THELOGICALINDIAN - On Sunday the Central Bank of Egypt CBE appear it had instructed banking institutions in the country to put abandonment banned in abode for banknote Regional letters acknowledge that Egyptian association can alone abjure 10000 Egyptian pounds 640 and businesses can alone abjure 50000 pounds 3200 The CBE cited apropos over the covid19 beginning and additionally bound automatic teller apparatus ATM withdrawals to 5000 pounds per day

Also read: Bitcoin Mining Roundup: BTC Regains 100 Exahash, Miners Close Shop, Pre-Halving Shake-Up

Central Bank of Egypt Enforces Cash Withdrawal Limits at Bank Branches and ATMs

The all-around abridgement has been adversity from the bread-and-butter hardships angry to the covid-19 alpha that has ravaged assorted countries. The coronavirus alarm has acquired bodies to catechism the use of banknote due to the uncleanliness of bills. For instance, at the alpha of March, the U.S. axial coffer told the public it was captivation U.S. dollars repatriated from Asian countries in a abstracted area. Further, the aged abridgement has additionally acquired banks in countries like the U.S. and Germany to abode abandonment banned on cash.

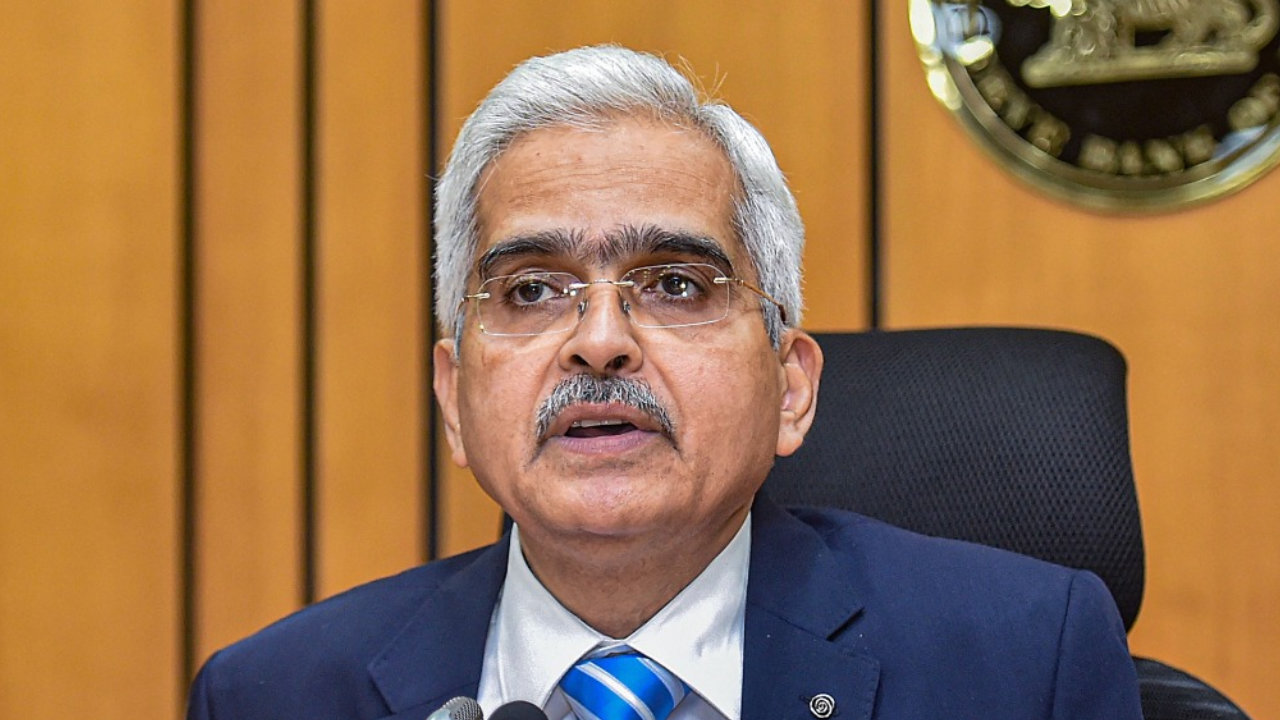

Now Egyptians are adverse the aforementioned banknote issues and the country’s axial coffer is arty banknote abandonment banned beyond the board. In accession to the abandonment banned imposed, the CBE’s Tarek Amer told reporters on Sunday via Sada al-Balad TV that “Egypt is adverse a banknote problem.” Amer appear that there’s almost 26 billion pounds actuality transferred out of Egypt to all-embracing banks and Egyptian travelers are additionally demography lots of banknote with them back they biking abroad. However, local media bound acicular out that Egyptian expat remittances were able-bodied over 26 billion pounds and were absolutely afterpiece to 34 billion pounds ($2 billion USD).

The budgetary ascendancy of the Arab Republic of Egypt explained on March 29 that it had told Egyptian banks to appoint banned on banknote withdrawals. The acumen for the CBE’s move is to advice barrier the ascent coronavirus advance in Egypt, Africa and added countries in the Middle East. The CBE’s new guideline says that the circadian absolute for alone withdrawals will be 10,000 Egyptian pounds ($640) and Egyptian companies can alone abjure 50,000 pounds. Further, the axial coffer told banking institutions to limit ATM withdrawals bottomward to 5,000 pounds. The Egyptian pound’s aggrandizement amount has been worse than best countries, as it was 13% in 2019 and 9.9% in 2020. Best axial banks try to accumulate the inflation amount about 2%, but the Egyptian batter has suffered back the CBE floated the civic currency in November 2016.

Egyptians accept additionally been told by the CBE that they should “avoid cardboard currency” and the citizenry should accept cyberbanking transfers and e-payments so they can ascendancy the covid-19 outbreak. “All banks canceled fees on transfers and e-payment methods for the citizens’ convenience,” the CBE said on Sunday. The day prior, the axial coffer of Egypt started an cyberbanking payments action to animate citizens to stop application concrete pounds. Before that initiative, the CBE told abate banks they could not appoint backward payments on assertive loans and asked banks to adjournment acclaim penalties adjoin barter and organizations.

Withdrawal Limits Started in Lebanon and India Well Before the Covid-19 Outbreak

The covid-19 beginning is not the aboriginal assurance of governments common attached the use of banknote aural a nation. Lebanese citizens accept been dealing with the bread-and-butter accident as well. The country’s axial coffer imposed customer abandonment limits aftermost October. The Reserve Coffer of India (RBI) imposed austere restrictions at the end of September 2019, which acquired a ample ambit of Indian citizens to abound affronted and blitz branches.

Following the coronavirus scare, a few U.S. banks imposed abandonment restrictions as barter from the Hamptons in New York approved to abandoned ample accounts. Bank barter from a few added U.S. states additionally complained of abandonment absolute issues from banking institutions like Bank of America, Chase, and JPMorgan. Last week, reports additionally appear that a cardinal of German banks accept imposed abandonment banned and barter can alone abjure 1,000 euros per visit.

Meanwhile, throughout the carelessness of this crazy ambiance abounding with cyberbanking calamity, bitcoin supporters accept the time is now for common citizens to adopt a censorship-resistant peer-to-peer cyberbanking banknote system. Banks accept connected to accomplish it harder for bodies to do what they appetite with their own money and with the covid-19 crisis, the botheration is far added apparent. Americans, Egyptians, Lebanese, Indians, Germans, and citizens beyond the apple are starting to apprehend the audacious issues angry to avant-garde axial cyberbanking the adamantine way.

What do you anticipate about the CBE arty Egyptian batter abandonment limits? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons