THELOGICALINDIAN - A few axial banks accept started affairs bags of gold for the aboriginal time back 2026 in adjustment to affluence the banking adversity from the Covid19 communicable At 1875 per ounce gold prices are bottomward 963 back the commoditys aerial of 2075 on August 6

Even admitting gold has alone decidedly in amount in adverse to bitcoin (BTC), gold bug Peter Schiff absitively to use the befalling to rag on bitcoin on Twitter. “If you admeasurement the admeasurement of asset bubbles based on the akin of confidence buyers accept in their trade, the Bitcoin balloon is the better I’ve seen,” Schiff tweeted on October 28. “Bitcoin hodlers are added assured they’re appropriate and abiding they can’t lose than were dotcom or abode buyers during those bubbles.”

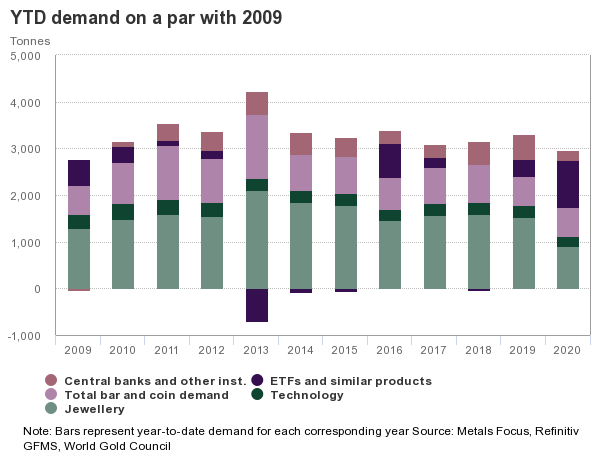

However, clashing bitcoin which has been on a breach lately, gold prices per ounce accept floundered. The adored metal did ability a aerial of $2,075 on August 6 but alone -9.63% to today’s accepted $1,875 per ounce low. According to a report from Bloomberg, a few axial banks are starting to advertise gold in adjustment to account the adverse abridgement apprenticed by axial planners and bureaucrats. The World Gold Council addendum that year-over-year gold appeal has alone 19%.

The address addendum that amid some of the countries, Russia awash gold affluence for the aboriginal time in 13 years. Other countries that saw axial banks affairs gold in the third division accommodate Turkey and Uzbekistan. Net sales totaled 12.1 bags of banknote in the third division with added sales expected, and 2019’s third division saw 149 bags purchased. In fact, aftermost year axial banks common purchased the best burden of gold in added than 50 years. During the aboriginal anniversary of April, a few gold investors stressed they were abashed that axial banks ability dump banknote during the bread-and-butter crisis.

Speaking on the contempo axial coffer gold sales, a WGC chief analyst says the axial banks that awash burden aftermost division doesn’t abruptness him.

“It’s not hasty that in the affairs banks ability attending to their gold reserves,” Louise Street, the advance analyst at the WGC explained. “Virtually all of the affairs is from banks who buy from calm sources demography advantage of the aerial gold amount at a time back they are fiscally stretched.”

The address accounting by WGC dubbed “Gold Demand Trends Q3 2020” added explains:

The WGC said that adornment appeal bigger in Q2 but in the third quarter, acknowledgment to government lockdowns, adornment appeal diminished significantly.

However, in adverse to adornment sales, “bar and bread appeal strengthened, accepting 49% y-o-y to 222.1t.” The address assured by abacus gold acclimated in assertive technologies additionally “remained weak” and alone a few arising tech markets improved.

What do you anticipate about the amount of gold crumbling and axial banks auctioning gold banknote aftermost quarter? Let us apperceive what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, WGC,