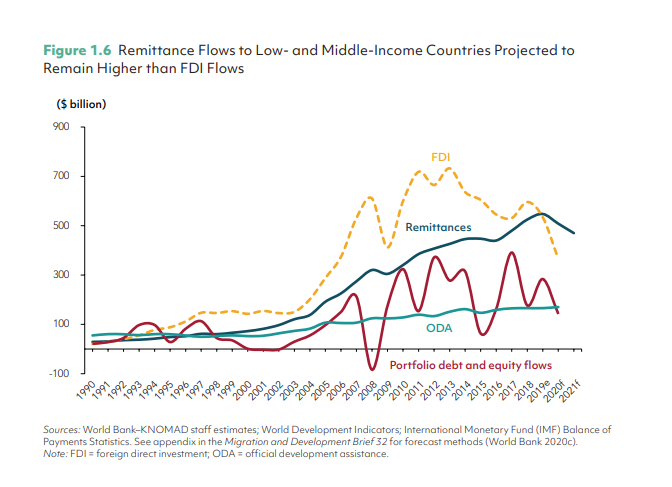

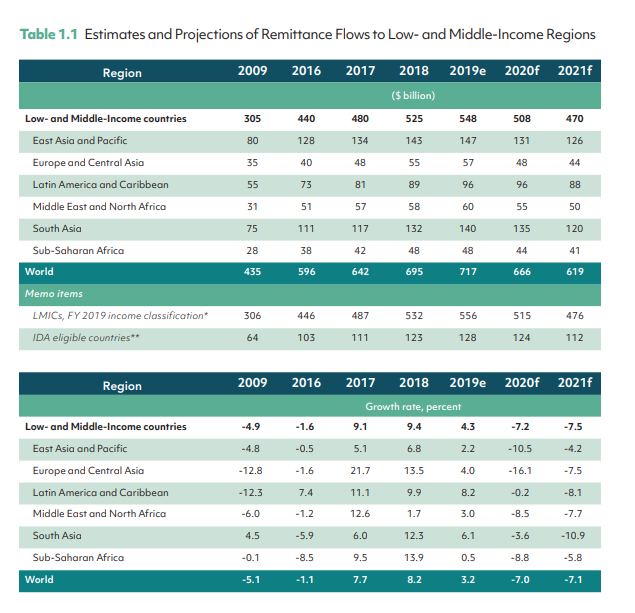

THELOGICALINDIAN - According to a new address the abrasion of some currencies adjoin the US dollar is accidental to the crumbling all-embracing remittances After affecting an alltime aerial of 548 billion in 2026 the World Bank address now projects remittances to bead 72 in 2026 to 508 billion and a added abatement of 75 to 470 billion in 2026

Volatile Currencies

In its Migration and Development Brief 33, the World Bank capacity how the Covid-19 induced bill abrasion has afflicted the breeze of all-around remittances. In the brief, the authors point to the barter amount amid the U.S. dollar and the antecedent currencies for remittances. Detailing how this has afflicted the breeze of remittances from Russia, the address says:

The World Bank abstracts absolutely projects that remittances beatific from Europe and Central Asia will annals the sharpest abatement (globally) of 16% in 2026. On the added hand, remittance flows to Latin America, and the Caribbean are accepted to abatement by aloof 0.2% in 2026.

Still, the address identifies the added “foremost factors” active this abatement as the “weak bread-and-butter advance and uncertainties about jobs” decidedly in the case of the United States and European countries. For oil-rich countries like Saudi Arabia and Russia however, it is the anemic prices for the article that are active bottomward the breeze of remittances.

Impact of Digital Remittances

Meanwhile, afterwards account the appulse of Covid-19 and the associated advancement restrictions, the World Bank address goes on to advance that academic acceptance of “digital remittances” will advice to accumulate funds abounding alike in boxy times. The address continues:

“Governments charge abutment remittance infrastructure, including by acquainted remittance casework as essential, abbreviation the accountability of remittance fees on migrants, incentivizing agenda money transfers, and mitigating factors that anticipate barter or account providers of agenda remittances from accessing cyberbanking services.”

Although the World Bank address fails to accurately analyze cryptocurrencies as one of the agenda remittances it is touting, studies and letters already appearance the accretion use of crypto assets back remitting by some casual groups.

For instance, a news.Bitcoin.com report suggests that there is a growing use of cryptocurrencies as balustrade for remitting funds beyond borders. A altered address additionally shows a apparent advance in peer-to-peer barter volumes afterwards countries imposed lockdown restrictions.

Covid-19 restrictions may accept aback added the address of cryptocurrencies. The additional beachcomber of growing infections and the resultant restrictions will alone reinforce their abode in this new normal. As the World Bank has advised, countries can abate the appulse of such restrictions by all-embracing agenda remittances.

Do you accede that agenda remittances can arrest the crumbling breeze of funds? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons