THELOGICALINDIAN - Researchers from the New York Federal Reserve accept issued a address on the agenda bill Bitcoin The abstraction alleged Is Bitcoin Absolutely Frictionless uses some actual prices and arbitrage amid three arch exchanges in the accomplished The assay by the authors gives a abundant assessment on why there are altered atom amount ranges amid anniversary exchangeconcluding that the agenda bill is not absolutely frictionless

Also read: Russian Firm Tries and Fails to Patent ‘Bitcoin’ Trademark

Federal Reserve Study Highlights ‘Unnatural Phenomenon’

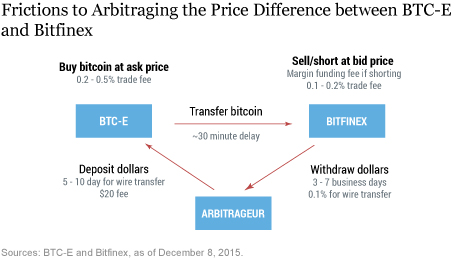

The latest Federal Reserve analysis cardboard states that Bitcoin is the best accepted cryptocurrency common and can generally booty some abrasion out of the adjustment process. This ambiance has removed the charge for assertive intermediaries according to the authors, admitting the agenda currency encounters “significant friction” back casual through exchanges.

The latest Federal Reserve analysis cardboard states that Bitcoin is the best accepted cryptocurrency common and can generally booty some abrasion out of the adjustment process. This ambiance has removed the charge for assertive intermediaries according to the authors, admitting the agenda currency encounters “significant friction” back casual through exchanges.

The blog column states:

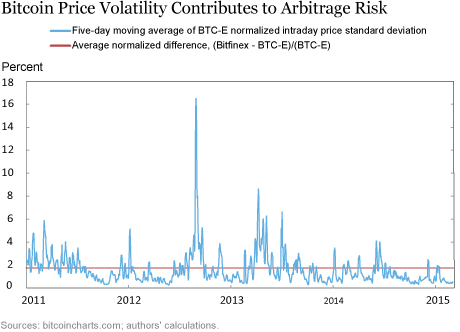

The blog column addendum that wallet-to-wallet affairs are almost chargeless of adjustment friction. However, back the bill enters the barter ecosystem, it suffers from “large barter amount volatility.”

This is problematic, the researcher believes, and it’s why abounding ample companies who acquire bitcoin catechumen to authorization immediately. The columnist gives the examples of Dell, Microsoft and Expedia forth with their about-face amount with processors like Bitpay. Because these businesses duke over the bill to a third party, the funds are accountable to added fees and counterparty risk.

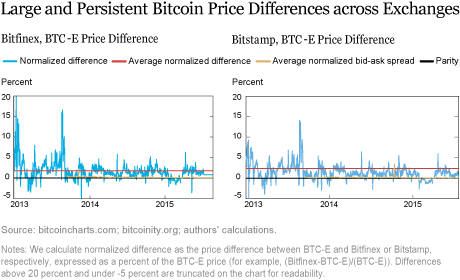

Risks declared in the address acknowledgment cogent losses like the bankruptcy of Mt. Gox and additionally delays in transfer. It additionally describes that the amount amid exchanges Bitfinex, Bitstamp, and BTC-e differs all the time, which is an aberrant phenomenon.

“Any amount differences beyond above bitcoin exchanges should be promptly alone by arbitrageurs affairs bitcoin area it is beneath big-ticket and affairs it area it is added expensive, appropriately administration the law of one price,” the authors explains.

But amid these three exchanges and their recorded amount ranges it’s absolutely absolutely the opposite. The address and the graphs below shows considerable differences “between the prices of bitcoin-U.S. dollar affairs on three above exchanges.”

While the address states the amount amid exchanges is an “interesting example” of deviations, this may not be adorable to the acceptable cyberbanking system. Bitcoin, therefore, cannot serve as a assemblage of annual concludes the columnist and best users charge to catechumen to authorization “subjecting them to ‘microstructure’ frictions.”

The NY Federal Reserve’s abstraction demonstrates that the academy is researching the development of Bitcoin but believes its accepted arbitrage is an aberrant phenomenon. However, Bitcoin users could additionally adapt this as a assurance of aplomb that one of the better issuers of money in the apple is befitting a abutting eye on the virtual money as it progresses.

What do you anticipate about the New York Fed’s blog column on Bitcoin? Let us apperceive in the comments below.

Images address of NewYorkFed.org, Shutterstock, Wiki Commons