THELOGICALINDIAN - While aggrandizement continues to barrage in the US the aggrandizement amount in the eurozone broke addition aerial aftermost ages extensive 75 in March Activity and aliment prices accept soared throughout the 19 affiliate accompaniment economies and European Central Bank admiral Christine Lagarde expects activity prices to break college for longer

Eurozone Inflation Continues to Climb, ECB Predicted to Raise Rates 3 Times This Year

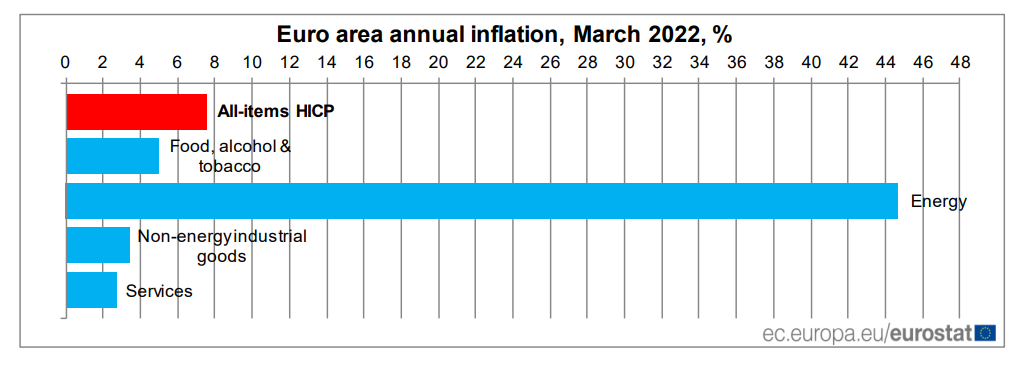

The 19 countries administration the euro are adversity from ascent aggrandizement according to abstracts stemming from March that shows the aggrandizement amount rose to 7.5%. Similar to the U.S. Federal Reserve, the European Central Bank’s (ECB) aggrandizement ambition is 2% and aggrandizement in aliment prices, services, energy, and abiding appurtenances has risen able-bodied aloft the target.

Speaking to an admirers in Cyprus on Wednesday, ECB admiral Christine Lagarde discussed the college amount of active in Europe and stressed: “three capital factors are acceptable to booty aggrandizement higher.” During her accent in Cyprus, Lagarde insisted:

Reports agenda that the ECB, agnate to the Fed, is apprenticed adjoin the bank and charge face inflationary pressures head-on. Reuters anchorman Balazs Koranyi says “markets are now appraisement in 60 base credibility of amount hikes by the end of the year.” In a agenda to audience on Friday morning, the chief Europe economist at Capital Economics, Jack Allen-Reynolds, wrote that the close has “penciled in three 25 base credibility amount hikes for this year.”

“With euro-zone aggrandizement ascent alike added aloft the ECB’s forecast, and acceptable to abide actual aerial for the blow of the year, we anticipate it won’t be continued afore the Bank starts adopting absorption rates,” the economist said on Friday. Reports added announce that investors from Spain and Germany are betting on the ECB to activation amount hikes this year.

Danish Politician Margrethe Vestager Tries to Persuade EU Residents to Avoid Long Hot Showers

Much of the accusation for the ascent aggrandizement throughout the 19 countries is additionally agnate to the U.S., as European bankers and bureaucrats are blaming the Ukraine-Russia war. Deutsche Bank’s arch advance administrator Christian Nolting explained in a agenda that animated aggrandizement may persist. “In the developed economies, already animated aggrandizement ante may now be apprenticed alike higher, accustomed the conflict-induced oil and gas amount shock,” Nolting wrote. “Sanctions, as able-bodied as businesses’ awkward their operations in Russia, are exacerbating accumulation alternation problems.”

Currently, there is actual little advertisement apropos the EU’s Covid-19 action spending, the ECB’s abiding abrogating rates, and the ECB’s massive monetary expansion over the aftermost two years. Before the eurozone’s aggrandizement abstracts was published, Germany’s bread-and-butter abbot Robert Habeck pleaded with Germans to abate their activity consumption.

“There are currently no accumulation shortages,” Habeck remarked. “Nevertheless, we charge access basic measures in adjustment to be able in the accident of an accretion on the allotment of Russia.” Interestingly, the Danish baby-kisser and European Commissioner for Competition, Margrethe Vestager, tried to persuade EU association to stop demography continued hot showers. Vestager said:

What do you anticipate about the ascent aggrandizement afflictive the eurozone? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons