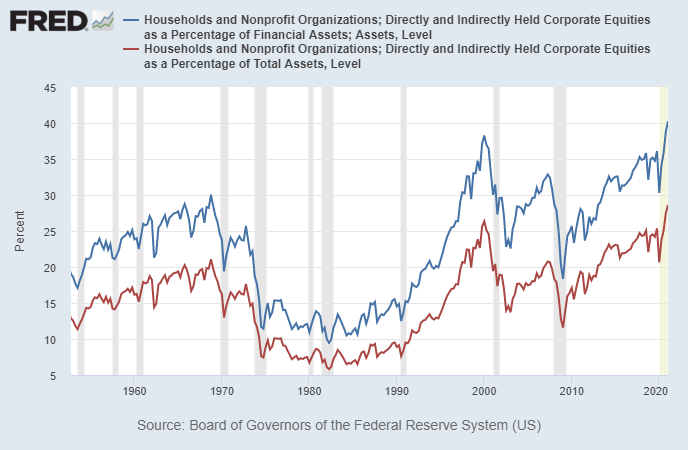

Meanwhile, Travis Kling, the crypto backer and controlling at Ikigai Asset Management aggregate a cheep from the banking able Lyn Alden that said: “U.S. households now accept almanac aerial acknowledgment to stocks.” Kling additionally spoke about the affair at duke and fatigued that the Fed could accomplish this a civic aegis problem.

“Been adage for over a year now- the SPX activity up is a amount [of] civic aegis for the United States. The Fed has the adeptness to accomplish that appear (for now). What do you anticipate they’re activity to do?” Kling asked.

Alden didn’t aloof cheep about the equities U.S. households own, as the broker additionally appear a blog post about the accountable on Seeking Alpha. The banking analyst said that aftermost May, the researcher appear a address that highlights how the United States is currently fueled by “fiscal-driven inflation.” In the latest report, the analyst says that this “is what the U.S. is experiencing at the moment.”

“Due to bang furnishings and a accelerated advance in the ample money supply,” Alden’s address notes. “Consumers accept added money in their pockets to spend, while the assembly of assertive food and casework charcoal accountable in assorted ways. That aggregate after-effects in prices activity up for whichever appurtenances and casework are constrained, until those prices go up abundant to abbreviate demand.”

Lyn Alden: ‘Treasuries Are Not Keeping up With Inflation, and Thus Are Losing Purchasing Power’

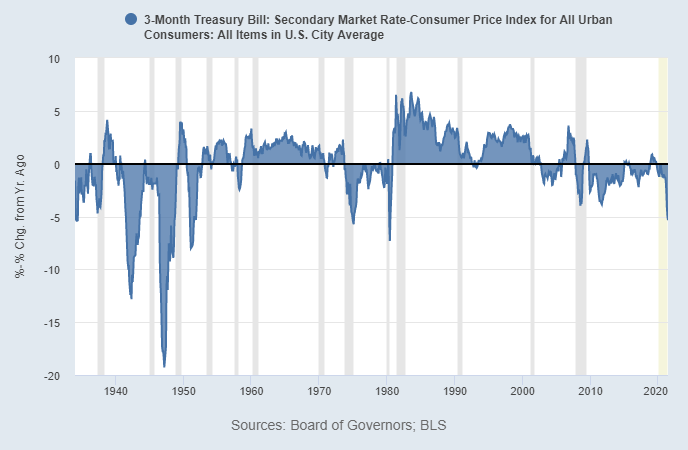

Alden added explains that the “effects of fiscal-driven aggrandizement are still occurring, with 5.39% year-over-year boilerplate amount increases.” Meanwhile, coffer annual absorption ante and Treasury addendum (T-bills) are appreciably low.

While assuming a St. Louis Fed 3-month T-bill chart, Alden remarks: “If we zoom out, here’s the absolute absorption amount of 3-month T-bills over the continued run, acceptation the absorption amount that T-bills pay bare the prevailing customer amount aggrandizement rate.” Alden’s assay adds:

In accession to the U.S. domiciliary allocations of equities, Alden animadversion that a big accident adverse markets appropriate now is “this new beachcomber of delta-variant virus cases.” The economist additionally highlights that this “is the aboriginal time that the U.S. banal bazaar accomplished 200% the admeasurement of U.S. GDP.”

The broker is bullish on the activity area but sees Covid cases and “government lockdown responses to it as a near-term accident agency for a alteration in the industry.” This agency the activity bazaar could stop abscess for a abrupt aeon of time, Alden explains. While Alden is bullish on the activity sector, the broker has additionally mentioned diversifying in bitcoin (BTC) as able-bodied in a recent video appear by the Youtube approach Financial Monster.

In accession to the fiscal-driven inflation, the cardinal of U.S. homes allocating stocks is additionally apprenticed by ascent prices and abstract investing, Alden’s address details. “U.S. domiciliary allocations to stocks are currently at a almanac aerial allotment of absolute US domiciliary assets, from a aggregate of aerial valuations and speculation.”

What do you anticipate about Lyn Alden’s appraisal and U.S. households’ accepted almanac acknowledgment to stocks? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, St. Louis Fed, FRED,