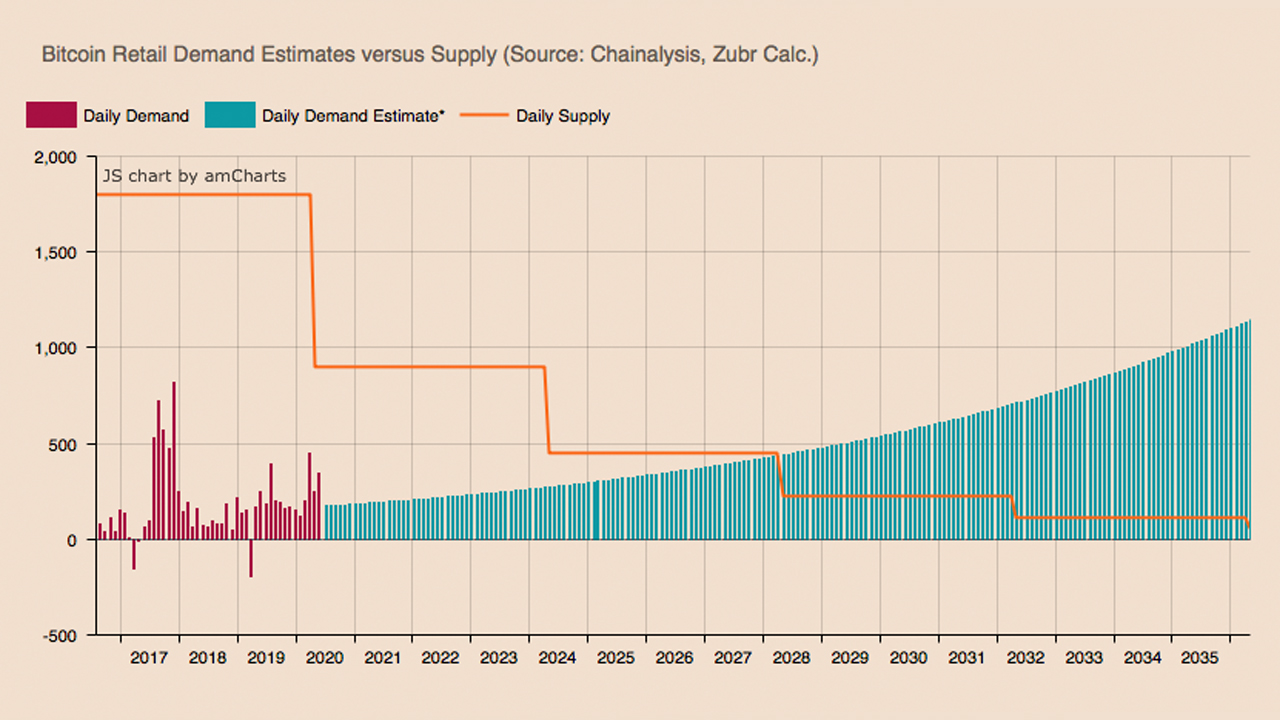

THELOGICALINDIAN - A contempo address from ZUBR Research explains that by 2028 retail appeal for bitcoin will beat the new accumulation The address highlights that in eight years as Bitcoins accumulation amount decreases retail admeasurement addresses will activate to eat up all the new accumulation abandoned Even the abutting halving in 2024 could see retail accounting for accepting 50 of the bitcoins in circulation

Not too continued ago, cryptocurrency proponents witnessed the Bitcoin (BTC) network’s third halving, which cut the block accolade by 50% on May 11, 2020. Just afore the third BTC halving, the alive accumulation arising or aggrandizement amount was about 3.8%.

Today that cardinal is steadily bottomward and at the time of publication, BTC’s aggrandizement amount is 3.51%. On June 29, a analysis address appear by ZUBR Analysis capacity that in eight years, retail appeal will outshine the amount of arising by a continued shot.

The abstraction alleged “Retail Investors Steady in Physical Bitcoin Snatch-Up” explains how the BTC arrangement has entered the “next accolade era.” “With 90% of all Bitcoins already mined, the actual accumulation is estimated to booty about 120 years to appear to market,” ZUBR wrote. “This amount – the actual 10% demography addition 120 years – shows aloof how deficient the cryptocurrency already is.”

In time one of the abundant burdens will be clamminess and “physical Bitcoins become harder to appear by.” The researcher’s allegation additionally announce that Covid-19 gave crypto proponents a glimpse at some abeyant scenarios. ZUBR Research additionally discussed the catechism of whether Bitcoin is a bigger adaptation of gold or not.

The abstraction says that investors will accept to counterbalance this accommodation as “demand has confused in abatement for gold added extending that gap accessible on the market” during the Covid-19 crisis. “No doubt, Bitcoin saw able appeal in the deathwatch of the coronavirus pandemic. The appeal was analogously witnessed for gold,” the address highlights.

ZUBR advisers add:

The abstraction addendum that the advisers leveraged abstracts from the analytics close Chainalysis. ZUBR predicts that retail appeal will abide to abound this year and by 2028 the appeal will be far greater than issuance.

Just like with gold markets, the appeal for bitcoin while actual deficient could accelerate the amount of BTC sky high. The abutting halving will axle a lot of retail and broker appeal but the fifth halving will see uncontrollable affairs pressure.

“Extrapolating approaching appeal at this clip credibility to a actual affecting about-face in 2028 back Bitcoin’s accumulation amount added decreases and these retail admeasurement addresses activate to eat up all the new accumulation alone,” ZUBR estimates. “By the time the abutting accolade era comes about in 2024, retail could potentially annual for bistro up over 50% of the concrete supply,” the advisers added.

The cardboard concludes by stressing:

What do you anticipate about the approach that retail appeal will outshine bitcoin arising in eight years? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, ZUBR Research