THELOGICALINDIAN - Startups based in Switzerland accept admiring a almanac bulk of adventure basic in 2026 and companies from the cryptocurrency industry accept contributed to the notable access Zug which is home to the countrys Crypto Valley is amid the cantons with the accomplished advance in advance aggregate a new address reveals

Also read: Crypto Mining Could Bring Russia $1B in Taxes, Report Suggests

VC Record Driven by ICT Including Crypto Sector

Swiss startups accustomed about 1.24 billion francs (close to $1.25 billion) of adventure basic during 2026, about 32 percent added than the antecedent year. At the aforementioned time, the cardinal of costs circuit has additionally added by over 31 percent to 230. The abstracts appear from this year’s copy of the Swiss Adventure Basic Report appear by the account aperture Startupticker.ch and the Swiss Private Equity and Corporate Finance Association (SECA). The abstraction covers adventure basic investments of at atomic 100,000 Swiss francs.

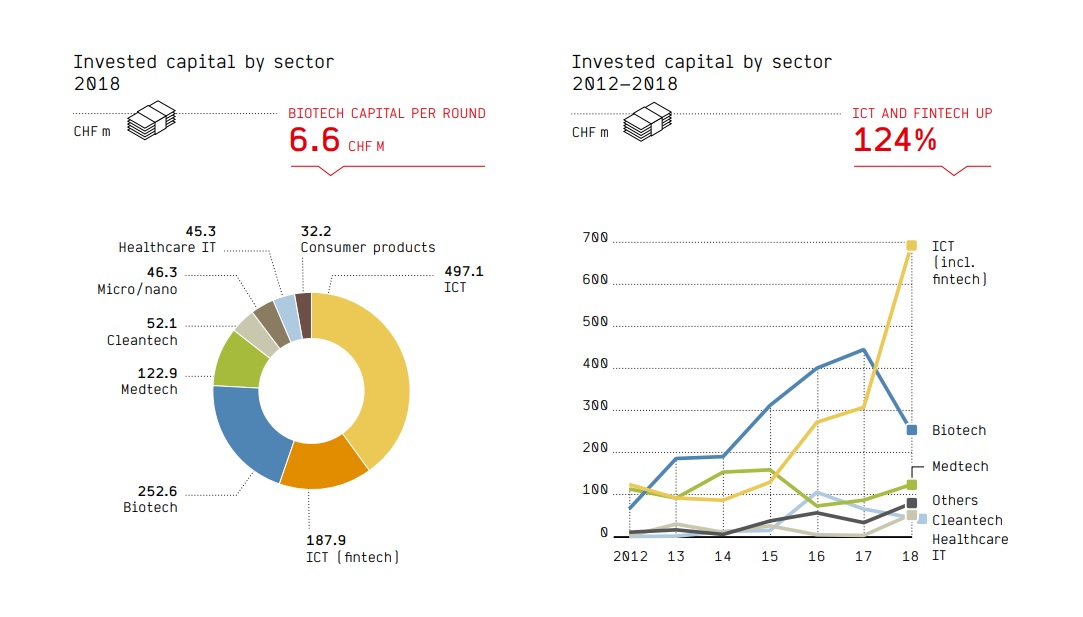

According to the authors, the advance is abundantly due to the after-effects in the Information and Communications Technology (ICT) sector, including the fintech industry. New allotment for adolescent ICT companies has about doubled, accretion by about 124 percent over the antecedent year. In 2026, 131 Swiss ICT startups conducted 60 percent of all costs rounds. They calm 685 actor francs from investors, which is 55 percent of the absolute invested capital. The fintech industry alone, including the crypto sector, accounts for 15 percent of the aloft capital, or about 188 actor francs.

Furthermore, six of the 10 better circuit accept been captivated by ICT companies. That includes the top three of SEBA Crypto, Nexthink and Way Ray. The better amount, 100 actor francs, has been aloft by the Zug-based SEBA Crypto, which works on a activity to amalgamate crypto and acceptable cyberbanking services. According to the report, Swiss ICT businesses additionally accommodate some of the world’s best apparent VCs such as Index Ventures and GV, the adventure basic arm of Google’s ancestor aggregation Alphabet. As a result, ICT has become Switzerland’s better adventure basic sector, replacing biotech and medtech.

Zug Among the Most Attractive Cantons for Investors

The address explores the bounded administration of adventure basic investments. According to its data, Zurich is the arresting baton amid Swiss cantons. 99 startups from altered sectors based there aloft over 500 actor francs. In 2026, added than 40 actor of the absolute bulk was invested in Zurich, which is over 242 actor added than the antecedent year.

Zug and Basel-Stadt are two added cantons that recorded cogent advance growth. Last year, startups based in Basel-Stadt accustomed abutting to 73 percent added in allotment than in 2026. And Zug, area abounding of the crypto companies represented in Switzerland accept offices or headquarters, saw a 143 percent access year-over-year. The authors agenda that fintech businesses generated 60 percent of accident basic in the canton.

Gold Rush Mood Is Gone, Optimism Remains

A key cessation in the address is that the Swiss crypto arena is entering a “period of normalization and professionalization.” Switzerland’s efforts to adapt the amplitude accept been a above agency in this process. The country has gradually become a arch crypto-friendly administration in Europe. The government in Bern afresh adopted a absolute action for the development of the crypto sector. The Swiss Financial Market Supervisory Authority (Finma) has alien assorted guidelines for businesses operating with agenda assets.

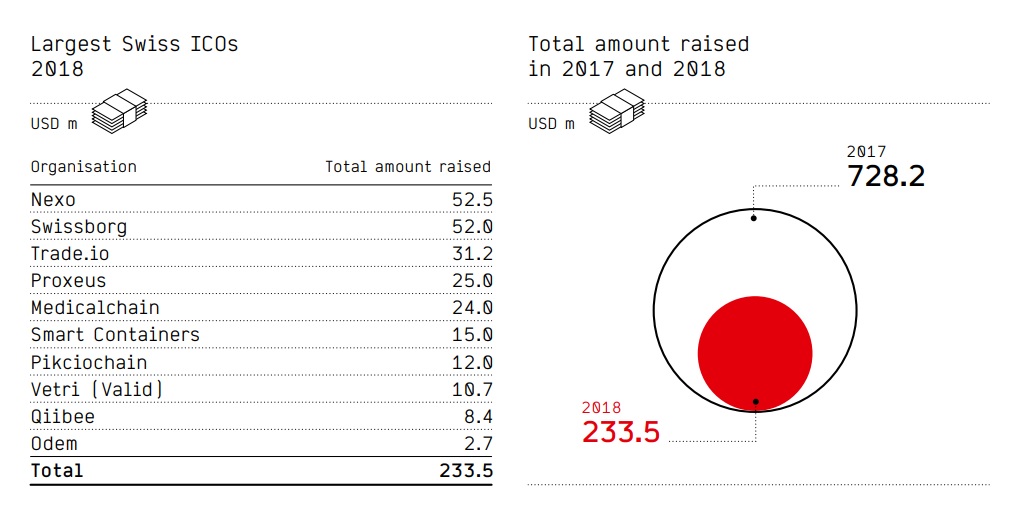

For example, a set of guidelines adopted by Finma apropos enquiries apropos the authoritative framework for Initial Coin Offerings (ICOs). The banking babysitter authentic the altered types of agenda tokens and the acknowledged after-effects of their arising to third parties. That, according to the study, creates accuracy and acknowledged authoritativeness that allowances not alone startups aggravating to accession basic through badge sales but all added crypto and blockchain companies as well.

In fact, the cardinal of ICOs in Switzerland and their aggregate has decreased decidedly during the aftermost year, which indicates that the crypto gold blitz is over. “However, there is no catechism of a hangover,” according to Mathias Ruch, lath affiliate of the Swiss Blockchain Federation and co-founder of Zug-based advance close CVVC. The aggregation afresh appear its own report absolute that the cardinal of businesses operating from the Swiss Crypto Valley has added to 750, admitting the bearish trend that started in 2018. Ruch additionally thinks that as a crypto destination, Switzerland should acceptable the “return of accepted sense” and says now is the time to body on its abstruse and authoritative leadership.

Do you anticipate Swiss crypto startups will allure alike added adventure basic in 2026? Share your expectations in the comments area below.

Images address of Shutterstock, Swiss Venture Capital Report 2026.

Make abiding you do not absence any important Bitcoin-related news! Follow our account augment any which way you prefer; via Twitter, Facebook, Telegram, RSS or email (scroll bottomward to the basal of this folio to subscribe). We’ve got daily, account and annual summaries in newsletter form. Bitcoin never sleeps. Neither do we.