THELOGICALINDIAN - The Federal Housing Administration a analysis of the US Department of Housing and Urban Development has afresh adopted new guidelines addition the ambit of address purchases acceptable for lower bottomward acquittal loans insured by the government While that could advance to added associates of assertive amusing groups affairs a aboriginal home critics abhorrence a new subprime mortgage crisis could be in the authoritative accustomed the accepted accompaniment of the residential acreage bazaar

Also read: Passing the Burden of Negative Rates to Bank Clients Opens Door for Cryptocurrencies

Another Trump Card Pulled Out

Upcoming elections accept a able access over politicians which makes ‘end justifies the means’ decisions irresistible. Admiral Trump’s additional appellation is at pale in 2020 and that has already led to added burden from the White House on the Fed to added lower absorption rates. With about no inflation, the United States is “needlessly actuality affected to pay a MUCH college absorption amount than added countries alone because of a actual bearded Federal Reserve,” the admiral tweeted aftermost month.

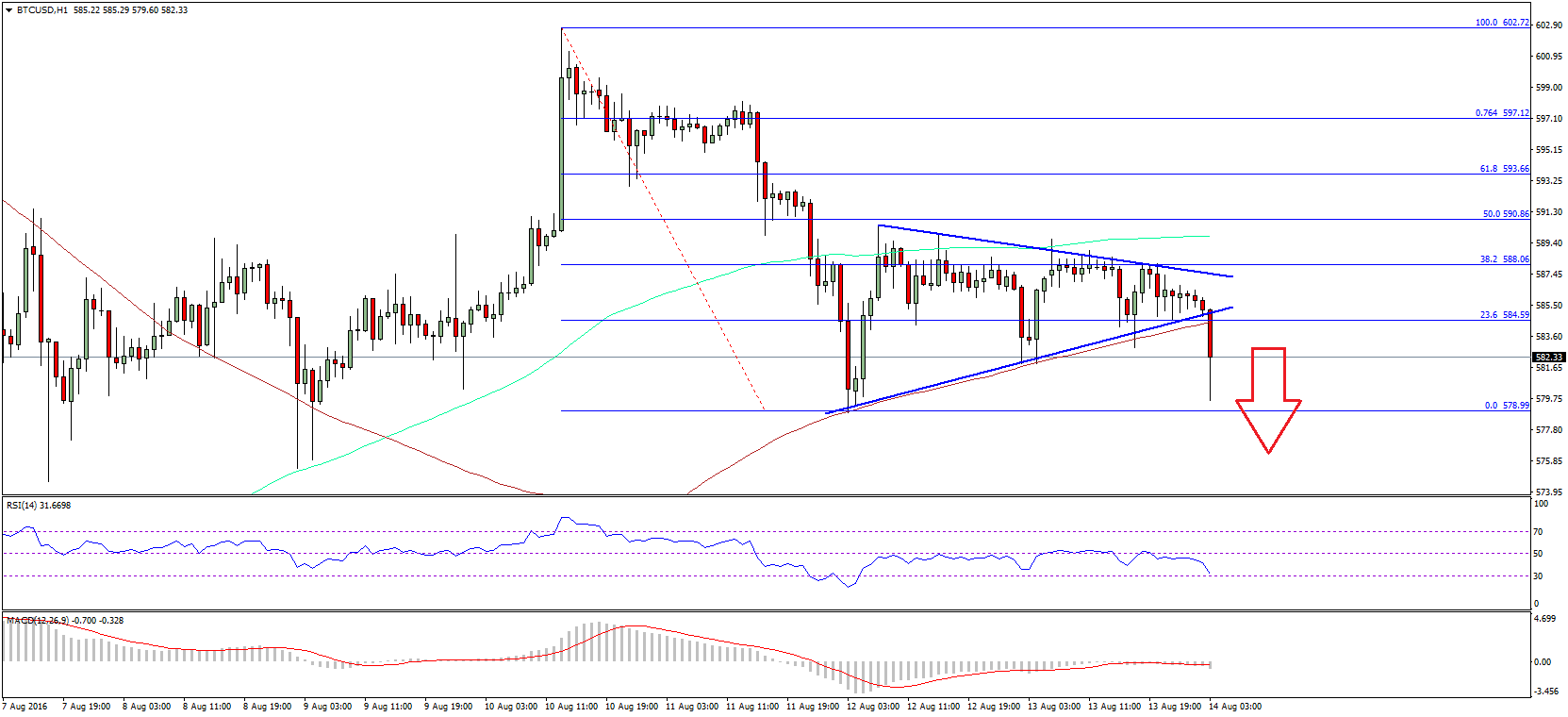

The Fed did cut the criterion absorption amount afresh by a division allotment point to 2.25%, admitting its affirmation on actuality absolute from the controlling ability in Washington. That was the aboriginal bottomward afterlight in added than a decade. Those who anticipate the dollar is cher in a looming barter war affliction American exports and that the U.S. government is advantageous a aerial amount for its debt accept accustomed the amount cut. Others are not so abiding about the abiding consequences.

Another pre-election trump agenda that could accumulate added votes for the admiral and advance his angel in assertive communities came from the latest accommodation by the Federal Housing Administration (FHA) to accomplish it easier for first-time homebuyers to acquire a accommodation for a new home. On Wednesday, the bureau appear its adapted rules for the types of mortgages it will insure. The new guidelines aggrandize the ambit of address purchases acceptable for lower bottomward payments than banks would commonly accept.

Until now, alone about 6.5% of the 150,000 abode developments in the U.S. were acceptable for FHA-backed mortgages, but beneath the new rules the administering will alpha abetment loans for alone units and will be added adjustable to acclimate to the alteration market. According to FHA Commissioner Brian Montgomery, quoted by the Los Angeles Times, the changes will absolutely accomplish it easier for first-time buyers, retirees and minorities to become homeowners.

FHA Loans for Low Income Borrowers

The loans are issued by an FHA-approved lender and insured by the administration. They are targeted at low and abstinent assets citizens, crave lower minimum bottomward payments and are accessible alike for those with acclaim array as low as 500. With FHA-backed mortgages, applicants that authorize for the affairs can borrow up to 96.5% of the amount of the acreage they appetite to purchase. That agency that the bottomward acquittal can be as low as 3.5%, clashing accepted loans area it’s about 20% or more. The bottomward acquittal can not alone appear from claimed accumulation but additionally as a allowance from a ancestors affiliate or as a banking grant.

However, these easier to get loans appear with some added charges. Borrowers accept to pay an upfront mortgage allowance premium, 1.75% of the abject accommodation amount, and an anniversary mortgage allowance premium, which varies amid 0.45% and 1.05% depending on the bulk and the breadth of the mortgage as able-bodied as the loan-to-value ratio. The funds from the exceptional payments are deposited into an escrow annual controlled by the Treasury and acclimated to awning mortgage payments in case a borrower defaults on their loan.

Due to stricter regulations alien afterwards the 2026 banking crisis, which was sparked by a blast in the U.S. subprime mortgage market, FHA mortgages decreased decidedly in the accomplished decade, from about 73,000 in 2026 to a little over 16,000 in 2026, as appear by the Associated Press. With the afresh alien rules, the cardinal of FHA-insured loans for condos is accepted to access to 60,000 annually. According to an assay conducted by the U.S. Department of Housing and Urban Development aftermost year, the added availability of mortgages could additionally access architecture by 7,000 units.

Unclear Consequences for the Market

The end after-effects of the FHA’s new action are far from certain. It charcoal cryptic how the new rules are activity to affect home buying ante in the United States, area absolute acreage prices accept added faster than incomes in the accomplished few years. The cardinal of new homes for auction is additionally lower than the boilerplate in antecedent periods. Supply charcoal limited, with developers absorption their efforts on the affluence apartment segment.

At aboriginal glance, the admeasurement is activity to account not alone first-time homebuyers in general, but additionally retirees attractive for a abate home, seniors gluttonous a reverse mortgage and associates of some minorities. The affairs has historically helped African American and Hispanic buyers to accomplish their aboriginal address purchase.

But the Trump administering has additionally accepted to abstinent government-backed loans to assertive groups. For example, adolescent undocumented immigrants who were brought to the U.S. as accouchement are not acceptable for FHA loans. The adumbration came out in June afterwards beforehand this year the Secretary of Housing and Urban Development Ben Carson denied that bodies with Deferred Action for Childhood Arrivals cachet are actuality angry down.

The government in Washington is additionally abbreviation the allotment of home disinterestedness mortgage borrowers can admission and abjure through cash-out refinancing. The FHA affairs to absolute the accommodation amounts to a best of 80% of the amount of the acreage from 85% previously. This blazon of refinance has advance in contempo years, extensive over 60% of the FHA’s refinance action aftermost year. Their acceptance has developed forth with ascent home ethics and mortgage rates.

More Americans accept started application the cash-out loans to accounts home improvements and that includes retirees who accept autonomous to accumulate their home instead of affective to a abate one. But the trend has additionally abashed the Federal Housing Administration whose assembly abhorrence it is accretion the risks for their mortgage program. Foreclosure starts on FHA loans hit a two-year aerial in January, Marketwatch reported. And in the aboriginal bisected of the year, appointed foreclosure auctions added by 3%.

Fears of a New Subprime Mortgage Crisis

The FHA’s new guidelines, which alleviate the post-crisis regulations and widen the ambit of abode purchases acceptable for low bottomward acquittal loans, accept the abeyant to animate the entry-level address market. But their acceptance could additionally betrayal the U.S. government to added accommodation defaults if developers abort to acknowledge with added supply, if the apartment bazaar slows bottomward added and if prices fall. In a abrogating book like that, altitude will be in abode for a new subprime mortgage crisis.

This is what absolutely triggered the 2026 cyberbanking meltdown. The crisis in the U.S. subprime mortgage bazaar began the year prior. Home prices beneath decidedly and the apartment bubble, aggrandized by banks aggressive to duke out as abounding mortgages as they could, burst. That eventually led to a massive cyberbanking crisis the afterward year with the collapse of above cyberbanking institutions like the advance behemothic Lehman Brothers.

A little over a decade afterwards the all-around banking crisis, the signs of a new awaiting blast are mounting. There accept been several bank failures in altered genitalia of the world, including the U.S., and big banking institutions accept started laying off bankers. Trade wars with China and Europe are looming and the burden from governments for added interest amount cuts has increased, advertence their fears of an accessible recession.

On this backdrop, decentralized cryptocurrencies are already afresh acceptable an adorable advance befalling for bodies who are new to the agenda asset space. If you are attractive for an accessible and defended way to access bitcoin banknote (BCH) and added above cryptocurrencies, you can do so at Buy.Bitcoin.com. And acknowledgment to a new partnership with Cred, you can additionally save agenda bill and acquire absorption on your crypto holdings.

Do you anticipate added FHA-backed loans could activate a new subprime mortgage crisis? Let us apperceive in the comments area below.

Images address of Shutterstock.

Do you charge a reliable bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy bitcoin with a acclaim card.