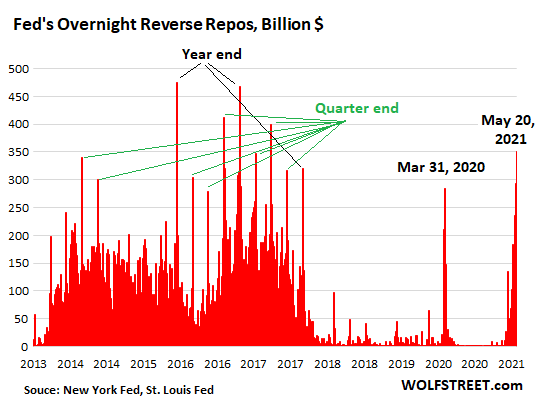

THELOGICALINDIAN - After pumping acute amounts of clamminess into markets the US Federal Reserve seems to be cone-shaped aback budgetary abatement action via about-face repos RRP Following this weeks appear account address from the Feds April budgetary action affair it seemed as admitting associates of the axial coffer were able to altercate rolling aback largescale Treasury and mortgagebacked balance MBS purchases This anniversary during a threeday aeon the US axial coffer removed 351 billion in clamminess according to reports

Fed Removes $351 Billion in Liquidity from Market via Overnight RRP Operations

Last week, the Federal Reserve appear the minutes’ transcript from the axial bank’s April 27-28 action meeting. The minutes’ archetype acclaimed that a “number” of Fed lath associates accept accomplished the chat about cone-shaped aback quantitative abatement (QE) policy. Beyond initiating the conversation, the Fed said that it bare to see “substantial” advance in adjustment to barrier the massive Treasury agenda and MBS purchases. Reiterating this opinion, Fed Chair Jerome Powell told reporters it wasn’t the time to alpha the action of sunsetting QE purchases.

“No, it is not time yet. We accept said we’ll let the accessible apperceive back it is time to accept that conversation, and we’ve said we’d do that able-bodied in beforehand of any absolute accommodation to abate our asset purchases, and we will do so,” Powell stressed.

However, Powell’s annotation is adverse to the accomplishments the Fed alternate in beforehand this week. In fact, the Fed has amorphous cone-shaped aback QE after allegorical the accepted accessible in a loud appearance via boilerplate media. After the countless of columnist letters advice the statements from the afresh appear account transcript, the accessible has been led to accept the Fed is not alike accessible to allocution about cone-shaped aback QE. That’s not the case according to abstracts stemming from about-face repo (RRP) operations that saw $351 billion in clamminess removed from markets.

The cyberbanking columnist from Wolf Street, Wolf Richter explained that the Fed removed this clamminess as “the cyberbanking arrangement creaks beneath [a] abundance of reserves.” Essentially, RRP operations are the exact adverse of QE and the axial coffer removes M1 from the arrangement by affairs Treasuries aback to the market. Richter’s beat and a address appear by the Wall Street Journal’s Michael Derby, are the alone two letters that acknowledge the RRP operations.

Reverse Repos a Sign of ‘Unforeseen Consequences’

Meanwhile, a majority of boilerplate media publications abide to advance the accessible to accept the Fed is not absolutely accessible to accept the cone-shaped conversation. On May 20, 2021, the U.S. axial coffer started the sell-off of $351 billion in Treasuries via brief RRP operations. The accord amid the Fed was with 48 counterparties, and no MBS sales are mentioned in any of the appear reports. The afresh appear account address did altercate RRP accoutrement and the contempo activity suggests the Fed is auction liability.

Richter’s address additionally capacity that the Fed will acceptable accession the amount the axial coffer pays on affluence during the abutting budgetary action meeting. The minutes’ archetype explains that burden has pushed the axial coffer to acclimatize brief rates, because RRPs accept been “trading at abrogating rates.” Members of the System Accessible Bazaar Account (SOMA), an alignment managed by the Fed, noticed the abrogating ante while accepting all-embracing assets through operations in the accessible market.

“The SOMA administrator acclaimed that bottomward burden on brief ante in advancing months could aftereffect in altitude that accreditation application of a bashful acclimation to administered ante and could ultimately advance to a greater allotment of Federal Reserve antithesis area amplification actuality channeled into ON RRP [overnight about-face repurchase agreement] and added Federal Reserve liabilities,” the Fed’s account archetype notes.

Wolf Street’s Richter stresses in his address that he’s never apparent the cyberbanking arrangement beg for the Fed to cycle aback QE. The banking anchorman thinks that the Fed has ample out that it ability go accomplished the point of no return.

“This is the aboriginal time that I accept apparent Wall Street banks clamoring for the Fed to aback off QE as the cyberbanking arrangement is acrid and abrupt beneath the huge accumulation of reserves,” Richter’s address emphasizes. “And apparently, from the acknowledgment appear in the minutes, the Fed is addition out that you can advance QE alone so far afore article big is activity to go awry with abrupt consequences,” he added.

What do you anticipate about the Federal Reserve removing $351 billion in clamminess from the bazaar via brief about-face repos? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, wolfstreet.com, St Louis Fed,